Net worth Certificate: Understand Its Meaning and Format

- August 20, 2024

- Registrationwala

- Home

- /

- Knowledge Base

- /

- News & other businesses

- /

- Blog

- /

- Net worth Certificate: Understand Its Meaning and Format

Net worth Certificate: Understand Its Meaning and Format

A networth certificate is crucial for applying for various licenses and registrations in India. This document is generally certified by a practicing Chartered Accountant (CA). In this article, we will understand what a networth certificate is, from the net worth certificate’s meaning to how you can get this certificate.

Net worth Certificate: Meaning

A net worth certificate is a document that contains an individual or entity’s net worth. A chartered accountant certifies this certificate after carefully scrutinizing the individual or entity's book of accounts, records and documents, and total assets and liabilities of an individual or entity.

How to Get a Net Worth Certificate?

You must reach out to a Chartered Accountant (CA) if you want to get a net worth certificate. There are certain personal documents that must be submitted to him for proof of identity, such as PAN, Aadhaar, Driving License, Voter ID, or Passport. Apart from these documents, you must also submit a passbook, income tax returns (ITR), utility bills like electricity or water bills, or a property tax copy as proof of address.

Additionally, you must provide your contact details, such as your email ID and phone number, as well as financial documents, such as your income statement and balance sheet, to the CA. The income statement must reflect your income as well as your expenses over a certain period. The balance sheet must give an overview of all your assets and liabilities over a specified period. Both these documents must be prepared by a certified chartered accountant.

You can get a net worth certificate for various purposes such as for getting a visa or obtaining approval for a loan. It is also required to apply for licenses or registration from regulatory authorities like RBI, IRDAI, SEBI, etc.

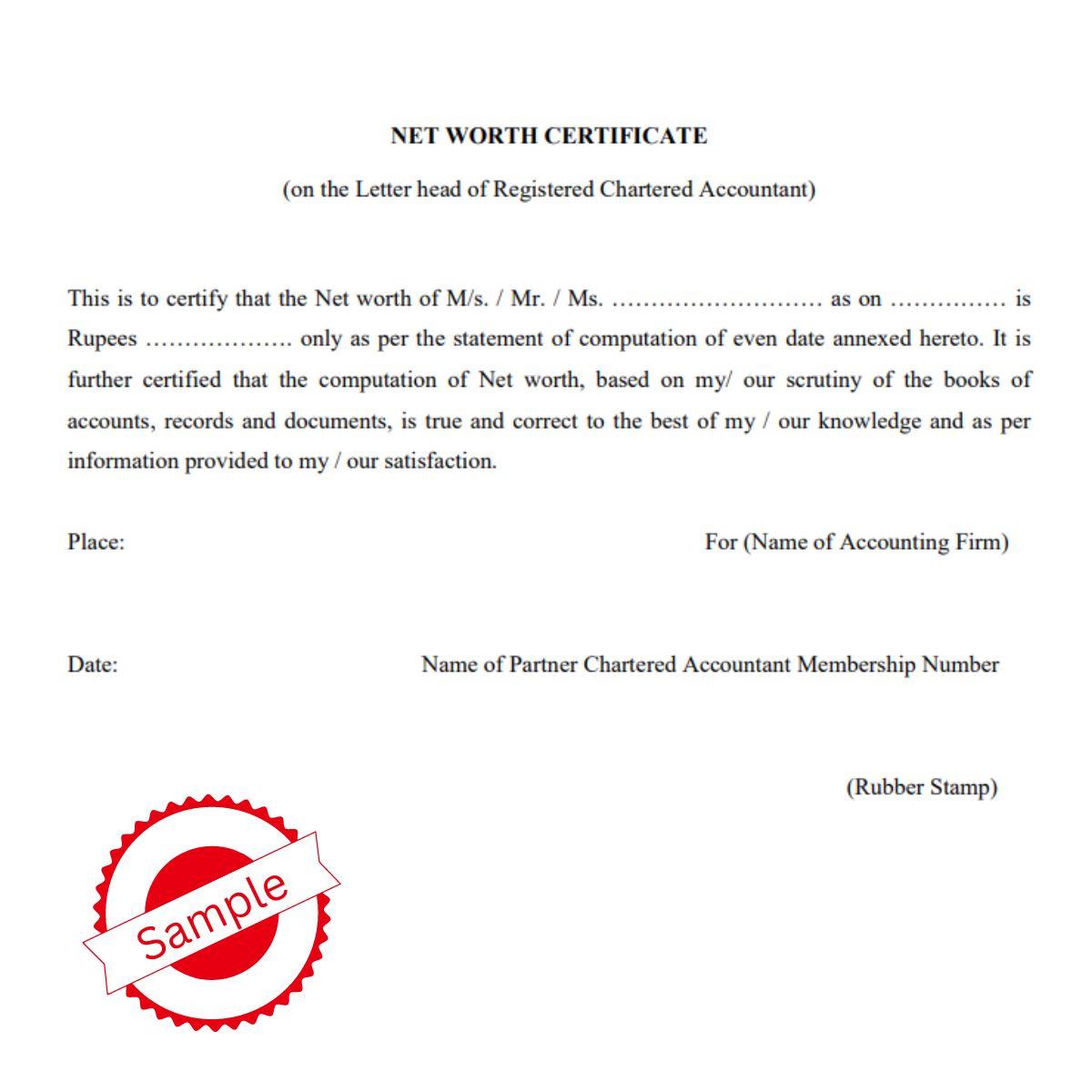

Net Worth Certificate Format

Net Worth Formula

The format for calculating net worth is: Net worth = Assets + Liabilities. When assets are less than liabilities, the net worth is represented as negative. Assets are your items holding value while liabilities are obligations owed by you.

Conclusion

A net worth certificate, issued by a chartered accountant, is an essential document for an individual or a company. It allows financial institutions and other institutions to evaluate an individual or entity’s financial standing. The net worth is calculated keeping in mind the assets and liabilities. If you want to apply for a loan or visa, then the net worth certificate is a crucial document for you. Since a certified chartered accountant issues this document, it is considered that the financial data provided in it is reliable and precise.

Frequently Asked Questions (FAQs) about Networth Certificate

Q1. Who provides the networth certificate?

A. The networth certificate is provided by a practicing Chartered Accountant (CA).

Q2. What are the net worth certificate fees?

A. The fees for the net worth certificate vary depending on why it’s required. If it’s necessary for visa approval (for traveling abroad), the net worth certificate fees will be relatively higher than compared to if this certificate is required for personal loan approval.

- 1506 views