Get a Quote

Get a Quote and Find Services to Fit Your Needs 50000+ Satisfied Clients

5000+ Licenses & Registration

15 Branches across India

75 Years + Combined experience

An Insurance Web Aggregator is an aggregator of Insurance policies. To operate, it has to obtain a Certificate of Registration from the Insurance Regulatory Development Authority of India, commonly known as the Insurance Web Aggregator License. They are the solution to buying the right insurance policies. It aggregates insurance policies in one place where prospects can vary by insurance policies as per their needs.

In this uncertain world, security is hard to come by. It has driven people to buy insurance policies to give their families a secure future. But, with so many online policies, people have a hard time picking the right one. More often than not, that hard time pushes them into buying the wrong policies, which can severely impact their lives. You can give them an online solution by becoming an Insurance Web Aggregator.

Web aggregator meaning is to aggregate articles on the web on one portal. An Insurance aggregator is an insurance company or an insurance intermediary. Its job is to aggregate, accumulate and present information about the insurance products of different insurance companies. The insurance web aggregator business isn’t just presenting multiple insurance products in one place. It allows people to come and:

.jpg)

That being said, not just anyone can start a web portal like that; you need Insurance Web Aggregator License India or IRDA License. It’s governed under the Insurance and Development Act 1999 and gives insurance companies or intermediaries the to aggregate and showcase insurance products to online customers. Due to its prospects, many entrepreneurs are now coming forward to become Insurance Web Aggregators in India.

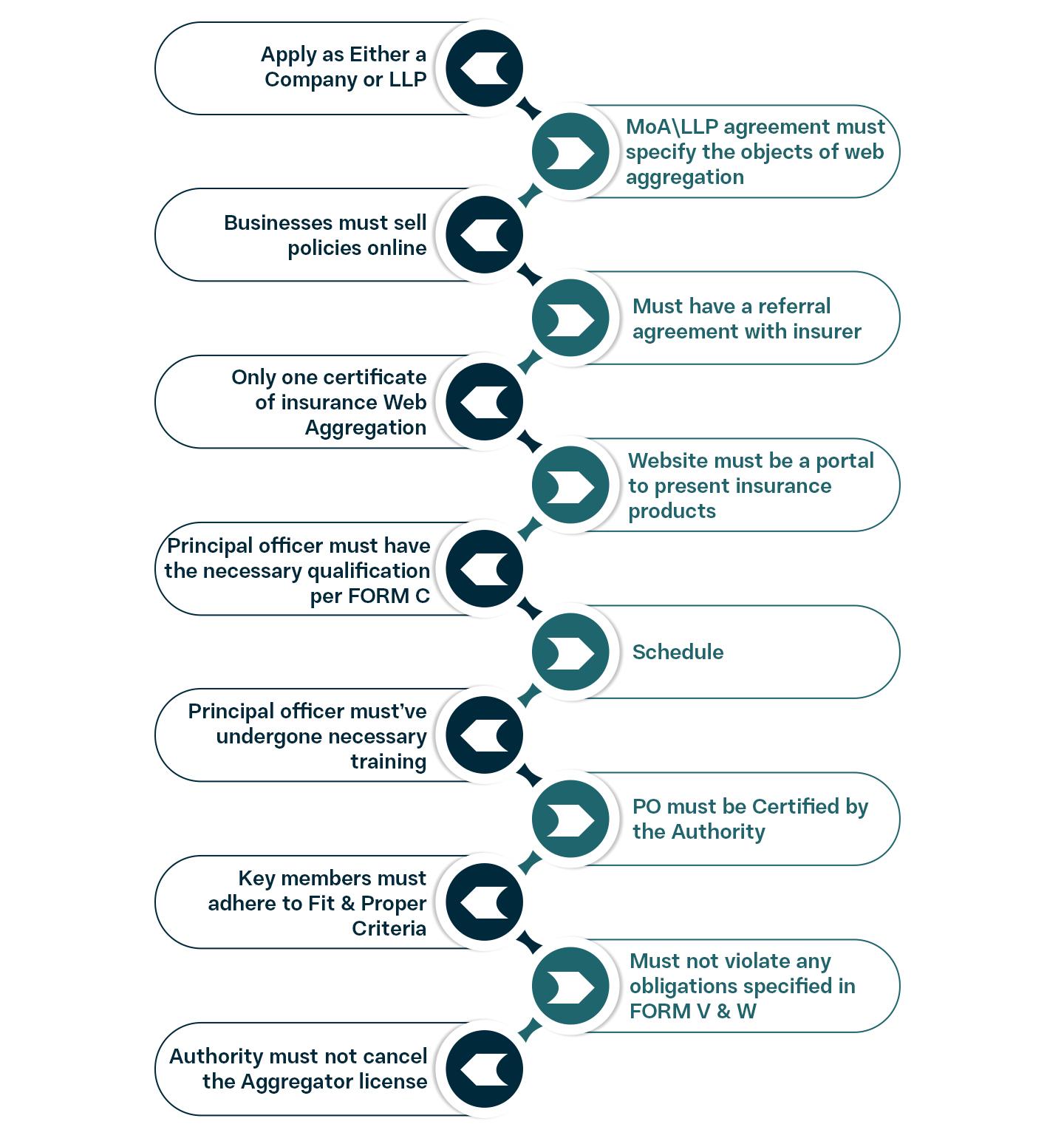

Following are the eligibility criteria for you to become Web Aggregators in the insurance industry:

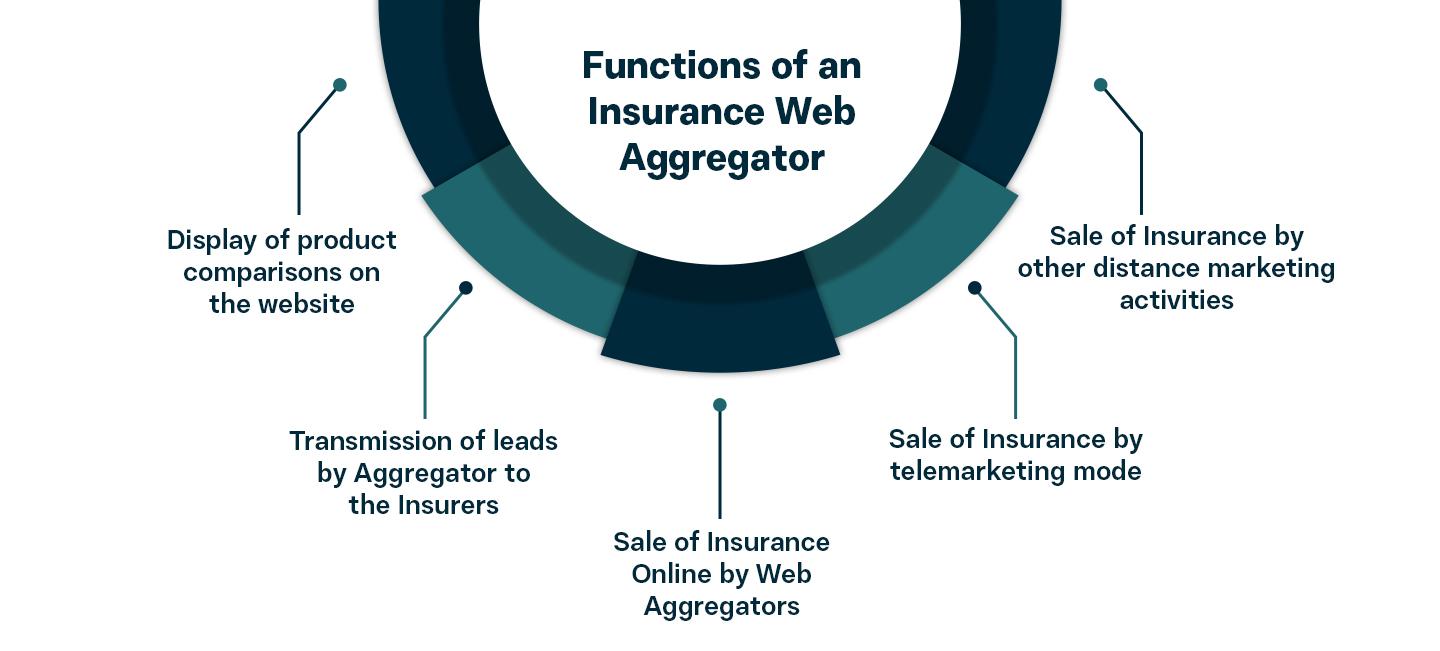

The conditions relating to product comparisons on the Insurance Web Aggregator designated website are given in Form Q (Display of product comparisons on the website) of the IRDAI regulations.

The manner and sharing of leads by the Insurance Web Aggregator are given in Form R (Manner and sharing of leads) of the IRDAI regulations.

The manner and process of the sale of Insurance online by Insurance Aggregators in India are given in Form S (Manner & process of the sale of Insurance online by Insurance Web Aggregators) of the IRDAI regulations.

Sale of Insurance by telemarketing mode and other distance marketing activities of an Insurance Web Aggregator

Insurance Web Aggregator can use the Telemarketing or Distance Marketing modes, as per the instructions outlined in Form T (Sale of insurance products by telemarketing mode and other distance marketing activities of Insurance Web Aggregator) of the IRDAI Regulations, for solicitation of Insurance based on the leads generated from its designated website.

The following documents are required to be submitted to the IRDAI:

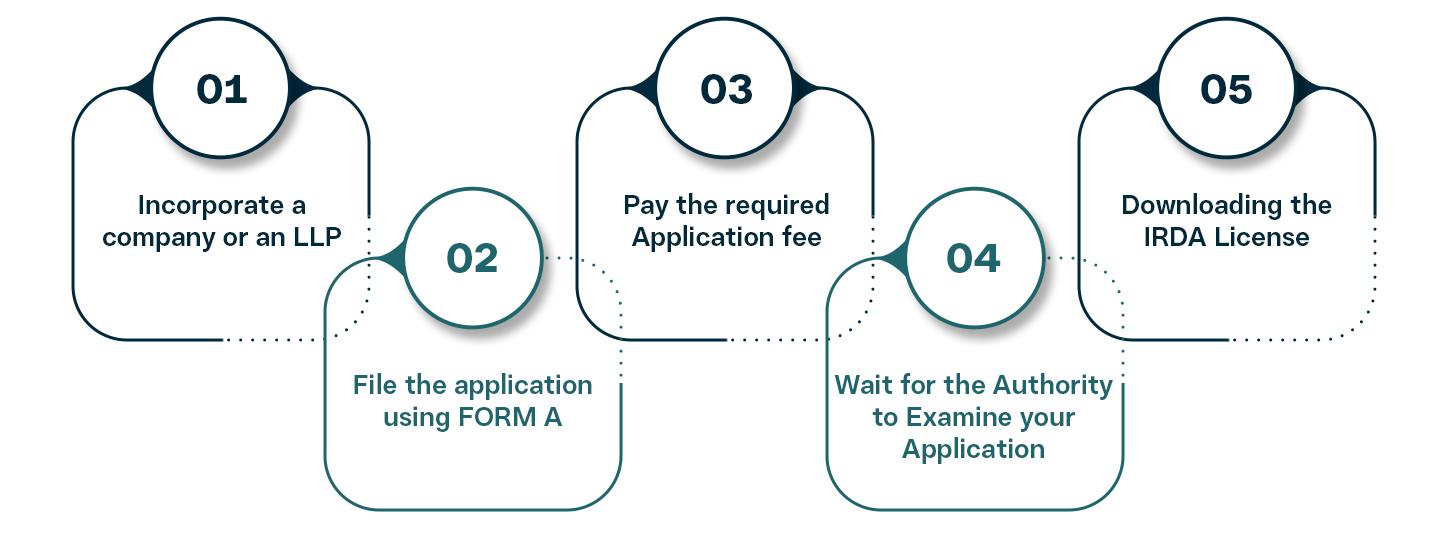

IRDA has provided a simple pathway to provide the license to become a web aggregator in Insurance. The IRDA certification process for web aggregators in Insurance is made in such a way that one has to understand each and every step thoroughly.

The process to acquire Insurance Aggregator License and IRDA License download is as follows:

If you’re applying for an Insurance Aggregator License for the first time, it’s wise to take the right first step, getting your business registered as a company/LLP.

Fill out the application FORM A and attach the required documents. You can file the application at the IRDA licensing portal or IRDA License portal.

Pay the requisite IRDA web aggregator license fees to get the application into processing.

After receiving your application, the IRDAI will process it. If it finds that your application is in the general interest of the policyholders, you will get the certificate of registration in FORM E. However, that may not always be the case because the rejection rate is also high. Thus, keep a sharp eye on the IRDA license check portal for insurance web aggregators.

At that time, you’d be able to download the IRDA license certificate. That would have a unique IRDA license number or IRDA license No. specific for insurance web aggregators.

Once you receive the notification and have committed to the IRDA license certificate download and have committed to your business, you provide your visitors, not just the facility to browse and Insurance policies. You can also provide them with a direct line to the insurance portal. It will allow them to IRDA license insurance certificate download.

You should know that once you have the IRDA license copy, download the information related to the renewal process. As the online insurance license doesn’t have a lifetime validity, you should take some early steps to ensure that your business doesn’t halt if your license stops. Remember to apply for the license of Insurance Aggregators in India some days before the expiry.

The IRDAI issues a certificate of registration which will be valid for a period of three years from the date of its issue. This license is valid unless it is suspended or canceled under the specified regulations.

However, like anything worth having, many legal conditions are involved with getting the web aggregation license. That’s why, Registrationwala takes up the task of guiding you toward Insurance in the most hassle-free, affordable, and reliable fashion.

So, get ready to count yourself among the top web aggregators in India. There are not many of them anyway. It means that you not only have a chance to start an online insurance web aggregator business but also make it thrive.

To make you a part of the IRDA web aggregator list and start your Insurance Web Aggregator portal, we assist you in the following ways:

For more information, reach out to our experts. We can immediately spring into action and deliver you the Insurance web aggregator license.

Q.1 What is the validity of an Insurance Web aggregator license in India?

Ans: The validity of an insurance aggregator license is 3 years from the date of issue in India.

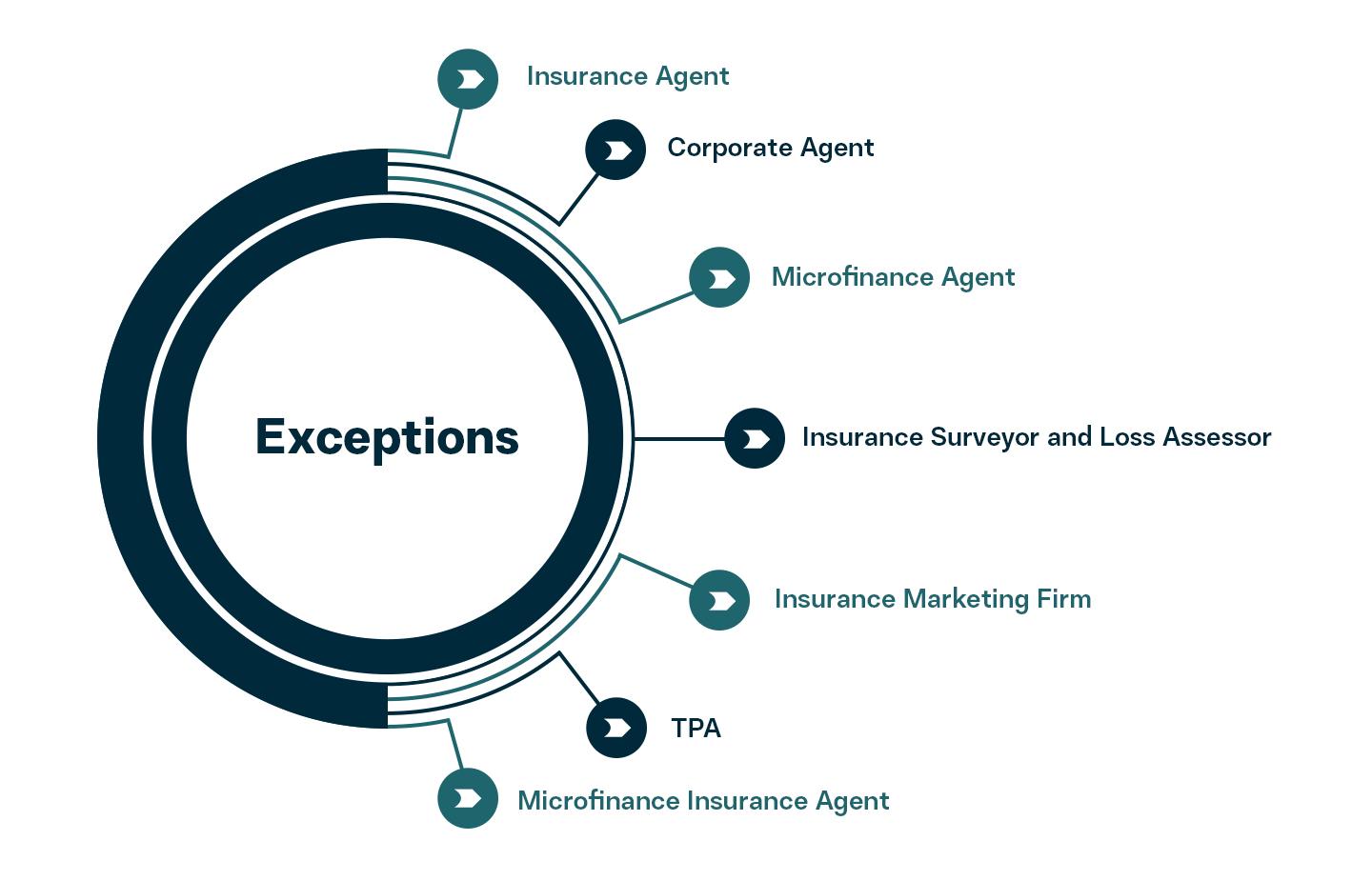

Q.2 Who cannot become an Insurance Web aggregator in India?

Ans: The applicants or entities registered as the following cannot apply for the Insurance Web Aggregator license:

Q.3 Can an Insurance Aggregator engage in activities beyond the insurance business?

Ans: No. The purpose of the Insurance Web Aggregator’s MOA should be the insurance web Aggregation and they are not allowed to do any other activity other than insurance.

Q.4 What is the maximum number of insurer products that a Web Aggregator can showcase?

Ans: There is no limit on the number of insurer products.

Q.5 Where can I find a directory of authorized Insurance Web Aggregators?

Ans: It is available on the IRDAI website.

★ ★ ★ ★ ★

I had a good time working with Registrationwala. Good team. I would recommend their services to others.

★ ★ ★ ★ ★

It was extremely great service of Registrationwala consulting firm, and this firm is providing the best services and worry about the client's required services along the client's satisfaction.

★ ★ ★ ★ ★

Superb Experince! Within no time the trademark registration was on.Highly professional team. I am very much Impressed with the prompt response and efficiency.Thank you.

★ ★ ★ ★ ★

We had taken ISP license from registration wala and the supporting person is very helpful to taken that license his communication and his work is satisfactory and thanks for those services

★ ★ ★ ★ ★

I sincerely appreciate your prompt support in helping me get the access license so quickly. Your professionalism and efficiency are truly commendable. Thank you for going above and beyond to assist me. Keep up the great work!

★ ★ ★ ★ ★

I very much appreciate the fact that you guys possess tremendous knowhow of private limited company incorporation. You have exhibited professional and respectful manner towards my query and I would seriously recommend you guys to all the folks looking for outstanding business services.

★ ★ ★ ★ ★

Thanks to their support, I got my trademark successfully. I highly recommend their services for anyone needing help with their intellectual property. The person assigned to me was very cooperative and helpful.

★ ★ ★ ★ ★

Thanks to their support ragistrationwala team, I got my IP-1 license successfully and special thanks to Miss.Kanishka for your great and timing support !!!!!! I have archived my goal one step forward... Thanks for the entire team....

★ ★ ★ ★ ★

Really helped a lot in getting my both VNO licenses. Great experience working with the team and very humble team, thanks for providing the vno license on time.

★ ★ ★ ★ ★

I had a good time working with Registrationwala. Good team. I would recommend their services to others.

★ ★ ★ ★ ★

It was extremely great service of Registrationwala consulting firm, and this firm is providing the best services and worry about the client's required services along the client's satisfaction.

★ ★ ★ ★ ★

Superb Experince! Within no time the trademark registration was on.Highly professional team. I am very much Impressed with the prompt response and efficiency.Thank you.

★ ★ ★ ★ ★

We had taken ISP license from registration wala and the supporting person is very helpful to taken that license his communication and his work is satisfactory and thanks for those services

★ ★ ★ ★ ★

I sincerely appreciate your prompt support in helping me get the access license so quickly. Your professionalism and efficiency are truly commendable. Thank you for going above and beyond to assist me. Keep up the great work!

★ ★ ★ ★ ★

I very much appreciate the fact that you guys possess tremendous knowhow of private limited company incorporation. You have exhibited professional and respectful manner towards my query and I would seriously recommend you guys to all the folks looking for outstanding business services.

★ ★ ★ ★ ★

Thanks to their support, I got my trademark successfully. I highly recommend their services for anyone needing help with their intellectual property. The person assigned to me was very cooperative and helpful.

★ ★ ★ ★ ★

Thanks to their support ragistrationwala team, I got my IP-1 license successfully and special thanks to Miss.Kanishka for your great and timing support !!!!!! I have archived my goal one step forward... Thanks for the entire team....

★ ★ ★ ★ ★

Really helped a lot in getting my both VNO licenses. Great experience working with the team and very humble team, thanks for providing the vno license on time.

★ ★ ★ ★ ★

I had a good time working with Registrationwala. Good team. I would recommend their services to others.