How to use NPS Calculator?

- October 14, 2024

- Registrationwala

- Home

- /

- Knowledge Base

- /

- News & other businesses

- /

- Blog

- /

- How to use NPS Calculator?

How to use NPS Calculator?

NPS Calculator is specially designed for calculating the corpus you can build if you enroll in the National Pension System. It takes into account several factors like the amount you invest, your age and investment strategy. Based on these parameters, the calculator for NPS calculates your investment’s maturity value and the pension amount you will receive from the National Pension Scheme.

Many websites offer NPS calculator which can give you an estimate of the corpus you’ll receive from the NPS. In this article, we’ll provide you with a list of free NPS calculators and guide you on how to use them.

List of Best NPS Calculators

Let’s check out the best NPS calculators in India:

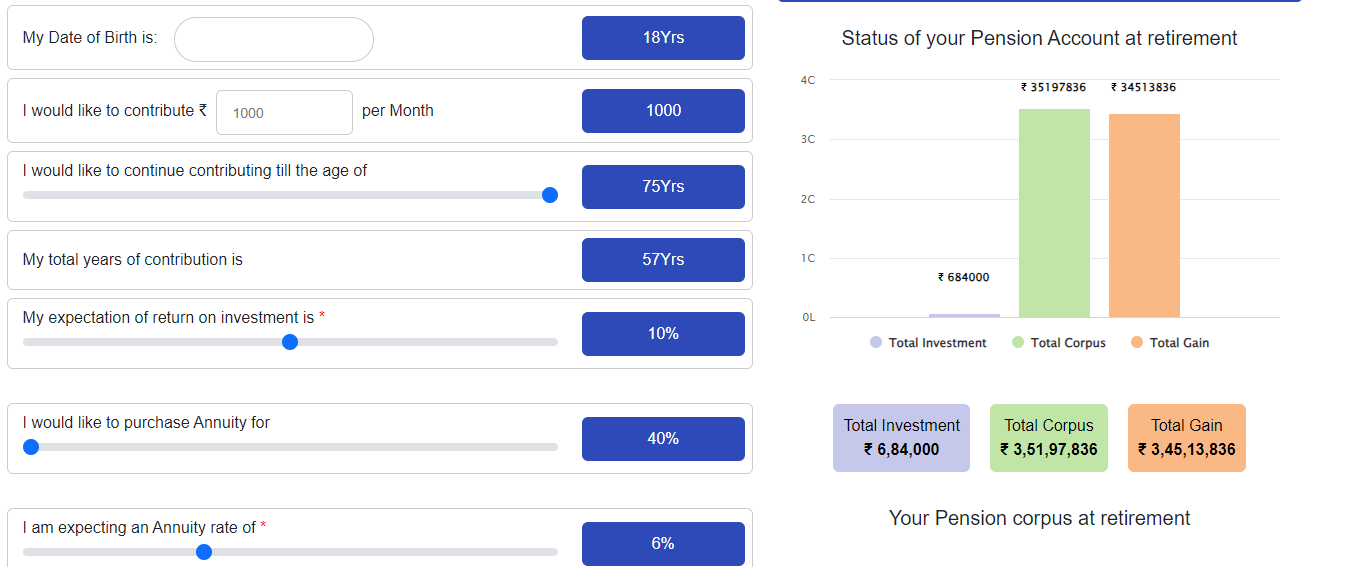

1. Pension Calculator by NPS Trust

The NPS Trust's Pension Calculator shows the approximate pension and lump sum amount that an NPS subscriber may receive upon maturity based on consistent monthly contributions, the corpus percentage reinvested for annuity purchases, and assumed rates for investment returns and the chosen annuity.

To use this calculator, you must enter your date of birth, contribution amount per month, age till which you want to contribute, total years of contribution, expectation of return on investment, price at which you want to purchase annuity and the annuity rate you’re expecting.

Based on the information provided, the NPS calculator will calculate your total investment, total corpus and total gain.

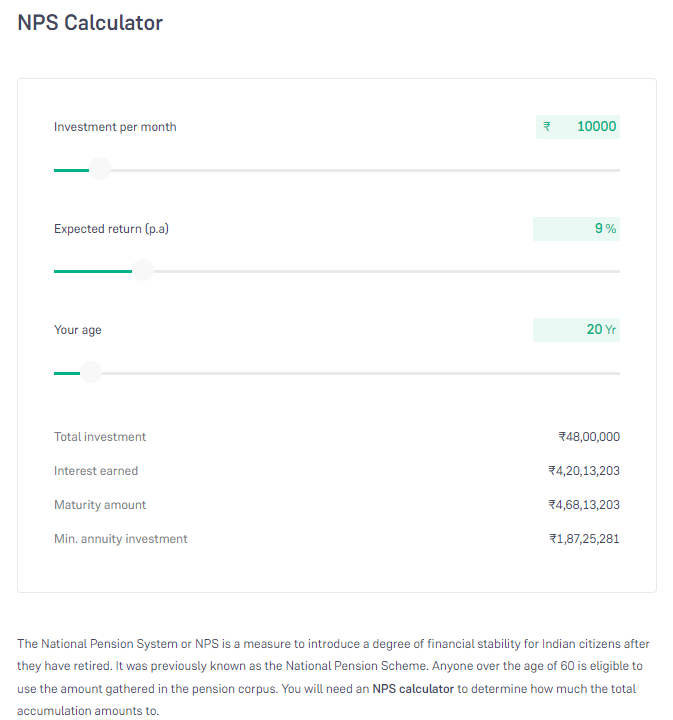

2. NPS Calculator by Groww

Groww offers a NPS calculator which is completely free of cost. It takes into account factors like investment amount, expected return and age of contributor. Based on this, it provides you an estimate of the NPS amount.

To use Groww NPS calculator, choose the investment you want to make per month, expected return per annum and your age. Based on this, the calculator for NPS will tell you the total investment, interest earned, maturity amount and minimum annuity investment.

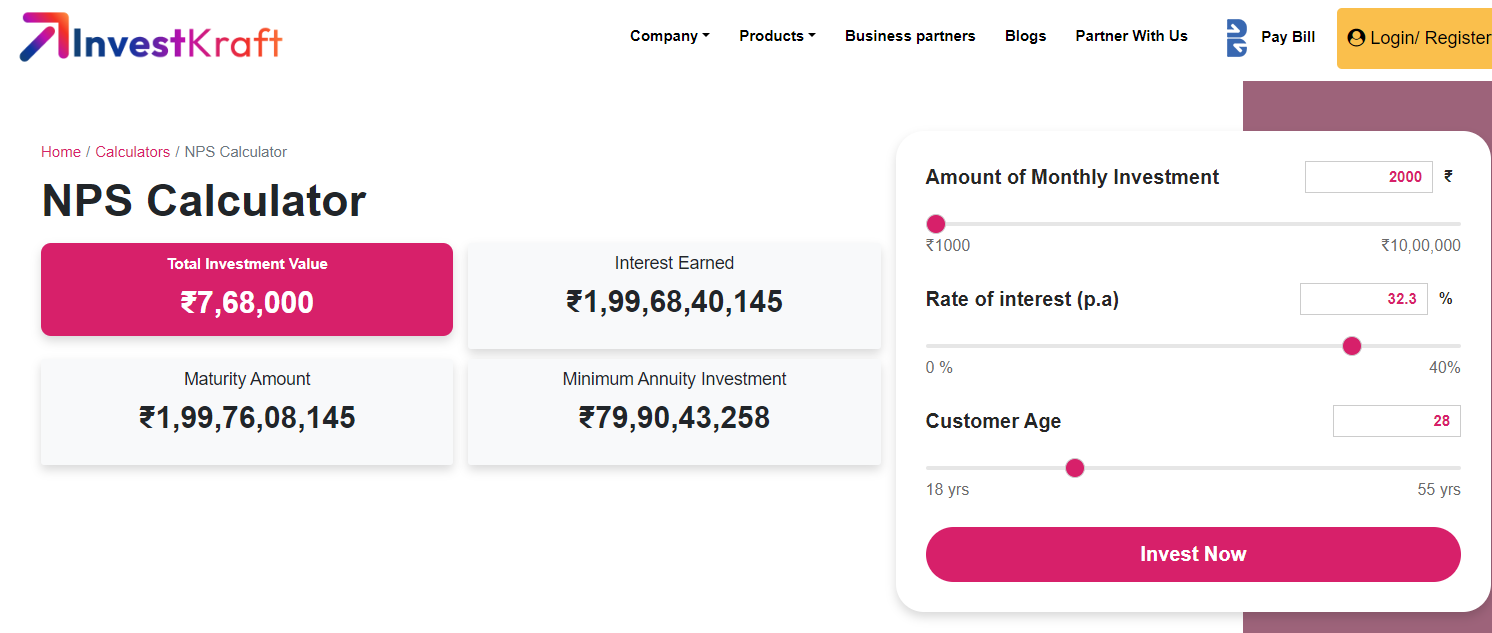

3. InvestKraft NPS Calculator

InvestKraft is an investment advisory firm. It offers various calculators such as SIP calculator, EMI calculator, FD calculator, PPF calculator and NPS calculator. All these calculators can be used for free.

To use the calculator for NPS, you need to enter the amount of monthly investment, rate of interest per annum and your age.

Based on the information provided, the calculator will show the total investment value, interest earned, maturity amount and minimum annuity investment.

Remember that the calculator will show you an estimate and not the exact NPS amount. Also, tax applicable is not mentioned in this calculator.

4. Max Life Insurance Calculator for NPS

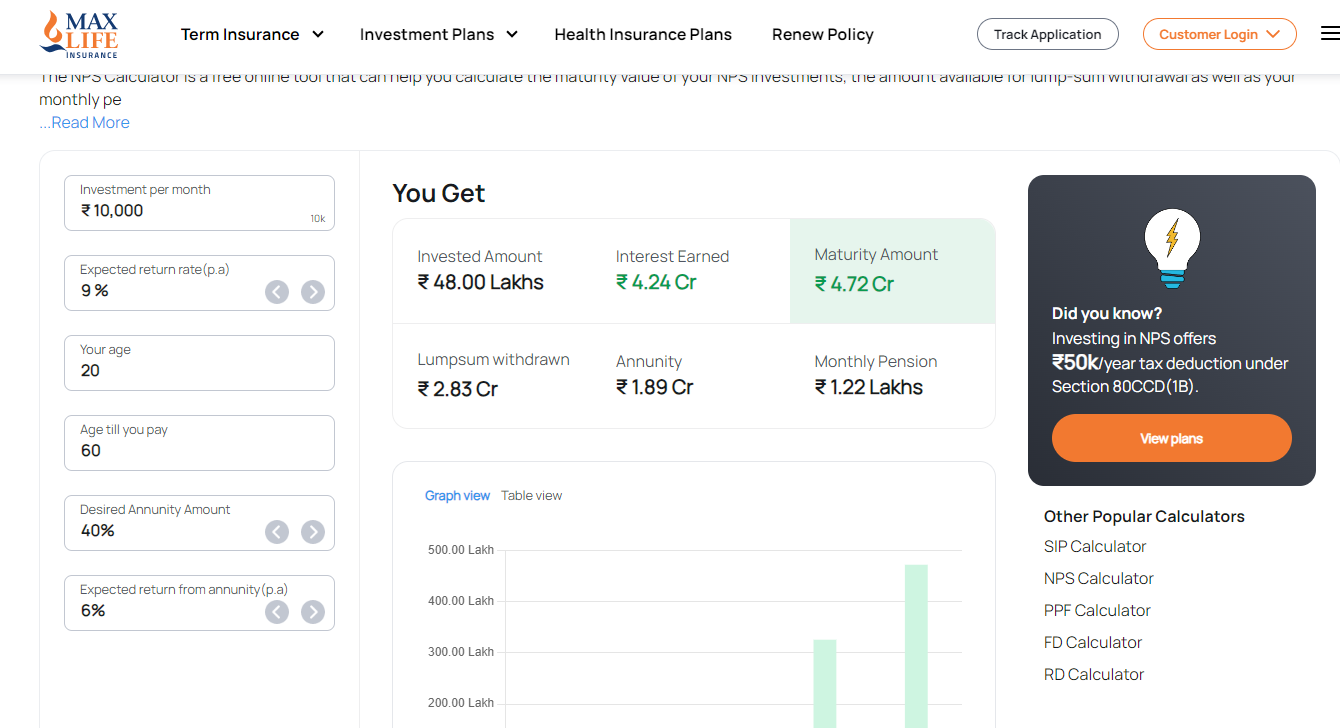

Max Life Insurance NPS calculator is one of the top NPS calculator. Using this calculator is easy.

To use this calculator, you must provide the monthly investment amount you plan to make in the NPS account. Then, in the next field, you must provide the expected rate of return from your NPS investment. Compared to debt-oriented investments, equity-oriented investments in NPS give higher long-term returns.

Now you must choose the age at which you want to start investment and the age till which you intend to make an NPS investment. On the basis of information provided, the NPS calculator will give you an estimate of the total amount invested, the total returns received from the investment and the maturity value in total. Now, you must provide the desired annuity amount and expected return from annuity per annum.

Based on this information, the NPS calculator will display the amount which can be withdrawn as lump-sum at retirement and the monthly pension which is expected to be received by the investor from the investment.

5. SBI NPS Calculator

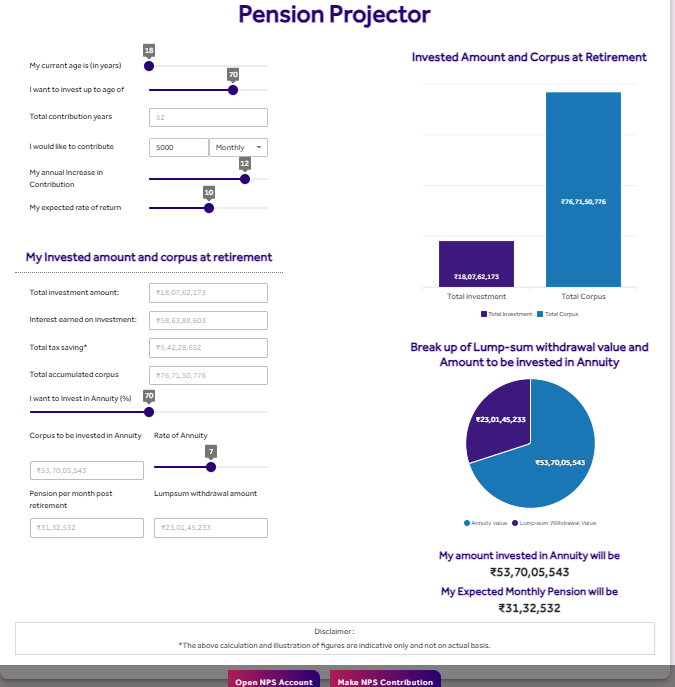

One of the best NPS calculator SBI, is a free NPS calculator. It is an online tool which you can use to estimate your NPS returns and monthly returns. It allows you to make informed decisions for planning your retirement.

To use the SBI NPS calculator, you must type your current age, the age till you want to invest in the NPS scheme, total years for which you want to contribute, the amount you want to contribute monthly or annually, your annual increase in contribution and your expected rate of return.

Based on this information, the calculator will show total investment amount, interest earned on investment, total tax saving, total accumulated corpus. Now, select the annuity percentage you want to invest in. Based on this, SBI NPS calculator will show corpus to be invested in the annuity. Now select the rate of annuity. After this, the pension per month post retirement and lump sum withdrawal amount will be reflected by the calculator.

How to calculate NPS pension without any calculator?

Like all the pension schemes available in the world, the NPS formula uses compounding interest for the calculation of returns.

NPS formula used by the National Pension Scheme calculator is:

A = P (1 + r/n) ^ nt

In this equation, the variables are as follows:

-

A refers to Amount

-

P refers to Principal Sum

-

R/r refers to Rate of Interest Per Annum

-

N/n refers to Number of Times Interest Compounds

-

T/t refers to Total Tenure

Let’s use this formula to calculate NPS corpus. Assume the following values:.

- P: ₹1,00,000 per year

- R/r: 10% (0.10 as a decimal)

- N/n: Annually (1 time per year)

- T/t: 25 years (Assuming retirement at 60 years)

According to the formula, the corpus under NPS after 25 years with an annual investment of ₹1,00,000 at a 10% interest rate, compounded annually, will be approximately ₹10,83,471.

This is a simple example for a single investment. Typically, in an NPS account, you make contributions annually, so further calculations would include each year’s individual compound growth for a more accurate corpus estimate.

Conclusion

In this blog post, we provided you with a list of best NPS calculators in India. You can use any of these calculators to get an estimate of the corpus you’ll build under the National Pension System of the Indian Government.

- 500 views