Get a Quote

Get a Quote and Find Services to Fit Your Needs 50000+ Satisfied Clients

5000+ Licenses & Registration

15 Branches across India

75 Years + Combined experience

The establishment of Unit Trust of India, in 1963, marked the evolution of the mutual funds industry in India. Back then, mutual fund wasn't very popular but now India's mutual funds industry outpaces global peers with 19% asset growth, leaving behind US, Japan and China.

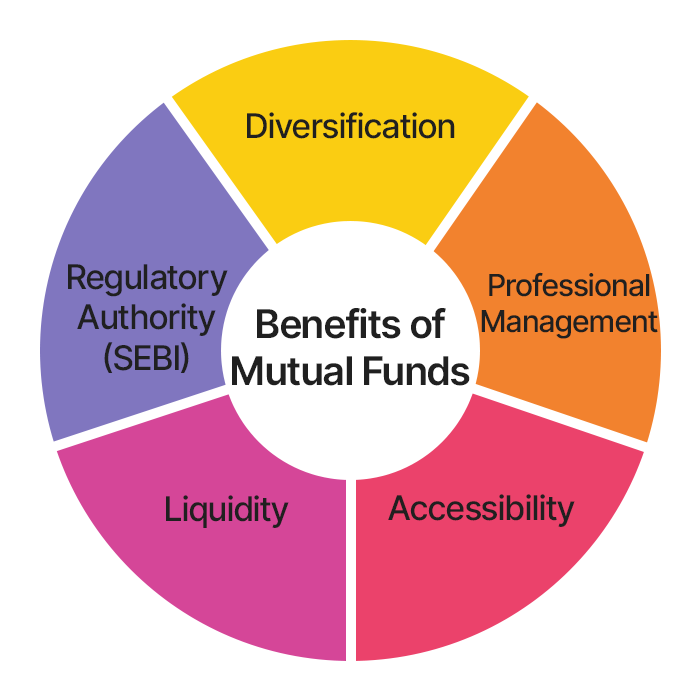

A mutual fund is an investment fund which consists of a portfolio of stocks, bonds and other securities which are managed by a professional manager. Mutual funds are an attractive investment option for individuals who want to grow their wealth with minimal risks. Here are some benefits of mutual funds:

According to SEBI, the Mutual Funds Schemes are broadly classified into the following groups:

Equity Fund refers to a mutual fund scheme that invests largely in shares of companies. As per SEBI, equity schemes are classified into 10 categories, the features of which, along with the uniform scheme description have been given below:

|

Category of Schemes |

Scheme Attributes |

Uniform Description of the Scheme |

|

Large Cap Fund |

Should invest 80% of total assets in equity and its related securities of large cap firms |

An open-ended equity scheme that majorly invests in large cap stocks |

|

Mid Cap Fund |

Should invest 65% of total assets in equity and its related securities of mid cap firms |

An open-ended equity scheme that majorly invests in mid cap stocks |

|

Small Cap Fund |

Should invest 65% of total assets in equity and its related securities of small cap firms |

An open-ended equity scheme that majorly invests in small cap stocks |

|

Multi Cap Fund |

Should invest 65% of total assets in equity and its related securities |

An open-ended equity scheme that majorly invests across large cap, mid cap, and small cap stocks |

|

Large & Mid Cap Fund |

Should invest 35% of total assets in equity and its related securities of large cap firms and 35% of total assets in equity and its related securities of mid cap firms |

An open-ended equity scheme that majorly invests in both large cap and mid cap stocks |

|

Dividend Yield Fund |

Should invest majorly in dividend yielding stocks and at least 65% of total assets in equity |

An open-ended equity scheme that majorly invests in dividend yielding stocks |

|

Value Fund |

Should follow a value investment strategy and invest 65% of total assets in equity and its related securities |

An open-ended equity scheme following a value investment strategy |

|

Contra Fund |

Should follow a contrarian investment strategy and invest 65% of total assets in equity and its related securities |

An open-ended equity scheme following a contrarian investment strategy |

|

Sectoral/Thematic Fund |

Should invest at least 80% of total assets in equity and its related securities of a particular theme or sector |

An open-ended equity scheme investing in (name of the theme or sector) |

|

Focused Fund |

Should invest 65% of total assets in equity and its related securities. Should focus on the number of stocks (a maximum of 30 stocks) |

An open-ended equity scheme investing in a maximum of 30 stocks (mention where the scheme intends to focus, viz., multi cap, large cap, mid cap, small cap) |

|

ELSS |

Should invest 80% of total assets in equity and its related securities (in accordance with Equity Linked Saving Scheme 2005 notified by the Ministry of Finance) |

An open-ended equity-linked savings scheme with a statutory lock-in of 3 years and tax benefits |

A debt fund is a mutual fund scheme which primarily invests in fixed income instruments, such as Corporate and Government Bonds, corporate debt securities, and money market instruments that offer capital appreciation. As per SEBI, debt schemes are classified into 16 categories:

|

Category of Schemes |

Scheme Attributes |

Uniform Description of the Scheme |

|

Low Duration Fund |

Should invest in debt and money market securities so that the Macaulay duration of the portfolio is between 6 months and 12 months |

An open-ended low duration debt scheme investing in securities with Macaulay duration between 6 months and 12 months |

|

Ultra Short Duration Fund |

Should invest in debt and money market securities so that the Macaulay duration of the portfolio is between 3 months and 6 months |

An open-ended ultra short-term debt scheme investing in securities with Macaulay duration between 3 months and 6 months |

|

Liquid Fund |

Should invest in debt and money market securities having a maturity of up to 91 days only |

An open-ended liquid scheme |

|

Overnight Fund |

Should invest in overnight securities with a maturity of 1 day |

An open-ended debt scheme investing in overnight securities |

|

Short Duration Fund |

Should invest in debt and money market securities so that the Macaulay duration of the portfolio is between 1 year and 3 years |

An open-ended short-term debt scheme investing in securities with Macaulay duration between 1 year and 3 years |

|

Medium Duration Fund |

Should invest in debt and money market securities so that the Macaulay duration of the portfolio is between 3 years and 4 years |

An open-ended medium-term debt scheme investing in securities with Macaulay duration between 3 years and 4 years |

|

Money Market Fund |

Should invest in money market securities with maturity of up to 1 year |

An open-ended debt scheme investing in money market securities |

|

Medium to Long Duration Fund |

Should invest in debt and money market securities so that the Macaulay duration of the portfolio is between 4 years and 7 years |

An open-ended medium-term debt scheme investing in securities with Macaulay duration between 4 years and 7 years |

|

Long Duration Fund |

Should invest in debt and money market securities so that the Macaulay duration of the portfolio is more than 7 years |

An open-ended debt scheme investing in securities with Macaulay duration of more than 7 years |

|

Corporate Bond Fund |

Should invest 80% of total assets in highest rated corporate bonds |

An open-ended debt scheme investing in the highest rated corporate bonds |

|

Dynamic Bond Fund |

Should invest across duration |

An open-ended dynamic debt scheme investing across duration |

|

Banking & PSU Fund |

Should invest 80% of total assets in debt securities of banks, public sector undertakings, and public financial institutions |

An open-ended debt scheme investing in debt securities of banks, public sector undertakings, and public financial institutions |

|

Credit Risk Fund |

Should invest 65% of total assets in the below highest rated corporate bonds |

An open-ended debt scheme investing in below highest rated corporate bonds |

|

Floater Fund |

Should invest 65% of total assets in floating rate instruments |

An open-ended debt scheme predominantly investing in floating rate instruments |

|

Gilt Fund |

Should invest 80% of total assets in government securities |

An open-ended debt scheme investing in government securities across maturity |

|

Gilt Fund with 10 year Constant Duration |

Should invest 80% of total assets in government securities so that the portfolio's Macaulay duration is 10 years |

An open-ended debt scheme investing in government securities that have a constant maturity of 10 years |

A hybrid fund is a classification of a mutual fund that invests in different types of assets to form a diversified portfolio. SEBI classifies hybrid schemes into 6 categories. Fund houses are only allowed to offer either a balanced hybrid fund or an aggressive hybrid fund, not both.

|

Category of Schemes |

Scheme Attributes |

Uniform Description of the Scheme |

|

Balanced Hybrid Fund |

Should invest between 40% and 60% of total assets in equity and its related securities |

An open-ended balanced scheme investing in equity and debt securities |

|

Aggressive Hybrid Fund |

Should invest between 65% and 80% of total assets in equity and its related securities; should invest between 20% and 35% of total assets in debt securities |

An open-ended hybrid scheme investing in equity and debt securities |

|

Conservative Hybrid Fund |

Should invest between 10% and 25% of total assets in equity and its related securities; should invest between 75% and 90% of total assets in debt securities |

An open-ended hybrid scheme investing mainly in debt securities |

|

Dynamic Asset Allocation or Balanced Advantage Fund |

Should invest in dynamically managed equity or debt securities |

An open-ended dynamic asset allocation fund |

|

Multi-Asset Allocation Fund |

Should invest in a minimum of three asset classes with a minimum allocation of 10% in each asset class |

An open-ended scheme investing in (names of the asset classes) |

|

Equity Savings |

Should invest at least 65% of the total assets in equity and its related securities and at least 10% of total assets in debt securities |

An open-ended scheme investing in equity, arbitrage, and debt |

|

Arbitrage Fund |

Should follow arbitrage strategy and invest at least 65% of total assets in equity and its related securities |

An open-ended scheme investing in arbitrage opportunities |

Solution oriented schemes are usually closed-ended mutual funds, wherein the investment remains locked in for five years. They’re ideal for those who have a specific goal such as a child's education or retirement planning. SEBI classifies Solution oriented schemes into 2 categories:

|

Scheme Category |

Scheme Attributes |

Uniform Description of the Scheme |

|

Children's Fund |

Lock-in period for at least 5 years or till the child attains majority age, whichever is earlier |

An open-ended fund for investment for children with a lock-in period for a minimum of 5 years or until the child reaches majority age, whichever is earlier |

|

Retirement Fund |

Lock-in period of at least 5 years or till retirement age, whichever is earlier |

An open-ended retirement solution-oriented scheme with a lock-in period of 5 years or till retirement age (whichever is earlier) |

SEBI classifies other schemes into two categories:

|

Scheme Category |

Scheme Attributes |

Uniform Description of the Scheme |

|

Index Funds/ETFs |

Should invest at least 95% of total assets in securities of a particular index |

An open-ended scheme tracking/replicating (name of the index) |

|

Fund of Funds (Overseas or Domestic) |

Should invest at least 95% of total assets in the underlying fund |

An open-ended fund of fund scheme investing in (name of the underlying fund) |

For more details, you can check out the circular of SEBI.

Investors can buy mutual fund shares from the funds directly or authorized mutual fund distributors that possess mutual fund distributor license. When investors purchase shares of a mutual fund, they pay a price which consists of the net asset value per share of the fund, plus any additional fees charged at the time of purchase, like sales loads. Investors can sell the shares back to the fund at any time, and the money for the shares sold gets transferred to your bank account within a week normally.

Investment is an excellent idea for those who want to increase their wealth. Mutual fund is one of the most popular ways to invest your money, and it can offer you great returns. There are many types of mutual funds, and you can pick the one you like after doing your research. You can also get it in touch with an authorized mutual funds advisor to help you out.

Want to know More ?