What is Udyam Registration Certificate?

- May 17, 2024

- Registrationwala

- Home

- /

- Knowledge Base

- /

- News & other businesses

- /

- Blog

- /

- What is Udyam Registration Certificate?

What is Udyam Registration Certificate?

The Udyam Registration Portal was launched by the Ministry of MSMEs to digitize India and streamline processes. It is a one-of-a-kind tech-first system which assists small and medium businesses to grow.

In this article, we will discuss everything you need to know about Udyam Registration.

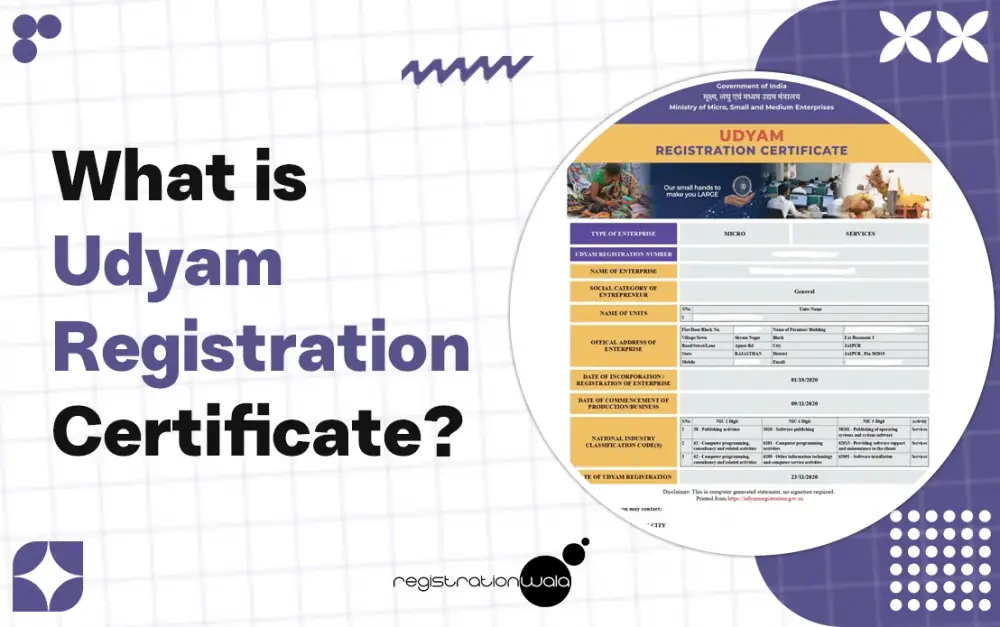

What exactly is Udyam Registration Certificate?

The term Udyam literally means “Enterprise”. Udyam Registration, also called MSME Registration, involves a government sign-off and the provision of a Udyam Registration Certificate and a Unique Number. If you seek legal and operational certification for small or medium-sized businesses, the Udyam Registration Certificate is mandatory.

The Udyam Registration for MSMEs is conducted by the Ministry of MSME, Government of India. The MSME Registration Certificate is received by the entrepreneurs upon the completion of the MSME registration process. A QR Code is mentioned in each Udyam Registration Certificate through which the web page of the MSME can be accessed through the Udyam Portal.

The Udyam Registration is a digital process which replaces the traditional complex paperwork and makes it easier for businesses to get official recognition. Udyam registration download or MSME registration download can be easily done using the Udyam Portal.

Certification Process by MSMEs

The Certification Process for MSMEs involves several crucial steps:

- Online Registration: The registration process is entirely conducted online which is convenient as well as easily accessible for MSMEs. To initiate the registration process, businesses have to access the Udyam Portal.

- Self-Declaration of MSME: The MSMEs need to provide self-declarations regarding their business, such as turnover for service businesses and investment in plant and machinery or manufacturing businesses’ equipment.

- Integration of Aadhaar: The registration procedure requires the Aadhaar number of the individual registering himself or herself. It links the entrepreneur’s identity with the MSME. Due to this integration, the legitimacy of the information entered during registration can be determined.

- Receipt of Instant Registration Number: Upon successful completion of Udyam Registration online process, MSME receives an instant registration number. This number works as a unique identifier for the enterprise and allows it to avail several benefits.

- Classification of MSMEs: Based on their business’s nature, MSMEs are classified into Manufacturing Enterprises and Service Enterprises. This classification helps them to customize certain promotional and support operations based on the specific business type.

- No Cost/Fees: One of the notable aspects of the Udyam Certification process is that there is no fee for Udyam Registration. This eliminates any financial barriers for MSMEs and encourages a more extensive participation of small businesses in the formal registration process.

What are the Features of Udyam Registration Certificate?

The features of the Udyam Registration certificate are as follows:

- Udyam Registration Certificate provides a permanent registration number to the MSMEs.

- The Udyam Registration Certificate is an e-certificate which is received on the entrepreneur’s email address once the online registration is completed.

- The Udyam Registration Certificate remains valid till the enterprise exists.

- More than one MSME registration cannot be applied by a single enterprise. Any number of activities including manufacturing or service or both must be specified or included in a single registration.

- To obtain loans from banks or NBFCs and avail benefits provided under various government schemes for MSMEs, the Udyam Registration Certificate is necessary.

- The Udyam Registration ensures that an enterprise is counted as an MSME.

Does Udyam Registration Certificate need to be Renewed?

Once Udyam Registration Certificate is issued to an enterprise after successful MSME Registration, it remains valid for a lifetime. Hence, there is no requirement for renewal of Udyan Registration Certificate.

Conclusion

Initially, the Government of India had launched Udyog Aadhaar for MSMEs to get their businesses registered. However, the registration process was a bit complex. Thus, from 2020 onwards, Udyam became the new portal for MSME registration. The Udyam Registration MSME portal is a single online portal for the registration of MSMEs.

The government’s Udyam Registration project is crucial to empower and assist MSMEs. This registration facilitates the expansion of small and medium-sized enterprises by providing them with a formal identity due to which they can easily obtain financing and also provides several other benefits. To secure long-term success and sustainability in today’s competitive business industry, the MSMEs must make use of all the benefits they can obtain.

Frequently Asked Questions (FAQs)

Q1. What are the tax benefits of Udyam/MSME Registration?

A. There are many tax benefits that come with Udyam Registration for MSMEs. These benefits include preferential treatment in terms of income tax exemptions, reduced interest rates and excise exemption. The Udyam/MSME registration allows MSMEs to enjoy these benefits and helps them in financial stability and growth.

Q2. What is meant by the MSME subsidy?

A. MSME subsidy refers to the financial help provided by the Government of India to the eligible businesses falling under the MSME category. These subsidies can take place in various forms like capital subsidies, internet subsidies and subsidies for technology upgradation.

Q3. Is GST Registration required before the Udyam Registration can be done?

A. No, GST Registration is not a requirement for the Udyam Registration for MSMES. GST Registration is optional for businesses having an annual turnover which is below the threshold limit. Udyam Registration is not dependent on it whatsoever.

Q4. Who is not eligible for MSME status?

A. Large enterprises, public corporations and businesses involved in activities excluded by the government are generally not eligible for MSME status. The eligibility criteria specified by the government must be reviewed carefully to determine the MSME status of a business.

Q5. Is Udyam Registration mandatory?

A. No, the Udyam Registration is not yet mandatory. However, it is highly recommended for MSMEs to get Udyam Registration as it opens doors to a multitude of government benefits such as financial support, subsidies and access to several schemes. By obtaining Udyan Registration, the credibility of an MSME gets enhanced and the process of securing loans and contracts becomes easier.

Q6. How is the MSME status beneficial for the start-ups in India?

A. The MSME status comes with a multitude of benefits for startups such as easier credit access, priority sector lending, and various incentives and subsidies. To offer support to the startups falling under the MSME category, the government has tailored several schemes and initiatives so that the entrepreneurs can benefit from them.

- 1984 views