Get a Quote

Get a Quote and Find Services to Fit Your Needs 50000+ Satisfied Clients

5000+ Licenses & Registration

15 Branches across India

75 Years + Combined experience

If you wish to work as a Mutual Funds Distributor for reputed Mutual Funds houses in India, then you must apply for the Mutual Funds Distributor (MFD) license with the Securities and Exchange Board of India. Getting an MFD license is an uphill task. Therefore, for your aid, we are facilitating the best-in-class MFD license registration services. Get the license and start dispensing the Mutual Funds services right away.

Satisfied Clients

Services

Years Combined Experience

Get Started!

A Mutual Funds Distributor can be thought of as a Person or a Company involved in the sales and distribution of Mutual Funds to prospective investors. These MFDs work on behalf of major Mutual Funds Houses or Dispensers. An MFD is basically an Investment Intermediary. They play a vital role in the financial world by arranging a connection between the Investors and Mutual Funds Investors for services like the stock market or mutual funds.

Each distributor of mutual funds must possess a mutual fund distributor license as a legal mandatory requirement. This license can also be called mutual fund distributors certification.

To engage in distribution of mutual funds in India, it is necessary to secure Mutual Fund Distributors Certification. Connect with Registration for assistance in securing this certification easily!

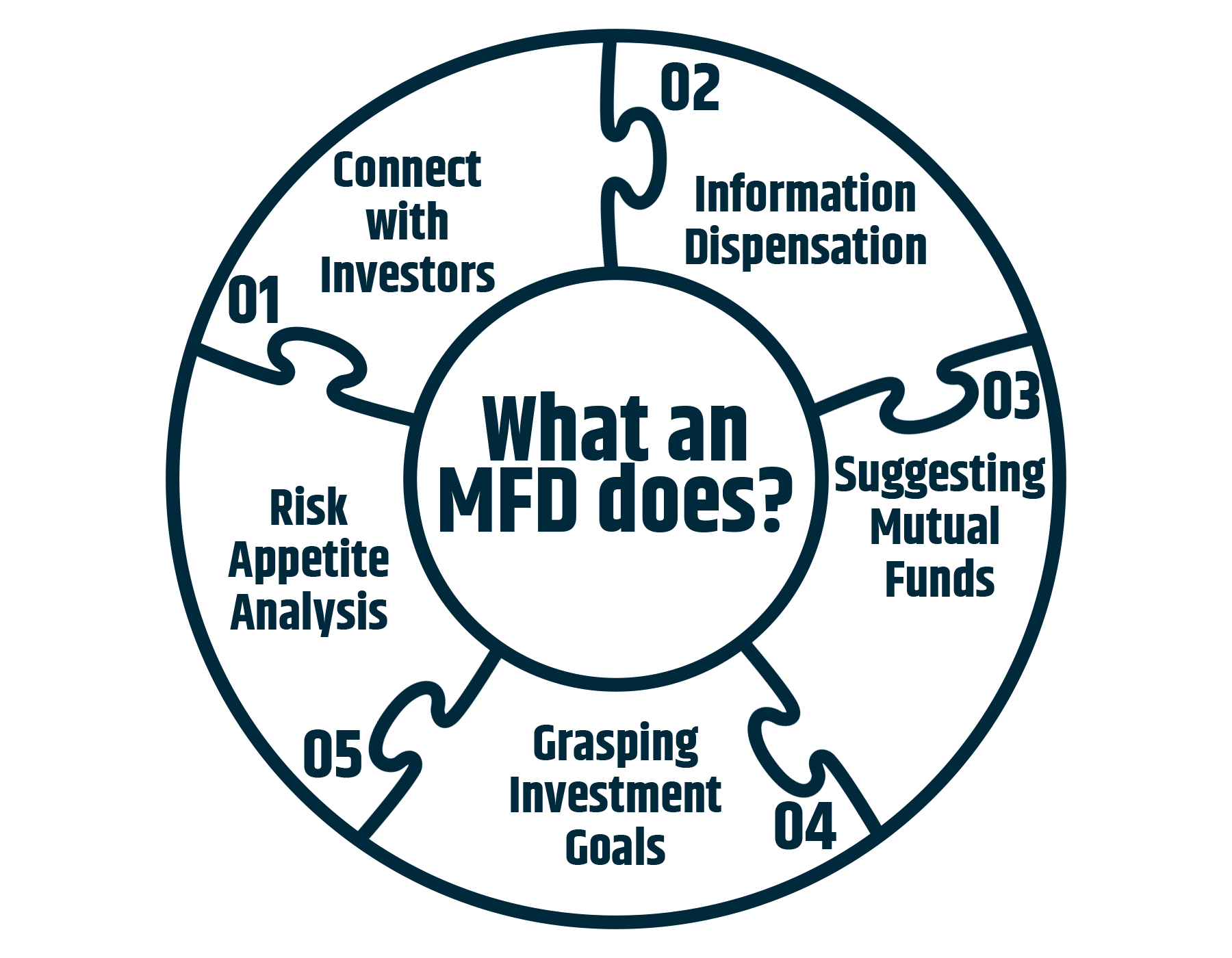

The Mutual Fund Dispensers in India hire the MFDs for the following purposes:

In India, the MFDs are registered with the Association of Mutual Funds in India, commonly known as AMFI. The Securities and Exchange Board of India regulates the operating behavior of MFDs in India. The MFDs earn their commission from the Mutual Fund houses as they bring businesses to them. The earned commission value varies from the type of Mutual Funds Dispenser the MFDs are engaged with.

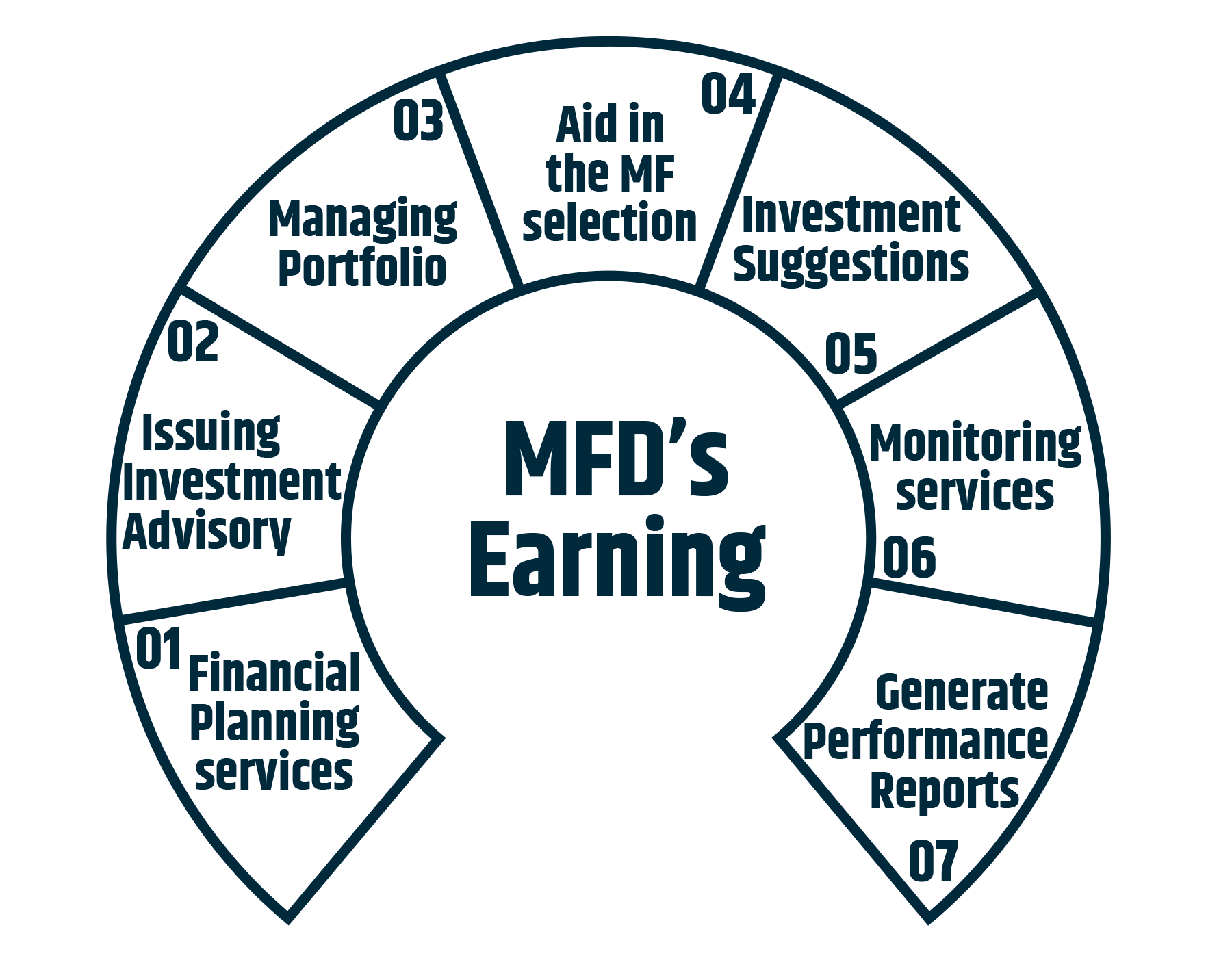

Apart from the commissions, the MFDs offer additional services to their clientele, such as:

Here we list some of the reputed MFDs operating in India.

To become an MFD in India, the applicant of MFD license India must meet the requisite pre-conditions as per the Securities and Exchange Board of India, defined in the following pointers:

The applicant must be of at least 18 years of age to apply for MF Distributor license.

The applicant must have passed at least Class 12.

The MF distributor license aspirant must obtain the requisite NISM or SEBI certification.

The applicant must possess at least two years of experience in the Securities Market.

The applicant must build a physical space for business service dispensation with the following basic amenities:

Computer

Internet Connection

Telephone

The applicant must comply with the following norms as prescribed by SEBI and other Authorities:

Anti-Money Laundering (AML)

Know Your Customer (KYC)

If you fulfill the mutual fund distributor eligibility requirements, then you can go ahead and initiate the application filing process.

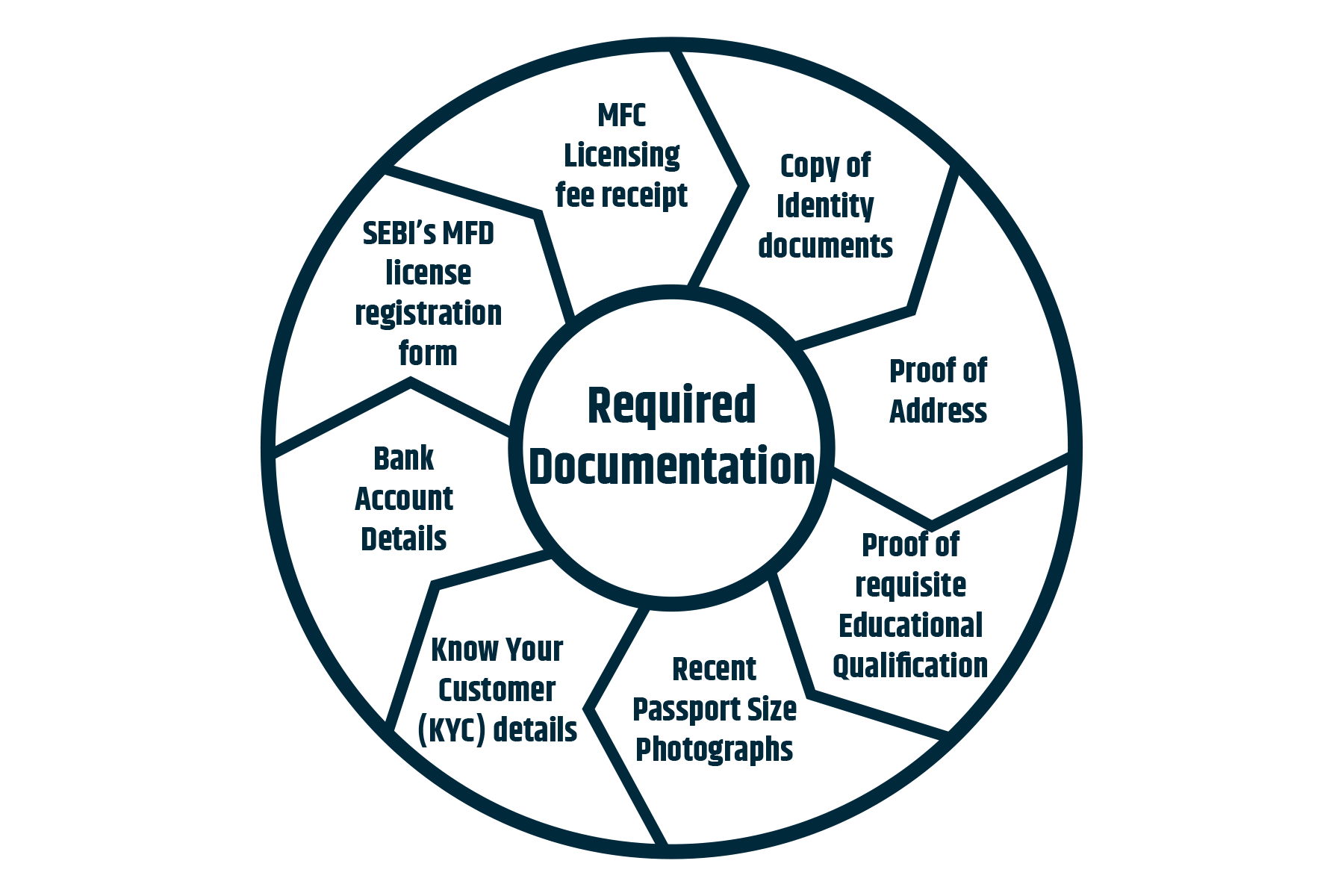

For Mutual Fund Distributor license registration, applicants must submit the necessary documents to further their candidature to the NISM. Therefore, we have detailed the required documentation for MF distributor license registration in India:

Apply for SEBI professional consultancy services to get a clearer idea of the latest documentation requirements per SEBI’s directives.

Every MFD license applicant in India must register itself with the AMFI, i.e., the Association of Mutual Funds in India. The AMFI issues the certification obtained from the NISM or the National Institute of Securities Markets. We have defined the mutual fund distributor process for you in the following steps:

The applicant must apply for and get a valid Permanent Account Number card before applying for the MFD license.

After attaining the PAN Card, the MFD license applicant must complete his Know Your Distributor or KYD process. He must file his KYD form along with the required documents to any of the following:

MF Intermediaries

Registrar

Transfer Agents

The applicant must register with the AMFI. The registration process goes by filing the registration form along with the following attachments:

PAN card

Proof of Residence

Applicant’s Photograph

Fee Payment

Thereafter, the applicant must obtain a NISM certification from the National Institute of Securities Markets (NISM). But the applicant will be awarded the certification when they pass the mutual fund agent exam known as the MFD Certification Examination from NISM.

After clearing the examination, the MFD license applicant must register with the Securities and Exchange Board of India for the SEBI MFD registration form, documents, and fee receipt.

After obtaining the requisite license, the newly registered MF Distributors must complete the training requirements as mandatorily directed by AMFI as well as SEBI periodically.

Since the MFD license registration is a remote service, its registration process and requirements are variable per the agency’s directives. We advise you to check with the involved agencies, like AMFI and SEBI, for the latest guidelines before applying for MFD license registration in India.

If you wish to become a Distributor of Mutual Funds in India, then you must seek the requisite MFD certificate from the AMFI. But the MFD certification procedure, as with many registration procedures, is a hassle for people not well-versed with such legal procedures. Here, Registrationwala comes in handy to you. The Legal Experts at Registrationwala can make you sail through the entire MFD certification procedure in no time. Let us take you through our MFD certificate consultancy procedures:

If you want to know more about the Mutual Fund Distributor licensing procedure, contact one of our Incorporation Experts. Our MFD certification consultants can also brief you on the related matters of the MFD registration fees.

Q1. How much do licensed Mutual Funds Distributors earn in their lifetime?

A. The earnings of a licensed MFD depend on multiple factors, like the type of Mutual Funds house and commissions. There are also additional sources from which an MFD can earn.

Q2. Who regulates the functioning of Mutual Funds Distributors in India?

A. AMFI and SEBI are responsible for regulating the functioning of MFDs in India.

Q3. How to become mutual fund distributor?

A. You can become an MFD by passing the NISM MFD Certification Examination, registering with AMFI, and obtaining an MFD license.

Q4. How can I find help in obtaining a license for a mutual fund distributor near me?

A. You can reach out to the Registrationwala team for assistance in obtaining an MFD license.

Q5. What are mutual fund distributor benefits?

A. The benefits of MFD are commission earnings, flexible Work Schedule, growing MF market, and client relationship building.

★ ★ ★ ★ ★

I very much appreciate the fact that you guys possess tremendous knowhow of private limited company incorporation. You have exhibited professional and respectful manner towards my query and I would seriously recommend you guys to all the folks looking for outstanding business services.

★ ★ ★ ★ ★

Thanks to their support, I got my trademark successfully. I highly recommend their services for anyone needing help with their intellectual property. The person assigned to me was very cooperative and helpful.

★ ★ ★ ★ ★

Thanks to their support ragistrationwala team, I got my IP-1 license successfully and special thanks to Miss.Kanishka for your great and timing support !!!!!! I have archived my goal one step forward... Thanks for the entire team....

★ ★ ★ ★ ★

Really helped a lot in getting my both VNO licenses. Great experience working with the team and very humble team, thanks for providing the vno license on time.

★ ★ ★ ★ ★

I had a good time working with Registrationwala. Good team. I would recommend their services to others.

★ ★ ★ ★ ★

It was extremely great service of Registrationwala consulting firm, and this firm is providing the best services and worry about the client's required services along the client's satisfaction.

★ ★ ★ ★ ★

Superb Experince! Within no time the trademark registration was on.Highly professional team. I am very much Impressed with the prompt response and efficiency.Thank you.

★ ★ ★ ★ ★

We had taken ISP license from registration wala and the supporting person is very helpful to taken that license his communication and his work is satisfactory and thanks for those services

★ ★ ★ ★ ★

I sincerely appreciate your prompt support in helping me get the access license so quickly. Your professionalism and efficiency are truly commendable. Thank you for going above and beyond to assist me. Keep up the great work!