Get a Quote

Get a Quote and Find Services to Fit Your Needs 50000+ Satisfied Clients

5000+ Licenses & Registration

15 Branches across India

75 Years + Combined experience

Credit rating is an analysis of a business entity’s creditworthiness and the ability to repay a financial obligation in completeness and within the established due dates. Credit rating in India is done by credit rating agencies authorized by SEBI. The credit rating agencies generate and assign credit rating based on the borrower's revenue, debt, earnings, and other factors.

Before approving or sanctioning a loan, credit rating is thought to be the first thing that lenders look at. A high credit score indicates that the borrower can make timely loan repayments.

At Registrationwala, we have a team of credit rating advisors having a vast understanding when it comes to a variety of financial analysis techniques and an in-depth understanding of qualitative and quantitative factors from a credit rating perspective. We’re your best bet if you want to obtain credit rating from one of the top credit rating agencies in India.

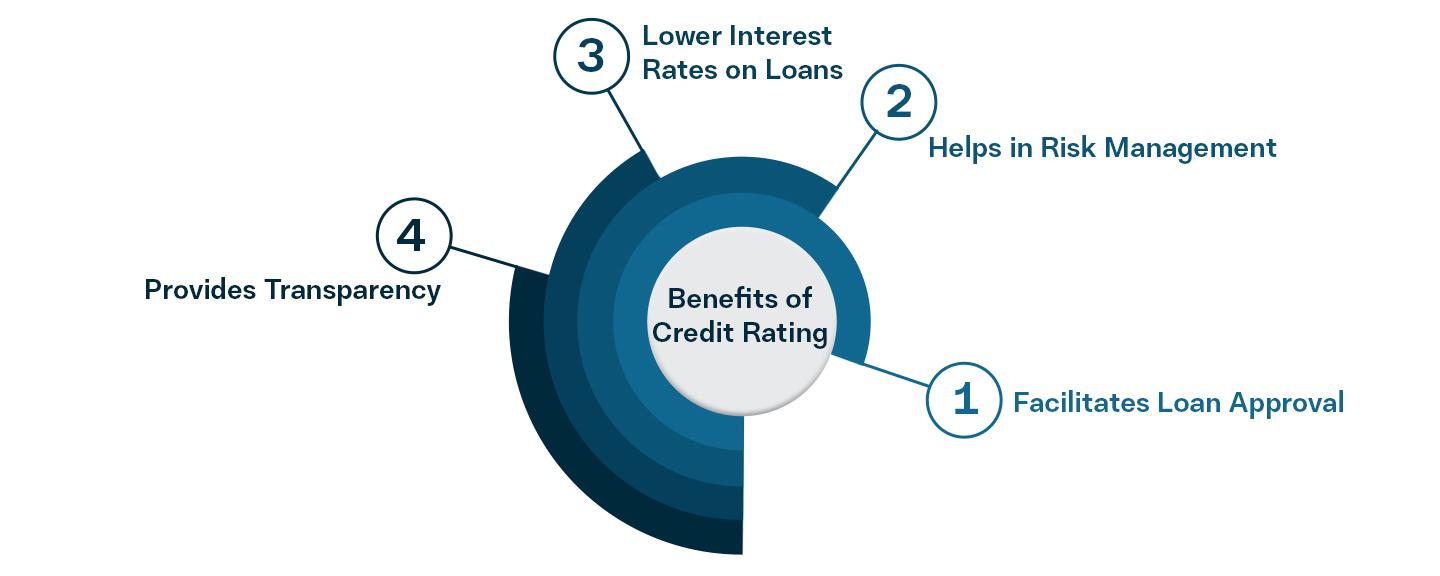

There are several benefits of credit rating. Some of them are mentioned below:

Credit rating is used by the lenders to assess the risk associated with lending money to the borrowers. When an entity has a high credit rating, loan approval is made easier. However, if an entity has a lower credit rating, obtaining a loan can be difficult. Sometimes, the loan application can even get rejected.

If you want to obtain a high credit rating, you can avail Registrationwala’s credit advisory services. Our consultants will guide you regarding how you can achieve a high credit rating.

Credit rating is an important tool for managing risks in the financial system as it helps the lenders and investors to manage their risk exposure and make informed decisions.

Entities with good credit ratings often get lower interest rates on loans. This can save them a lot of money.

An impartial and objective assessment of credit risk is offered by credit ratings assigned by credit rating agencies. They help the lenders and investors to make well-informed decisions by offering consistency and transparency in the creditworthiness assessment process.

While applying for credit rating, it is necessary to submit certain documents. The following documents must be submitted by an entity for credit rating:

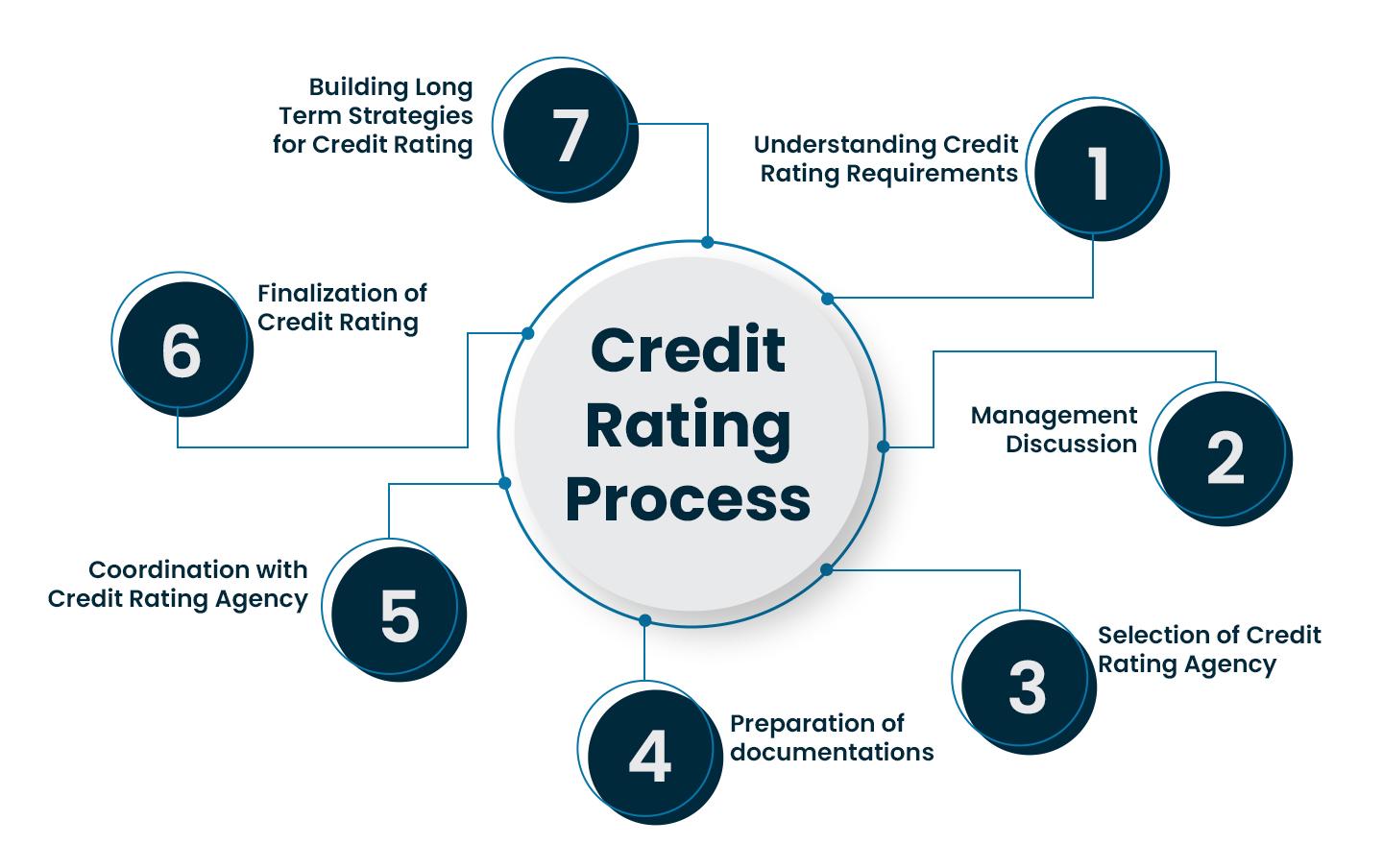

If you decide to avail our credit rating advisory services, the credit rating process will take place in the following manner:

As a first step, Registrationwala’s credit rating consultants will understand your entity’s credit rating requirements and the outcome that you expect. For this, we might request your financials, project details and other required information so that we can do the primary analysis of the data. This way, we’ll be able to offer you a personalized consultation.

After our analysis, we will share our valuable insights with you and suggest areas of improvement if required. You will get Registrationwala’s full support. We will address all the weaknesses and highlight your credit strengths. If required, we will also prepare you regarding the questions which might be asked by credit agencies.

We keep a full track record of the sector outlook of various credit rating agencies in India and credit ratings done in the past in a particular industry by these agencies. Once we have done our analysis, we will help you to pick the appropriate credit rating agency for your company as we have the required expertise for it.

Once we have selected the ideal credit rating agency, we will assist you in the preparation of the supplementary material and documents which are required to be submitted to the credit rating agency. This will help them to take a fair view on the credit worthiness of your company.

After the submission of your documents to the credit rating agency, we will keep you informed and updated regarding the status of your credit rating application. On your behalf, we'll coordinate with the credit rating agency and ensure that it receives all the necessary details and documents of your company. Throughout the process of credit rating, we will be in touch with you and be available to answer your queries.

Once our client has received the credit rating, we advise them whether they should appeal any aspect of the decision or accept the credit rating and convert it to a public rating, whichever is appropriate.

The role of credit rating in financial services is important. Credit rating is a continuous process majority of the time. It is examined and reviewed periodically. Therefore, it is crucial for the businesses to monitor the credit rating. Our credit rating consultants at Registrationwala help the clients to build long term strategies so that they can maintain and improve their creditworthiness.

Registrationwala is a leading credit rating advisory firm in India. We provide high-end analytical support to some of the leading companies in India. We bring with us over a decade of experience when it comes to credit advisory services.

Many companies have Registrationwala as their reliable partner due to our unmatched credibility and in-depth understanding across various sections. By availing our remarkable credit advisory services and solutions, many of our clients have improved their financial efficiencies.

Here are a few reasons why you should consider choosing us as your Credit Rating Advisor:

Expertise and Experience: We are leaders in facilitating credit ratings from CRAs in India. We make use of our years of experience to ensure accuracy in our guidance and offer seamless support throughout the entire process of credit rating.

Personalized Solutions: Consultants at Registrationwala offer personalized solutions that are specifically tailored to meet the unique needs and objectives of the clients. We ensure that the credit rating process perfectly aligns with our clients’ business goals.

Timeliness and Accuracy: At Registrationwala, we know the importance of timely credit ratings for companies. We expedite the credit rating process from our end with zero compromise on the accuracy.

Comprehensive Advisory: Services offered by Registrationwala go beyond just facilitating the credit rating process. We offer comprehensive advisory support to our clients, which includes our assistance for getting all the documents ready, interpretation of the credit reports and strategic planning based on the outcome of the credit rating to decide the way forward.

Dedicated Customer Support: If you face any issues during the credit rating process or even after it’s completed, we would be happy to assist you. At Registrationwala, we believe in providing a seamless and positive experience for each and every client associated with us.

If you want a trusted credit rating advisor, choose Registrationwala. We will not only facilitate your credit rating but also help you with a strategic approach to build creditworthiness in the Indian market.

Q1. Why does a company require credit rating?

A. Before approving or sanctioning a loan, lenders take into account the credit rating of a company. Through credit rating, the lenders can assess the creditworthiness of the potential borrowers.

Q2. What is the credit rating scale of CRAs?

A. Credit rating scales in India are categorized as AAA, AA, A, BBB, BB, B, CCC, C, D, etc. The highest credit rating is AAA. If the credit rating is below BB, it is considered that the borrower’s creditworthiness is poor.

Q3. Which regulatory body regulates CRAs in India?

A. Credit rating agencies (CRAs) are regulated by the Securities and Exchange Board of India (SEBI) under the SEBI (Credit Rating Agencies) Regulations, 1999.

Q4. How can a good credit rating be established and maintained by a company?

A. To establish and maintain a good credit rating, a company must pay off all its loans and EMI dues on time and also get its business registered.

★ ★ ★ ★ ★

I had a good time working with Registrationwala. Good team. I would recommend their services to others.

★ ★ ★ ★ ★

It was extremely great service of Registrationwala consulting firm, and this firm is providing the best services and worry about the client's required services along the client's satisfaction.

★ ★ ★ ★ ★

Superb Experince! Within no time the trademark registration was on.Highly professional team. I am very much Impressed with the prompt response and efficiency.Thank you.

★ ★ ★ ★ ★

We had taken ISP license from registration wala and the supporting person is very helpful to taken that license his communication and his work is satisfactory and thanks for those services

★ ★ ★ ★ ★

I sincerely appreciate your prompt support in helping me get the access license so quickly. Your professionalism and efficiency are truly commendable. Thank you for going above and beyond to assist me. Keep up the great work!

★ ★ ★ ★ ★

I very much appreciate the fact that you guys possess tremendous knowhow of private limited company incorporation. You have exhibited professional and respectful manner towards my query and I would seriously recommend you guys to all the folks looking for outstanding business services.

★ ★ ★ ★ ★

Thanks to their support, I got my trademark successfully. I highly recommend their services for anyone needing help with their intellectual property. The person assigned to me was very cooperative and helpful.

★ ★ ★ ★ ★

Thanks to their support ragistrationwala team, I got my IP-1 license successfully and special thanks to Miss.Kanishka for your great and timing support !!!!!! I have archived my goal one step forward... Thanks for the entire team....

★ ★ ★ ★ ★

Really helped a lot in getting my both VNO licenses. Great experience working with the team and very humble team, thanks for providing the vno license on time.

★ ★ ★ ★ ★

I had a good time working with Registrationwala. Good team. I would recommend their services to others.

★ ★ ★ ★ ★

It was extremely great service of Registrationwala consulting firm, and this firm is providing the best services and worry about the client's required services along the client's satisfaction.

★ ★ ★ ★ ★

Superb Experince! Within no time the trademark registration was on.Highly professional team. I am very much Impressed with the prompt response and efficiency.Thank you.

★ ★ ★ ★ ★

We had taken ISP license from registration wala and the supporting person is very helpful to taken that license his communication and his work is satisfactory and thanks for those services

★ ★ ★ ★ ★

I sincerely appreciate your prompt support in helping me get the access license so quickly. Your professionalism and efficiency are truly commendable. Thank you for going above and beyond to assist me. Keep up the great work!

★ ★ ★ ★ ★

I very much appreciate the fact that you guys possess tremendous knowhow of private limited company incorporation. You have exhibited professional and respectful manner towards my query and I would seriously recommend you guys to all the folks looking for outstanding business services.

★ ★ ★ ★ ★

Thanks to their support, I got my trademark successfully. I highly recommend their services for anyone needing help with their intellectual property. The person assigned to me was very cooperative and helpful.

★ ★ ★ ★ ★

Thanks to their support ragistrationwala team, I got my IP-1 license successfully and special thanks to Miss.Kanishka for your great and timing support !!!!!! I have archived my goal one step forward... Thanks for the entire team....

★ ★ ★ ★ ★

Really helped a lot in getting my both VNO licenses. Great experience working with the team and very humble team, thanks for providing the vno license on time.

★ ★ ★ ★ ★

I had a good time working with Registrationwala. Good team. I would recommend their services to others.