Get a Quote

Get a Quote and Find Services to Fit Your Needs 50000+ Satisfied Clients

5000+ Licenses & Registration

15 Branches across India

75 Years + Combined experience

If you are looking to get credit from the market, you may come across the term – ‘line of credit’. Many people don’t understand its meaning and avoid it unnecessarily. In this post, you will get to know how is a personal line of credit and how does it work.

A personal line of credit simply refers to a type of money financing in which borrowers can take the money over and over again. However, this type of financing comes with a certain limit on the maximum amount. The borrower amount carries a certain interest rate. You can compare a personal line of credit with a credit card.

A line of credit is also known as an open-end credit or revolving debt. This type of finance can be availed by individuals having excellent credit records.

A majority of personal lines of credit tends to come along with a life cycle in two stages: the draw period and the repayment tenure. These stages typically endure 3 to 5 years each.

Draw period: In simple words, a draw period can also be called a borrowing period. This refers to the time for which a borrowers takes the money from his or her line of credit. He or she is supposed to make a minimum monthly payment towards the line of credit.

Repayment period: A borrower won’t be able to borrow during the repayment period. He or she is supposed to repay the borrowed amount within this timeframe.

Helpful Post: How to Check CIBIL Score in Phonepe?

Rather than banking upon the draw/repayment period system, a few lines of credit only come along with a draw period. In such cases, the outstanding amount might be due completely after the expiry of the draw period. A borrower might get a continuous draw period, given the policy of the money lender. The lines of credit function like a credit card as a person can borrow money as long as he continues to make minimum monthly payments and follow his maximum limit.

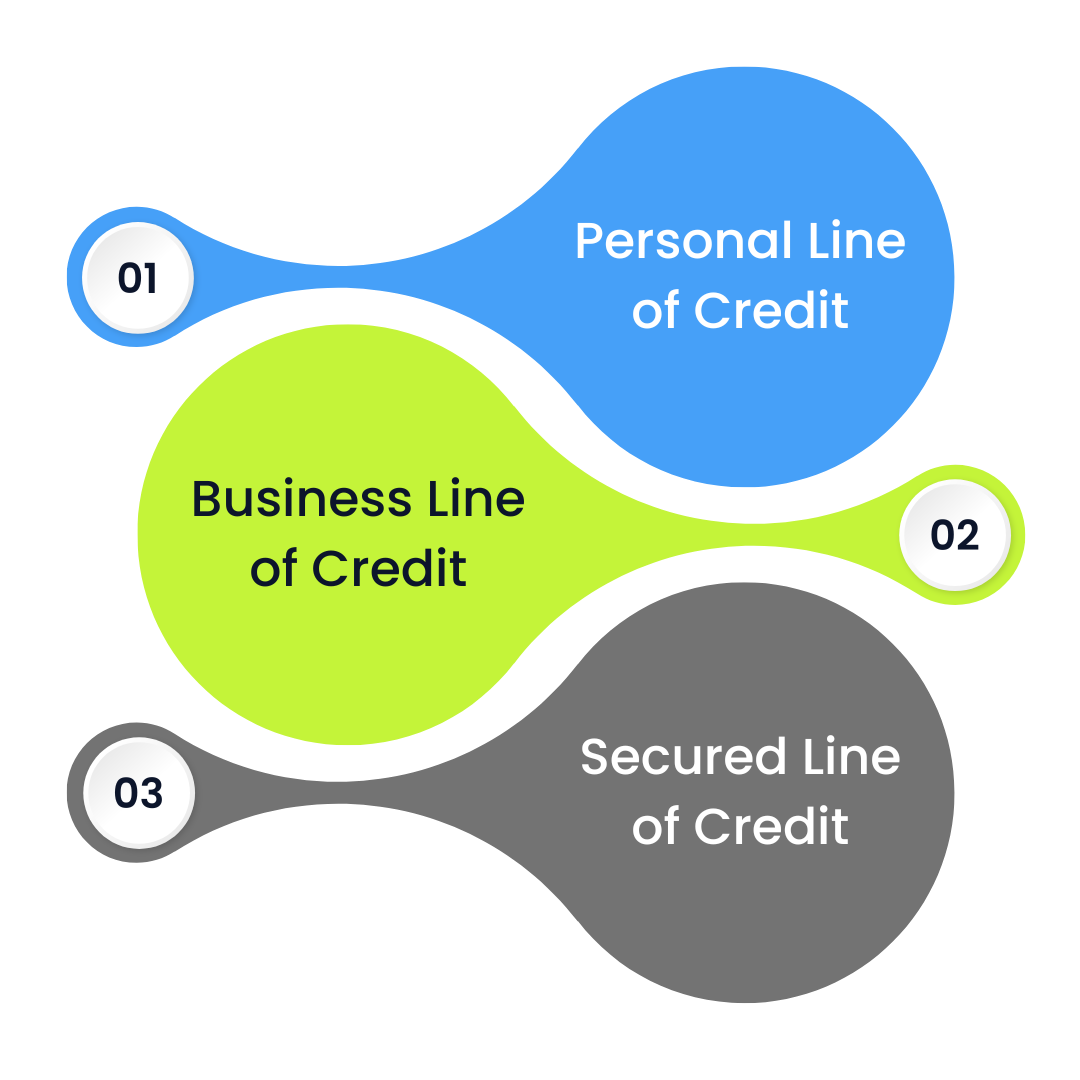

Types of Line of Credit

There are three major types of lines of credit available to choose from.

A personal line of credit simply means an unsecured loan given a person’s creditworthiness. The borrowers can use this fund for any purpose, and the borrowed amount may levy a higher credit than a secured line of credit. Also, the available credit limit may be lower than that of a secure line of credit.

A business line of credit refers to a rotating credit account meant particularly for businesses. The credit limit remains higher in comparison to a personal line of credit whereas the interest rates may fall on a lower end. The borrowers can utilize the funds for any commercial purpose such as machinery financing, inventory purchases, or payroll expenses.

Need a Credit Rating Advisory? Click here

A secured line of credit refers to a credit in which the amount is secured by collateral, like a home or other assets. The interest rate remains typically usually lower than an unsecured line of credit with a higher credit limit. However, in the case of non-payment of the amount, the lender is liable to seize your collateral.

Overall, a line of credit is an easy source of getting funds anytime for those who have excellent credit scores. Today, there are several line of credit service providers that enable easy borrowing and repayment to people and businesses looking for fast and flexible credit options. To get the best deal, it is recommended to do thorough research before choosing a particular lender.