Get a Quote

Get a Quote and Find Services to Fit Your Needs 50000+ Satisfied Clients

5000+ Licenses & Registration

15 Branches across India

75 Years + Combined experience

Satisfied Clients

Services

Years Combined Experience

Get Started!

A sole proprietorship in India is the most popular form of business structure for micro and small businesses operating in the unorganized sectors due to its simplicity, ease of information access, and nominal cost. Because of these factors, single owners are going for sole proprietorship registration in India.

The sole owners are liable for all the business debts and have unlimited liability. So, their business and personal assets are at risk. getting a certificate of incorporation for sole Proprietorship is a good idea. However, obtaining a certificate of sole Proprietorship is generally unsuitable for medium and large-scale businesses due to the array of disadvantages like unlimited liability, no separate legal entity, non-transferability, and limited company life.

The government of India has not prescribed any mechanism for registering sole proprietorship firms. Thus, the registration of a proprietorship can only be recognized through tax registrations that the Business must have as per the rules and regulations. These tax registrations may include GST Registration that must be obtained in the Proprietor's name to establish that the Proprietor is operating a business as a sole proprietorship.

When you apply for sole Proprietorship online, your idea of a business entity differs from the rest. You are not looking for a robust structure, instead, you are looking for a free way to conduct a business. Simply put, you think about firm registration for Proprietorship because of the following differences it has from other business entities in India:

Unlike most business registrations in India, sole Proprietorship has no regulatory authority. There is nobody other than the standard income tax department watching over those with the Sole Proprietorship license – a term we use exceptionally loosely.

One that sets a Sole proprietorship is that there is no need for Annual Compliance unless you discount the yearly income tax returns. Many times people ask the question – Do I need to register for Sole Proprietorship in India?

3. Also, no one to hold your hand

Without no regulatory authority, there are not many rules you can follow. And without regulatory Compliance, you don't know the constraints within which you can do your Business. You must learn about everything independently if you attempt proprietorship business registration in India.

There is no memorandum of association for sole Proprietorship. Traditionally, a Memorandum of Association is the core document that states the purpose of your Business. While some legal document during proprietorship registration online states the Business, it is not as robust as a Memorandum of Association or an LLP Agreement.

A proprietorship firm registration certificate in India does not exist. Furthermore, there is no existence of any Proprietorship register either. Then what is the proof of business ownership for sole Proprietorship? Without a proprietorship registration certificate, it can be challenging. Isn't it? Not really. All you need is a bank account in your company's name, which will prove that you have registered a proprietorship firm online.

There is no concept of firm name registration. You can give any name to your sole Proprietorship – even your name would suffice. Because of so many lacks of restrictions, there are benefits to be had when you register a sole proprietorship in India.

After registration of a Proprietorship firm in India, you gain access to the following perks:

A sole proprietorship lacks regulatory authority, they do not have an incorporation or dissolution process. However, for operating a business the proprietor required certain registrations and licenses to comply with the laws and regulations of India.

Due to the lack of oversight, there are not many regulatory requirements for you to follow. You can fill out your income tax returns each year – GST returns if you are earning more than enough – and you are ready to go.

A Sole proprietorship is very easy to manage as a single-owner business registration. There are not many components for you to consider. In most cases, only small shops go for proprietorship business registration. Thus, other than taking care of some of the backend finances, there is not much infrastructure you need to bother yourself with.

As you can start your business solo, you are free to conduct your Business in any way you want. Consider a sole proprietor as a lone ranger in the forest of business entities that can conduct his Business without unnecessary regulations.

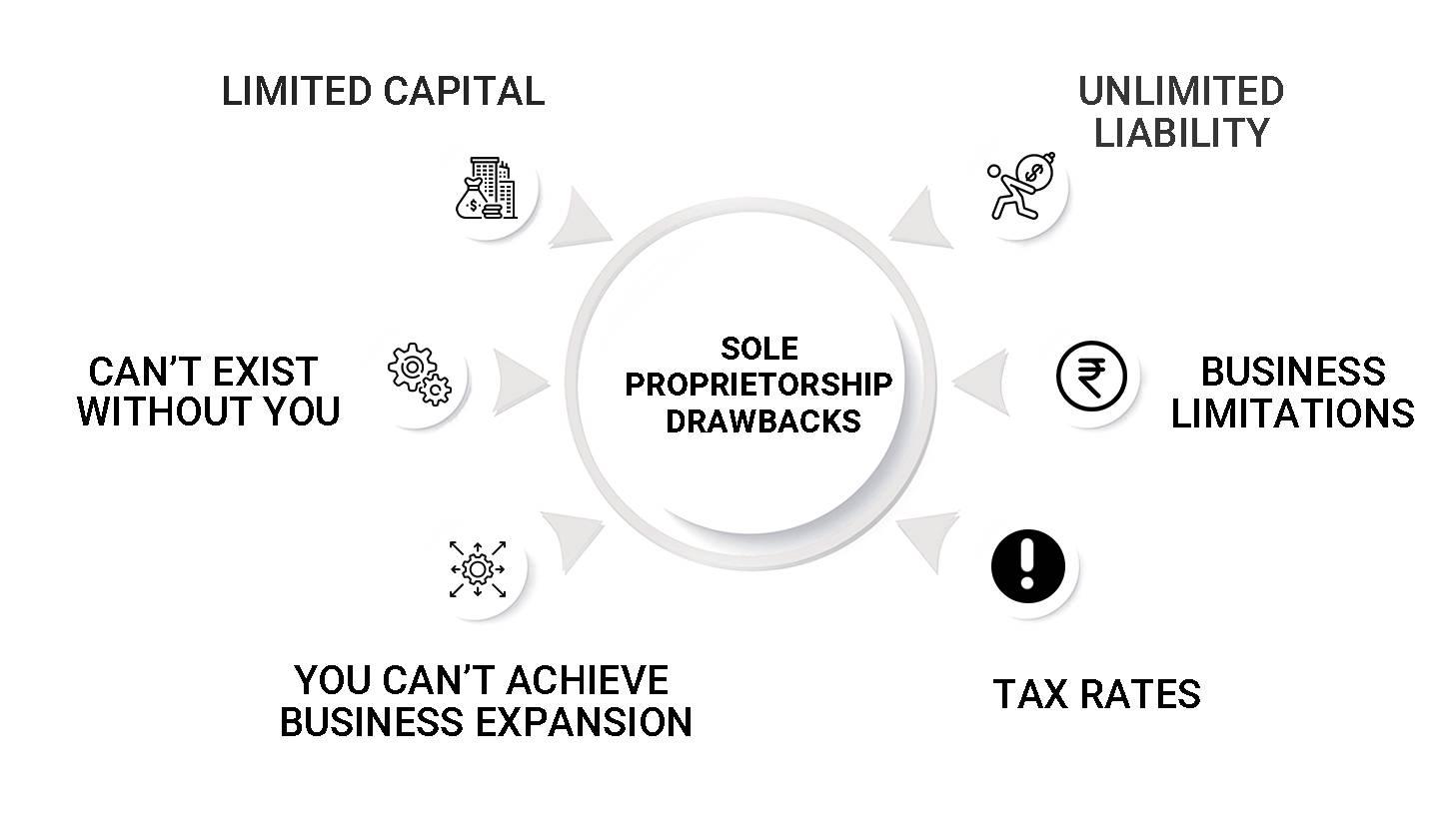

If you want to incorporate a sole proprietorship, then it is also prudent to learn about its drawbacks.

When registering a sole proprietorship firm, remember that you will be handling all your business expenses. As an individual, raising funds would be difficult. It limits the capital that a sole proprietorship firm can have access to.

You are not different from the sole proprietorship and as your firm isn't separate from you, all your business liabilities fall on you. This factor of unlimited liability removes any sense of security from your business. You cannot afford mistakes – for they can mark the end of your business enterprise.

Don't register a sole proprietorship if you want to set up your business as a legacy. Your business entity ceases to exist as soon as you leave the proprietorship firm.

Running this business depends on a single person – you – don't expect diversifications when it comes to doing business in India.

Everything you earn will be taxed as personal tax. Furthermore, being a sole proprietorship firm, your business entity won't get many government benefits such as employee health insurance and more.

Because of the infrastructure, or lack thereof, there is a limit to the type of business you can do with your sole proprietorship firm. You cannot engage with complex enterprises; you must stay within your capabilities.

So you see, there are drawbacks to proprietorship company registration. But that doesn't digress from the fact that it is still worth it.

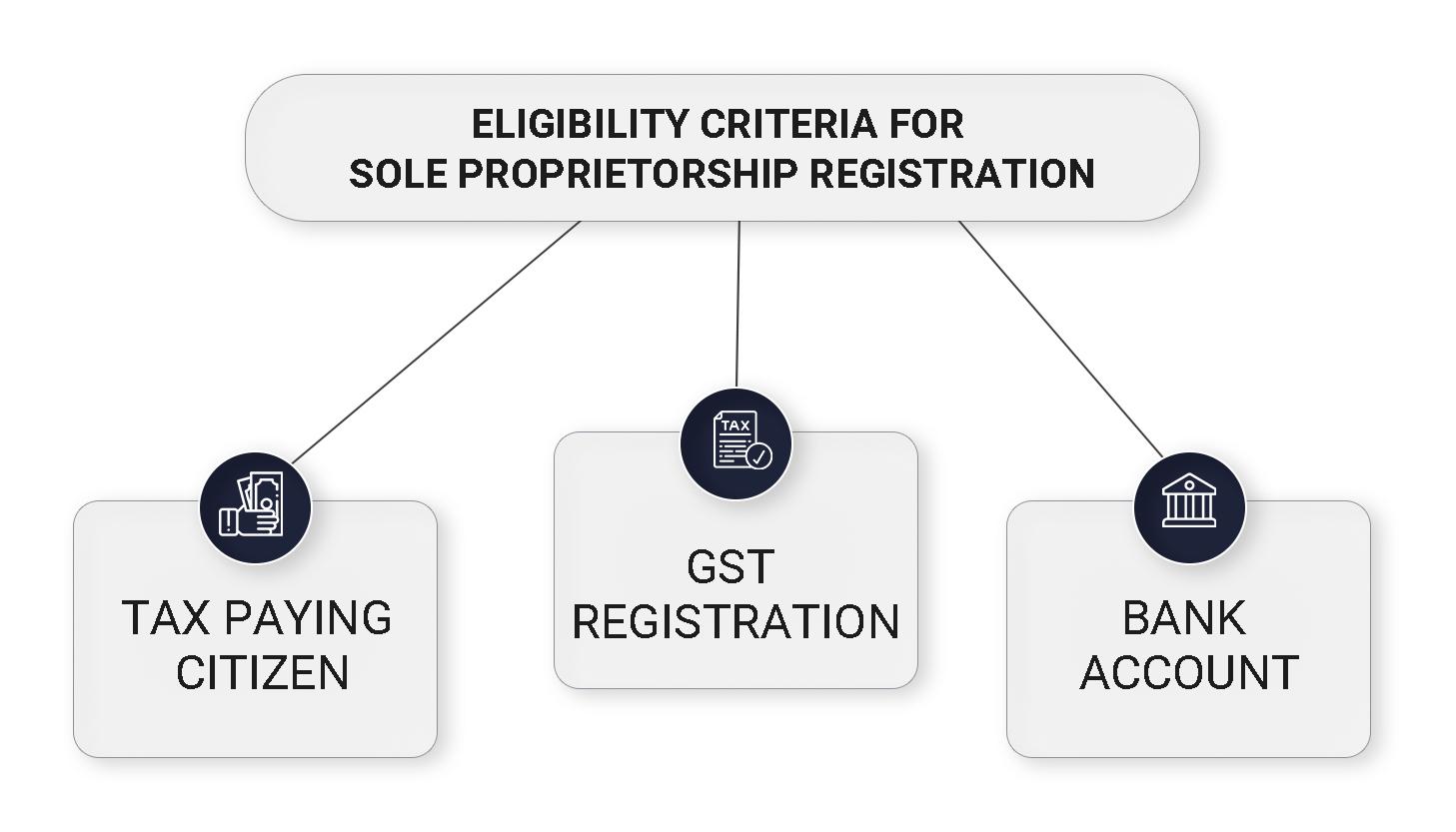

Eligibility Criteria for Sole Proprietorship Registration in India

As the government doesn’t count Sole Proprietorship as a legal business entity, it has not given any discernible criteria to start one. Thus to get sole proprietorship, you need to adhere to all the following criteria:

1. Applicant must be a tax-paying citizen: Online sole proprietorship firm registration is only for entities running a local business. If you do, only then can you start a proprietorship firm. This business entity is deemed too free by the government of India, and therefore, only those from India can create this business entity.

2. Applicant must obtain the GST registration for its Business: If the annual turnover of your business is more than INR 40 Lakh, you must get the GST registration certificate in India. It will act as proof for your Business.

3. Register a Bank Account in the Proprietorship's name: One criterion for sole proprietorship firm certification is to open a bank account in the name of your Proprietorship. It will help you conduct your business financial transactions properly.

Documents Required for Sole Proprietorship Registration in India

The documents required for registering a proprietorship firm are the following:

The following registrations are required for a sole proprietorship firm:

Here is the answer to your question – How to start a Sole Proprietorship Firm in India? The procedure for Sole Proprietorship registration in India is as follows:

Note: There is no Sole proprietorship registration online. It is just a marketing term meant to lure. The truth is, to start a proprietorship, you need to physically pay a visit to the authorities and provide them with the documents.

We at Registrationwala provide end-to-end solutions for Sole Proprietorship registration in India. Our services include:

Registrationwala.com is a leading legal consultancy firm providing comprehensive services relating to the incorporation of a sole proprietorship. Our expert team will give you the full-fledged assistance required for the seamless registration of a Sole Proprietorship Firm.

Q. Does sole proprietorship need to be registered?

A. Generally, there is no need to register a sole proprietorship and you can run your business from anywhere without registration.

Q. Where to register a Sole Proprietorship?

A. A Sole Proprietorship is registered by opening a bank account in the firm's name. It can be done at any bank.

Q. What are the compliances of proprietorship?

A. The compliances of proprietorship are filing income tax, GST return, and TDS return. All this must be filed through the ITR-3 or ITR-4.

Q. In which type of business sole proprietorship is very suitable?

A. Businesses related to retail trading activities such as household goods, electric goods, grocery selling, bakery, etc can come under the category of business.

Q. What are the 4 types of a proprietorship?

A. The types of proprietorship business are sole proprietorship, One Person Company, Registered Proprietorship, and Unregistered Proprietorship.

★ ★ ★ ★ ★

I very much appreciate the fact that you guys possess tremendous knowhow of private limited company incorporation. You have exhibited professional and respectful manner towards my query and I would seriously recommend you guys to all the folks looking for outstanding business services.

★ ★ ★ ★ ★

Thanks to their support, I got my trademark successfully. I highly recommend their services for anyone needing help with their intellectual property. The person assigned to me was very cooperative and helpful.

★ ★ ★ ★ ★

Thanks to their support ragistrationwala team, I got my IP-1 license successfully and special thanks to Miss.Kanishka for your great and timing support !!!!!! I have archived my goal one step forward... Thanks for the entire team....

★ ★ ★ ★ ★

Really helped a lot in getting my both VNO licenses. Great experience working with the team and very humble team, thanks for providing the vno license on time.

★ ★ ★ ★ ★

I had a good time working with Registrationwala. Good team. I would recommend their services to others.

★ ★ ★ ★ ★

It was extremely great service of Registrationwala consulting firm, and this firm is providing the best services and worry about the client's required services along the client's satisfaction.

★ ★ ★ ★ ★

Superb Experince! Within no time the trademark registration was on.Highly professional team. I am very much Impressed with the prompt response and efficiency.Thank you.

★ ★ ★ ★ ★

We had taken ISP license from registration wala and the supporting person is very helpful to taken that license his communication and his work is satisfactory and thanks for those services

★ ★ ★ ★ ★

I sincerely appreciate your prompt support in helping me get the access license so quickly. Your professionalism and efficiency are truly commendable. Thank you for going above and beyond to assist me. Keep up the great work!