Get a Quote

Get a Quote and Find Services to Fit Your Needs 50000+ Satisfied Clients

5000+ Licenses & Registration

15 Branches across India

75 Years + Combined experience

When starting a business, most individuals prioritise planning the business activities, process, marketing, funding, etc. But sometimes forget to get business licenses in the first place and get in last..

Some reasons why business licenses are ignored till the last are because of a long process, tons of documents requirement, and application submissions to different authorities. That’s why most businesses keep the business registration process till last and complete other parts first.

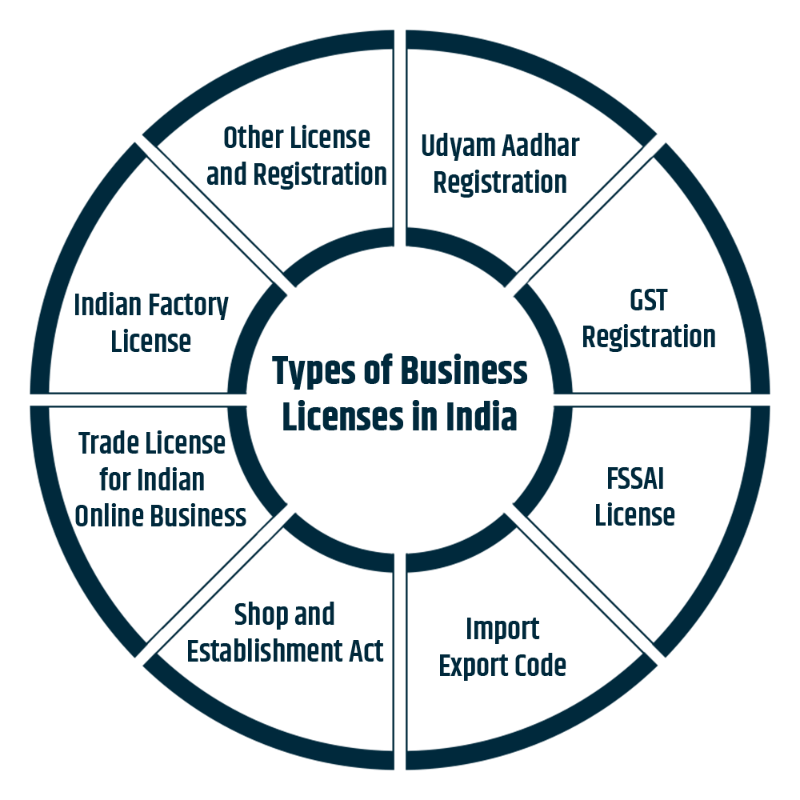

Different types of business licenses depend on the nature and location of the business. For business registration, these licenses can be obtained from different jurisdictions and authorities. After obtaining the license the business gained significance in the market as licenses are government regulated. So, below are the different types of business licenses covered for different businesses.

A business license is a permit given by government agencies that allow individuals or companies to conduct business within the government's geographical jurisdiction.

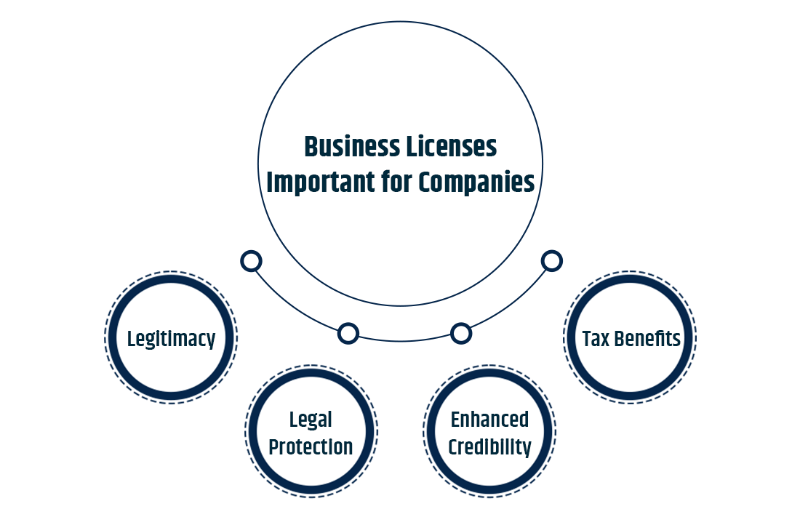

So, the requirement for business licenses can depend on the country, state and local municipalities. To legally operate a business, build credibility, and get access to business loans, you must have business licenses as per the requirement of your business. Below are some other reasons to get a business license.

The following are the reasons which are important to get the business licenses in the first place:

The following are the different business licenses in India based on the nature and requirements of the business.

The Udyam registration is important for Micro, Small and Medium Enterprises. The registration process is completely online, and it is mandatory for all MSMEs. It provides a certificate and a twelve-digit Unique Number. After the registration, a permanent identification number and e-certificate will be provided.

From July 1st, 2020, the Udyog Aadhar Registration converts to Udyam Aadhar and every existing MSME should convert the Udyog to Udyam certificate. There are criteria and processes which should be followed to register on the official portal. Check the Udyog Aadhar Detailed Guide here.

The Goods and Services Tax is the tax paid on the consumption of goods and services. It is an indirect tax which is divided into two parts: Central GST and State GST. There is another part which is integrated GST taken by the central government for every interstate transaction.

Any person and entity with an annual turnover of more than Rs. 20 lakhs must acquire a GST registration. In some states, the turnover is fixed at Rs. 10 lakhs. On the other hand, businesses are included in the supply of goods and have a turnover of Rs. 40 lakhs in a year. To check the complete process of GST registration, read the article here.

The Food Standards and Safety Authority of India (FSSAI) is accountable for food safety in India. It is a regulating and governing body for food safety in India. To operate a food business in India, you must acquire an FSSAI license. The food business registration is online and can be done through the FSSAI portal.

In India, there are three FSSAI licenses available, such as FSSAI Central License, FSSAI State License and Basic FSSAI Registration. As the food is related to consumers directly, maintaining hygiene and quality is important. And the FSSAI department ensures compliance and regulations.

An Import Export Code is a unique 10-digit alphanumeric code based on the basis of PAN of the entity. Without IEC Code, any import and export cannot be done in India. So, for businesses who want to do business internationally, they must have an IEC. So, an individual can use their company or their own name to apply for IEC. After applying, you receive an e-IEC by the Director General of Foreign Trade (DGFT) which is under the Ministry of Commerce, Government of India.

The Department of Labour regulates the Shop and Establishment Act. It ensures that working conditions and employment of workers will improve in shops, commercial establishments, hotels, theatres, etc. All the rights of workers are maintained such as leaves, holidays, working hours, termination, etc. Currently, each state has its own shop act which is important to follow for every business. You must obtain the license within 30 days of commencing your business.

A trade license is important for businesses to work in an ethical environment. This license is issued by the local administration and it ensures that business does not indulge in any unethical practice.

All the business includes trading, repairing, manufacturing, and rendering services connected with the import and export of goods. To get the trade license, you must submit an application and proof of financial stability. The authority will grant you the certificate once you fulfil all your requirements. If you are running a trade business without a license then you could be fined up to Rs. 10 lakhs or imprisoned for two years.

Every factory owner has to register the factory with the local authorities before the Factories Act, of 1948 came into force. The local authorities gave them permission to manufacture the products and carry out other business activities.

The Factories Act 1948, provides a license to certain factories which fulfil the conditions given in the Act. There are certain factories which must obtain the factory license: first, when the factory has ten or more workers involved in manufacturing activity with the aid of power, second, when the factory has 20 or more workers involved in the manufacturing activity without the aid of power.

Businesses in insurance, financial services, broadcasting, defence, etc have to collect the license from regulatory bodies like the Reserve Bank of India (IRDAI), etc. Some other permits are necessary to obtain such as fire department, pollution control board, or include in a local healthcare system. So, all the licenses depend on the nature of the business. It is advisable to connect with experts to know the license requirements.

To conclude, the small business comparatively required fewer licenses than a private limited or partnership firm. Business licenses help companies to comply with Indian laws and permits. In India, you can start a business without registration but there are some benefits which are only provided to those who are registered with government authorities.

Want to know More ?