Get a Quote

Get a Quote and Find Services to Fit Your Needs 50000+ Satisfied Clients

5000+ Licenses & Registration

15 Branches across India

75 Years + Combined experience

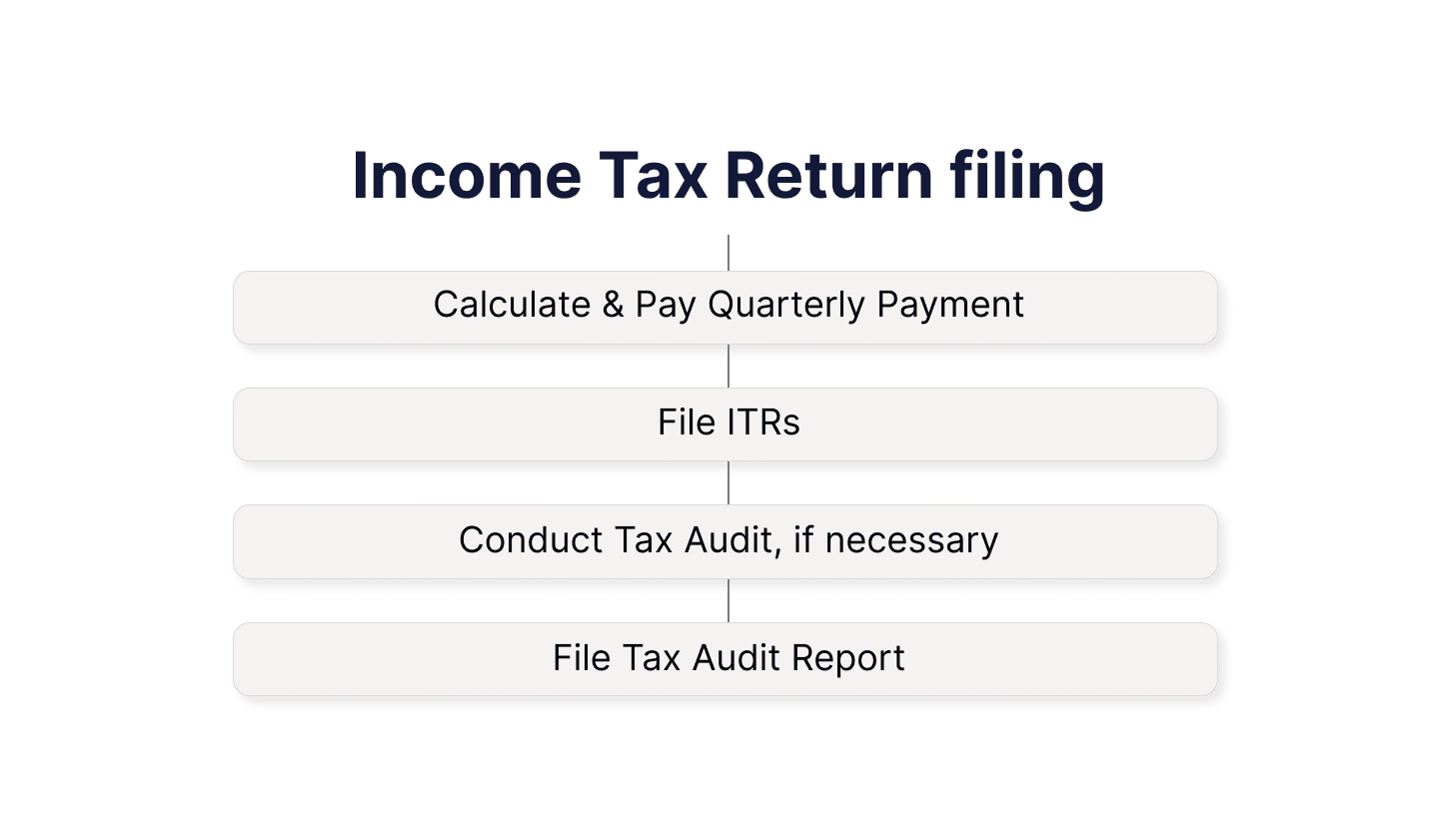

Once you have registered your private limited company, you can run your business legally. However, you still have to file annual returns to the MCA to be legitimate in the eyes of the law. These annual returns or compliances for private limited company must be filed annually, biannually, half-yearly, and quarterly.

Fulfilling annual compliances for private limited company is an important step to ensuring compliance with the Companies Act, 2013. For assistance in ensuring pvt ltd annual compliance, connect with Registrationwala pvt ltd co consultants.

These are compliances that are filed on certain MCA notifications.

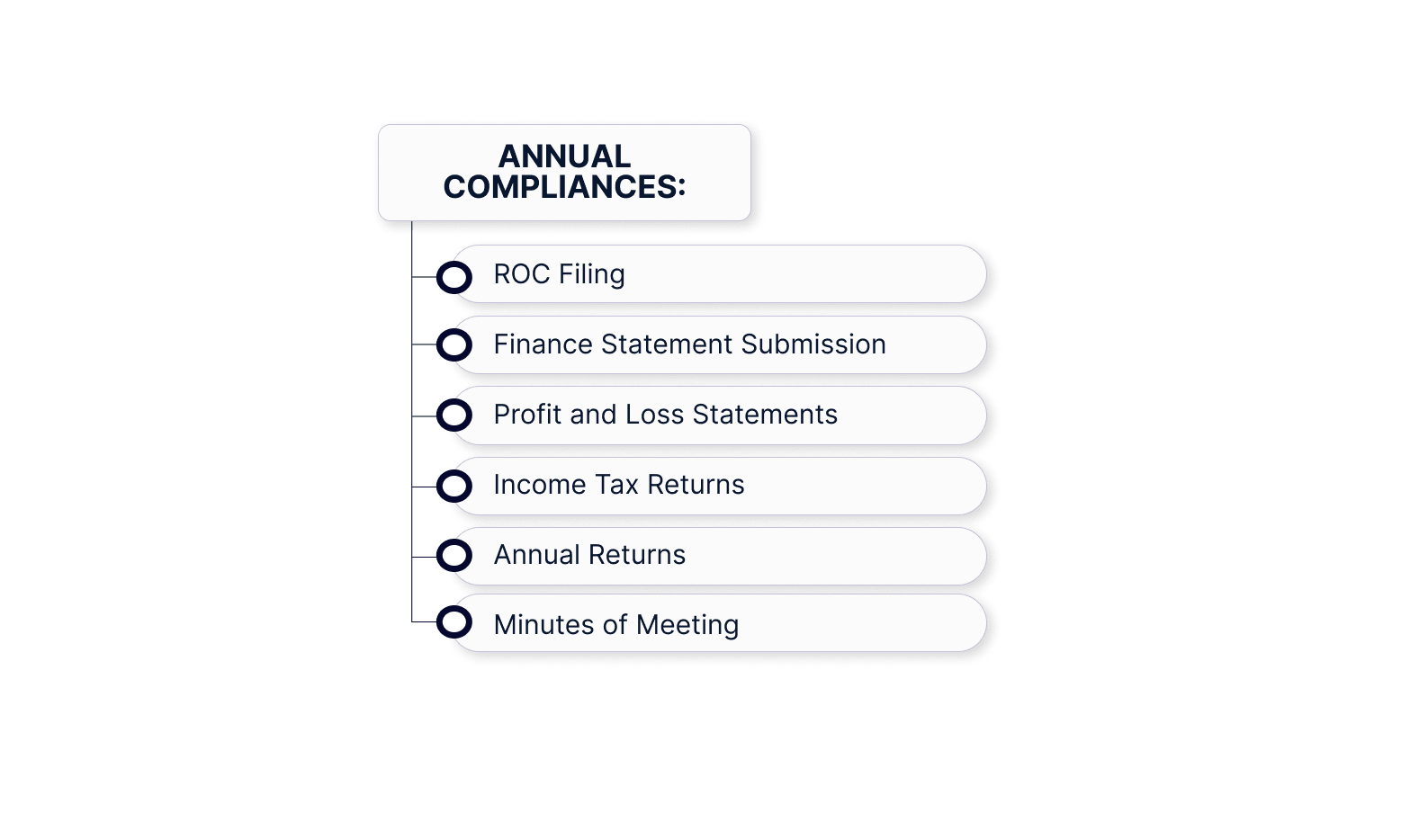

The annual compliance for pvt ltd company needs to be filed regularly. They are mandatory compliances that the private limited companies need to prepare for. The Annual Compliance of a company contains the following matters:

These are legal matters that can be attended to best through the aid of business experts. Therefore, these experts should only file Compliance for a Private Limited Company. This is where we step in.

We are Registrationwala, India's leading business registration, and compliance experts team. We provide the best Annual compliance services for a Private Limited Company in India. So contact our experts, give us your details and leave the rest to us.

.png)

The reasons for which every Private Limited Company should stay compliant are as follows:

Once a company has met all its legal obligations, it can market it positively on websites or through ads. It can be put in job applications and all other places the Company is reaching the market. Managing Compliance brings a good name to the Company.

Many compliance issues deal with the benefit of the employees. Some even talk about protecting the employees. For a company that adheres to these guidelines, it becomes easy to retain the employees as the workforce feels at home. The Company must strive to work to improve the business and the product.

Thus, for a Private Limited, which is bound by many compliance guidelines, it is paramount to manage all that. Moreover, in the long run, it showers the Company with all the benefits that may or may not be visible initially.

Certain rules help more than they harm. For example, regulations related to discrimination and harassment help create a better working environment for employees, leading to better productivity. Also, better security – financial as well as physical – help employees provide more to the Company.

Considering that the needs and burdens of Compliance will never go away, it is time to embrace them—not only as a cost of doing business but for the many benefits they bring, including the 5 listed here.

Once a company has lived up to the compliance requirement, it saves itself from many legal and financial troubles. By legal troubles, we mean the investigation and business interruptions that follows.

In cases where Compliance is done on time, certain filters and reference points always help eliminate paraphernalia and ensure the Company is stuck to what is best suited for developing its services.

Any stakeholder or regulator, while doing business with a company, ensures that the business he is stepping into is ethically and morally a well-set unit.

Compliance ensures that there is transparency in the way a business functions. The customers, when provided with a true and honest story, which happens when you complete the Compliance on time about a company, they are lured into it.

Compliance programs ensure that everyone in the Company knows the actual agenda. Because of its legal nature, it is like a whip to ensure everyone is on the same page regarding the Company's mission.

All organizations need to be managed efficiently and in a professional manner. So it is very important how it is controlled and adapted to these rules and regulations. It's always better to hire compliance filing experts to take care of all the due dates and avoid last-minute hassle and government penalties.

If you're a private limited company, then regardless of your turnover, you need to file the annual Compliance of your Company.

The documents you need to fulfill your annual Compliance are as follows:

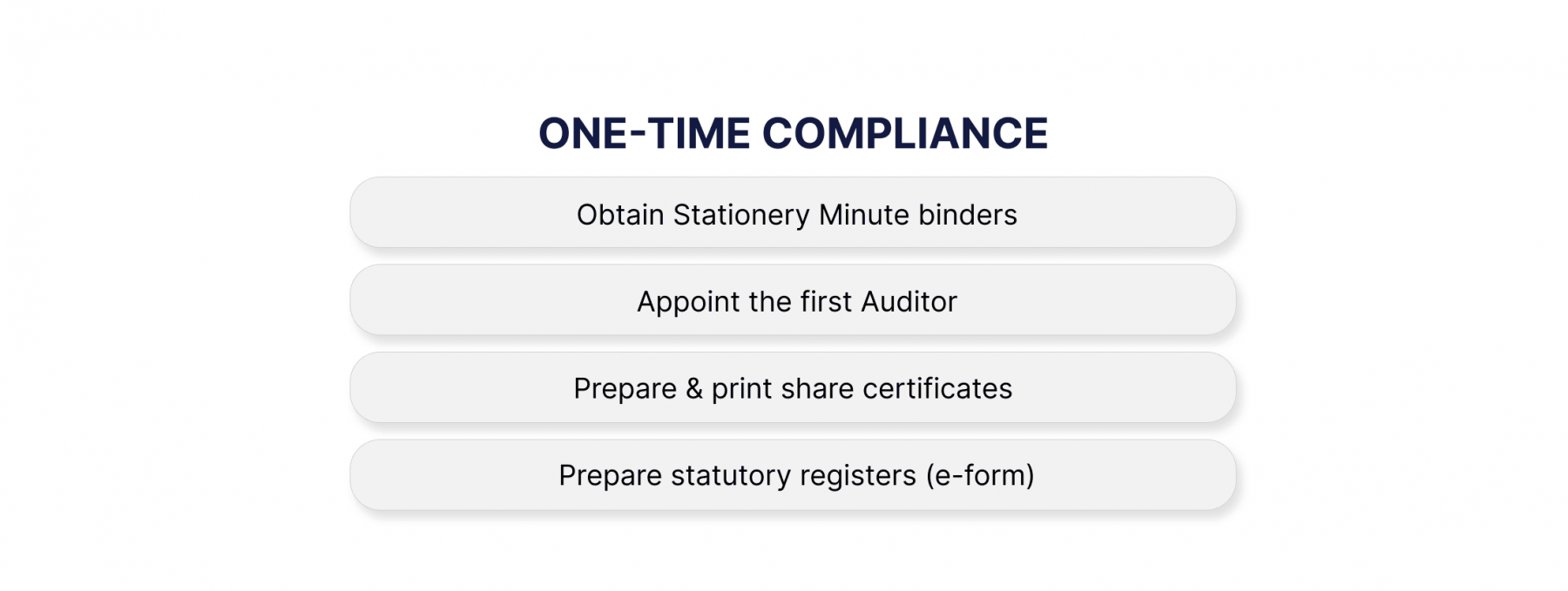

The Compliance related filing includes legal compliances for Private Limited Companies. Here is the list of compliance requirements that every form of Company is required to fulfill:

Fixing a Board: Every Company must fix a board outside the registered office of the Company. The Board must contain the name of the Company and the registered address of the Company. The information printed on the Board shall be in English and the regional languages.

Letterheads and Invoices: It should also ensure that every letterhead and invoice of the Company contains its full name, registered address, telephone number, corporate identity number, and E-mail ID. In addition, the name shall be printed in Header and CIN No, Add of registered office and E-mail id of the Company in Footer.

Maintaining Company's website: The official website of every Company shall contain the following information about the Company on its landing or home page.

.jpg)

Every Company must maintain various statutory registers and records as required by the Company law. Below mentioned are some of the logs and records which are required to be maintained:

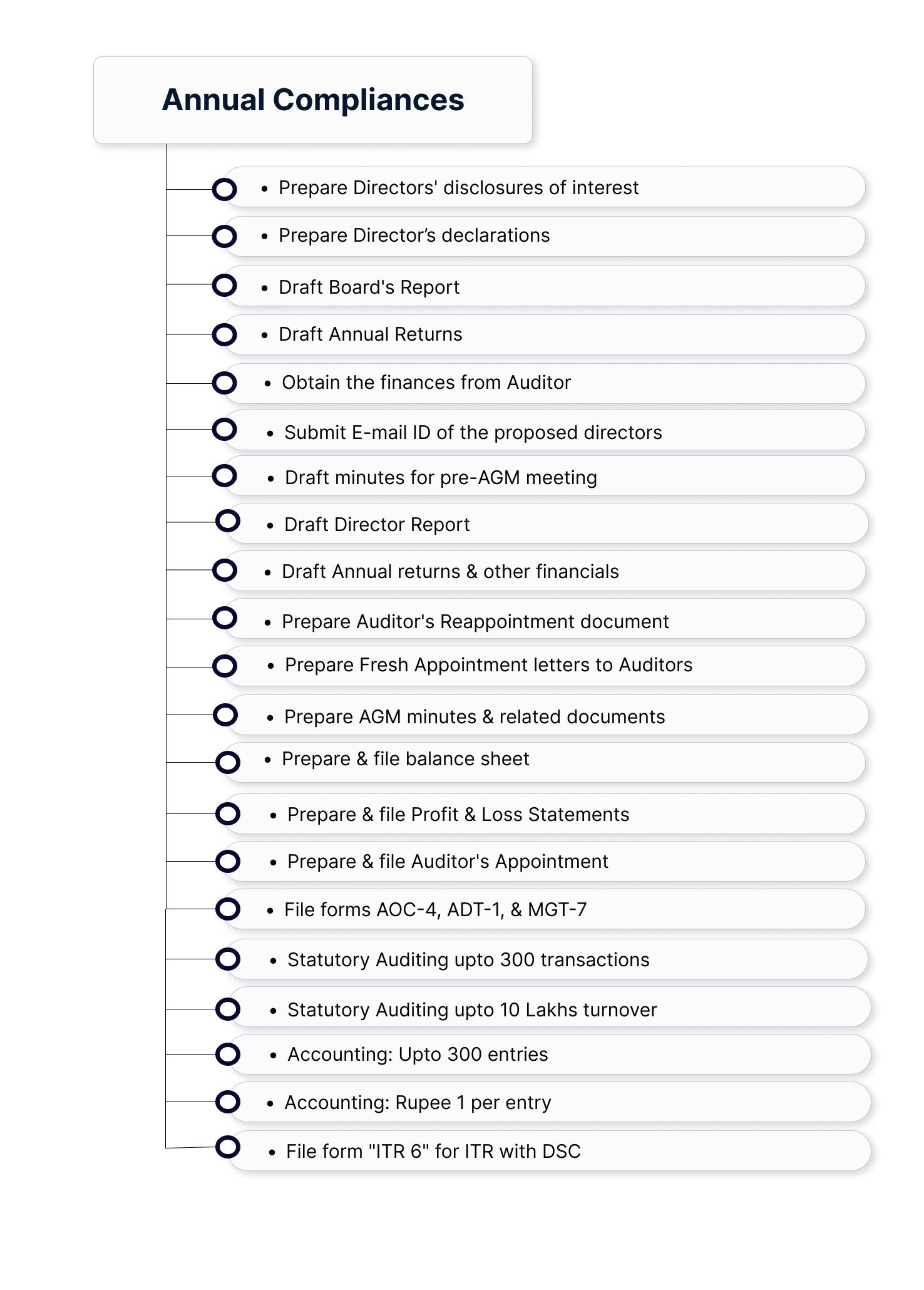

We at Registrationwala provide end-to-end solutions for filing Annual Compliances. Our services include:

Registrationwala.com is a leading legal consultancy firm providing comprehensive annual compliance services for private limited Companies. To know more about the Private Limited Company's Annual Compliance Services in India or to file your yearly Compliance, reach out to us now.

Q1. What is an Annual Compliance?

A. Once you have registered your Company, you will run a business freely. However, you still have to file annual returns to the MCA to be legitimate in the eyes of the law. These annual returns or compliances for the private limited Company must be filed annually, biannually, half-yearly, and quarterly.

Q2. What are the types of Pvt Ltd Company Compliances?

A. There are four kinds of Compliances for a Private Limited Company:

Q3. What is the cost of filing Annual Compliance for a Private Limited Company?

A. To know about the pvt ltd company annual compliance charges, connect with compliance experts at Registrationwala.

Q4. What is Compliance Filing meaning?

A. Annual Compliance filing for Private Companies at regular intervals are mandatory compliance provisions the Company must prepare. They contain the following matters:

Q5. What is the cost of filing Annual Compliance for a Private Limited Company?

A. To know about the compliance filing processing fee, connect with compliance experts at Registrationwala.

★ ★ ★ ★ ★

I had a good time working with Registrationwala. Good team. I would recommend their services to others.

★ ★ ★ ★ ★

It was extremely great service of Registrationwala consulting firm, and this firm is providing the best services and worry about the client's required services along the client's satisfaction.

★ ★ ★ ★ ★

Superb Experince! Within no time the trademark registration was on.Highly professional team. I am very much Impressed with the prompt response and efficiency.Thank you.

★ ★ ★ ★ ★

We had taken ISP license from registration wala and the supporting person is very helpful to taken that license his communication and his work is satisfactory and thanks for those services

★ ★ ★ ★ ★

I sincerely appreciate your prompt support in helping me get the access license so quickly. Your professionalism and efficiency are truly commendable. Thank you for going above and beyond to assist me. Keep up the great work!

★ ★ ★ ★ ★

I very much appreciate the fact that you guys possess tremendous knowhow of private limited company incorporation. You have exhibited professional and respectful manner towards my query and I would seriously recommend you guys to all the folks looking for outstanding business services.

★ ★ ★ ★ ★

Thanks to their support, I got my trademark successfully. I highly recommend their services for anyone needing help with their intellectual property. The person assigned to me was very cooperative and helpful.

★ ★ ★ ★ ★

Thanks to their support ragistrationwala team, I got my IP-1 license successfully and special thanks to Miss.Kanishka for your great and timing support !!!!!! I have archived my goal one step forward... Thanks for the entire team....

★ ★ ★ ★ ★

Really helped a lot in getting my both VNO licenses. Great experience working with the team and very humble team, thanks for providing the vno license on time.

★ ★ ★ ★ ★

I had a good time working with Registrationwala. Good team. I would recommend their services to others.

★ ★ ★ ★ ★

It was extremely great service of Registrationwala consulting firm, and this firm is providing the best services and worry about the client's required services along the client's satisfaction.

★ ★ ★ ★ ★

Superb Experince! Within no time the trademark registration was on.Highly professional team. I am very much Impressed with the prompt response and efficiency.Thank you.

★ ★ ★ ★ ★

We had taken ISP license from registration wala and the supporting person is very helpful to taken that license his communication and his work is satisfactory and thanks for those services

★ ★ ★ ★ ★

I sincerely appreciate your prompt support in helping me get the access license so quickly. Your professionalism and efficiency are truly commendable. Thank you for going above and beyond to assist me. Keep up the great work!

★ ★ ★ ★ ★

I very much appreciate the fact that you guys possess tremendous knowhow of private limited company incorporation. You have exhibited professional and respectful manner towards my query and I would seriously recommend you guys to all the folks looking for outstanding business services.

★ ★ ★ ★ ★

Thanks to their support, I got my trademark successfully. I highly recommend their services for anyone needing help with their intellectual property. The person assigned to me was very cooperative and helpful.

★ ★ ★ ★ ★

Thanks to their support ragistrationwala team, I got my IP-1 license successfully and special thanks to Miss.Kanishka for your great and timing support !!!!!! I have archived my goal one step forward... Thanks for the entire team....

★ ★ ★ ★ ★

Really helped a lot in getting my both VNO licenses. Great experience working with the team and very humble team, thanks for providing the vno license on time.

★ ★ ★ ★ ★

I had a good time working with Registrationwala. Good team. I would recommend their services to others.