How can Directors file DIN KYC?

- May 21, 2024

- Registrationwala

- Home

- /

- Knowledge Base

- /

- News & other businesses

- /

- Blog

- /

- How can Directors file DIN KYC?

How can Directors file DIN KYC?

Director Identification Number (DIN) is a unique identification number which is allotted to a person who wishes to be a director or is an existing director of a company.

The Ministry of Corporate Affairs (MCA) has made it compulsory for all the directors with a DIN to submit their KYC details annually using e-Form DIR-3 KYC.

In this article, we will discuss DIN KYC filing for Directors.

Why is Director KYC required?

Director KYC filing process involves individuals holding a DIN to provide updated information and KYC details to the ROC at every financial year’s beginning. This way, MCA is able to maintain up-to-date records of the directors in India.

Who is required to file Director KYC?

Every individual who is allotted a DIN on or before the last financial year’s end i.e., 31st March, is required to file the KYC of the director using DIR-3 KYC Form to the ROC. The Form DIR- 3 DIN KYC has to be filed on or before 30th September, 2024.

This form needs to be filed even if a person has resigned as a director or doesn’t hold any directorship or is not a designated partner of an LLP. As long as someone holds a DIN, the DIR-3 KYC Form needs to be filed.

Once the DIN is allotted and has been previously used in any directorship or as a designed partner of LLP, it cannot be surrendered. DIN can only be surrendered on the grounds that it is never used to become a company’s director or an LLP’s designated partner.

What happens if the Director doesn’t file DIR-3 KYC within the prescribed due date?

If the director fails to file the e-form DIR 3 KYC by 30th September on MCA portal, the DIN of such a director will be marked as “deactivated due to non-filing of DIR-3 KYC”. After this, if the director wants to re-activate their DIN by filing the missed out e-form DIR-3 KYC, he has to submit a late fee of Rs. 5000. This fee amount can be paid on or after 30th September of the year in which the e-form DIR-3 KYC is to be filed.

What Documents are Required for Filing DIR-3 KYC?

The following documents are required for directors while filing DIR-3 KYC:

- Permanent Address Proof (Voter’s ID/Driving License/PAN Card)

- Current Address Proof (Utility Bills such as Water Bills or Electricity Bills not older than 2 months/Rental Agreement)

- Identity Proof such as Aadhaar Card and Passport

- Digital Signature Certificate (DSC)

- Attestation of the above-mentioned documents by a currently practicing CA, CS or Cost Accountant

- Declaration signed by the director and attested by CA, CS or Cost Accountant

- Other documents, if required

What Steps are Involved in Filing DIR-3 KYC?

The filing of e-form DIR-3 KYC involves the following steps:

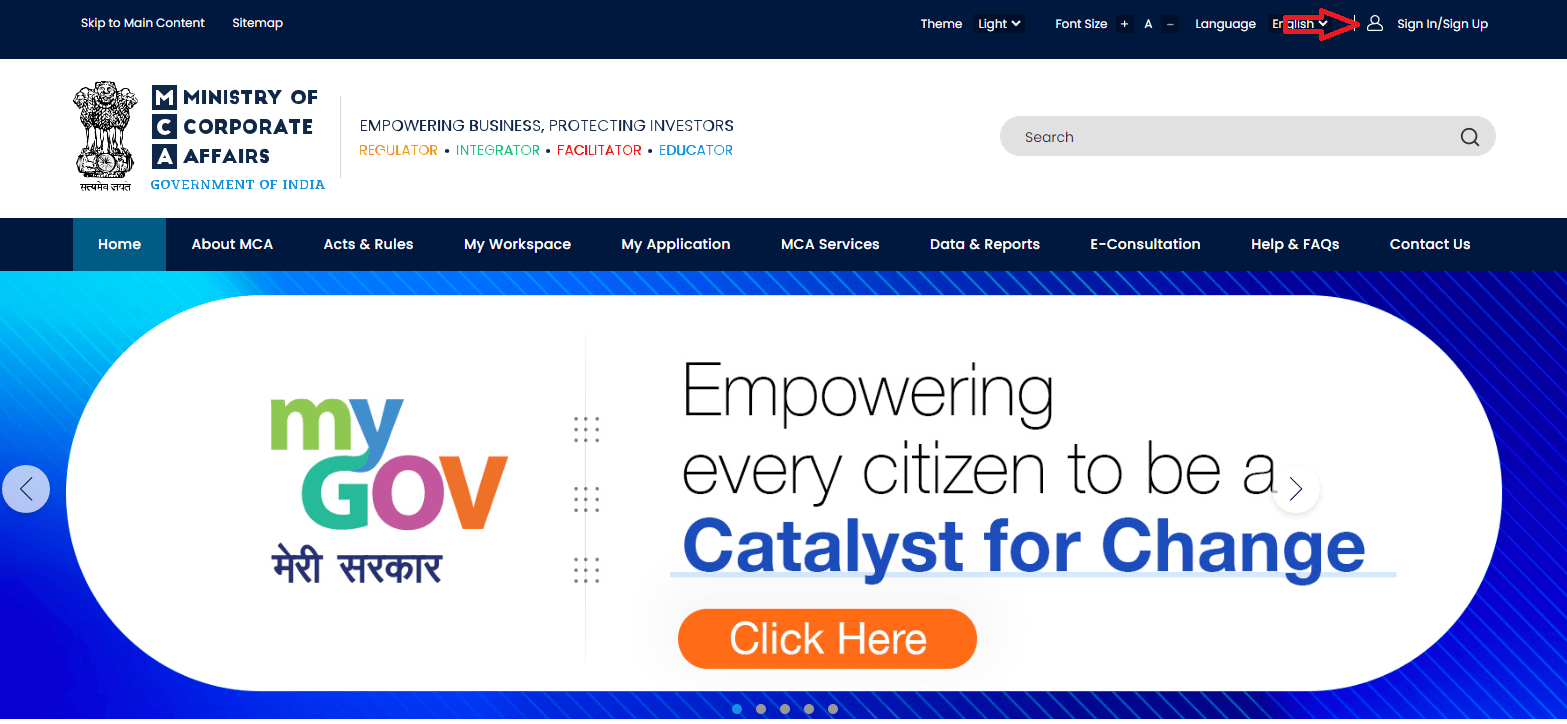

Visit the Official Portal of MCA

First and foremost, the applicant (director) needs to visit the official website of MCA and login by clicking on the ‘Sign In/Sign Up’ button on the homepage.

If the applicant is not an existing user, they can register by clicking on the ‘Register’ button and enter all the required information. Once the registration is complete, the director can enter their user ID and password to login.

Enter your Phone Number and Email Address

Once the applicant has logged into the MCA portal, they must go to the ‘MCA Services’ tab, then select ‘Company e-Filing’ and ‘DIN Related Filings’ and then click on ‘Form DIR-3 KYC’ or ‘Form DIR-3 KYC Web’.

The director must enter the DIN number, mobile number and email address on the form. Thereafter, an OTP will be sent on the mobile number as well as email address. Click on ‘Next’ after entering the OTP correctly.

Fill all the Necessary Details in the DIR-3 KYC Form

The director has to fill general details asked in the form such as name, father’s name, nationality, D.O.B, gender, PAN number, mobile number, OTP sent to mobile number, email address, OTP sent to email address, aadhaar number and permanent as well as current residential address.

Note: The above-mentioned details are pre-filled in case the director chooses to file e-form DIR-3 KYC Web. Only the details which are not pre-filled are to be mentioned by the director. Also, it is mandatory to declare PAN. Once PAN details are entered, the director has to get the PAN details verified by clicking on the ‘Verify Income-Tax PAN’ button. Foreign nationals who do not possess a PAN must mention the same name in the form as the name mentioned in their DSC for successful validation.

Upload the Required Documents

The director must now upload the required documents. Once all the necessary documents are attached, a declaration must be made by the director stating that the information provided by them on the e-Form DIR-3 KYC is correct and attach their DSC.

The e-form must have a digital signature of a CA, CS or Cost Accountant who is currently practicing. The details of the practicing professional must be entered and their digital signature must be attached. Now, the director has to click on the ‘submit’ button for the submission of DIR-3 KYC form.

Service Request Number (SRN) Generation

Once the e-form DIR-3 KYC can be submitted successfully, an SRN for the user will be generated. This number will be required for future correspondence with MCA.

Conclusion

DIN KYC form is a mandatory form which needs to be filed by company directors annually. This form helps the government to keep up-to-date records of company directors in India. If you are a director of a company, make sure you file the DIR 3 on the MCA portal in a timely manner!

Also Read: Difference between Partner and Designated Partner in LLP

- 1211 views