Get a Quote

Get a Quote and Find Services to Fit Your Needs 50000+ Satisfied Clients

5000+ Licenses & Registration

15 Branches across India

75 Years + Combined experience

A Registered Investment Advisor is an entity, individual or corporate, which is authorized by the Security Exchange Board of India (SEBI) to give unsolicited advice to their clients. The SEBI issues specialized permits known as the RIA license to entities for dispensing Investment Advisories in the market.

If you wish to provide Investment Advisory services in India, then you must get yourself registered as an Investment Adviser or IA. Here, the SEBI issues an RIA license or the Registered Investment Advisor license only to worthy applicants. But there are specific perimeters on which SEBI tests the worthiness of the RIA certification applicant. The Exchange Board issues specific eligibility criteria for every IA aspirant that he must ensure before applying for the RIA application. But, embarking on this RIA license registration journey, let us first understand what an RIA is.

A SEBI Registered Investment Advisor is an entity, both person and a business, that wishes to engage in the Business of providing unsolicited Investment Advice to its clients. Here, the client can be a person or a group of persons. Even someone holding himself out as a Registered Investment Advisor can be a client of another Investment Advisor.

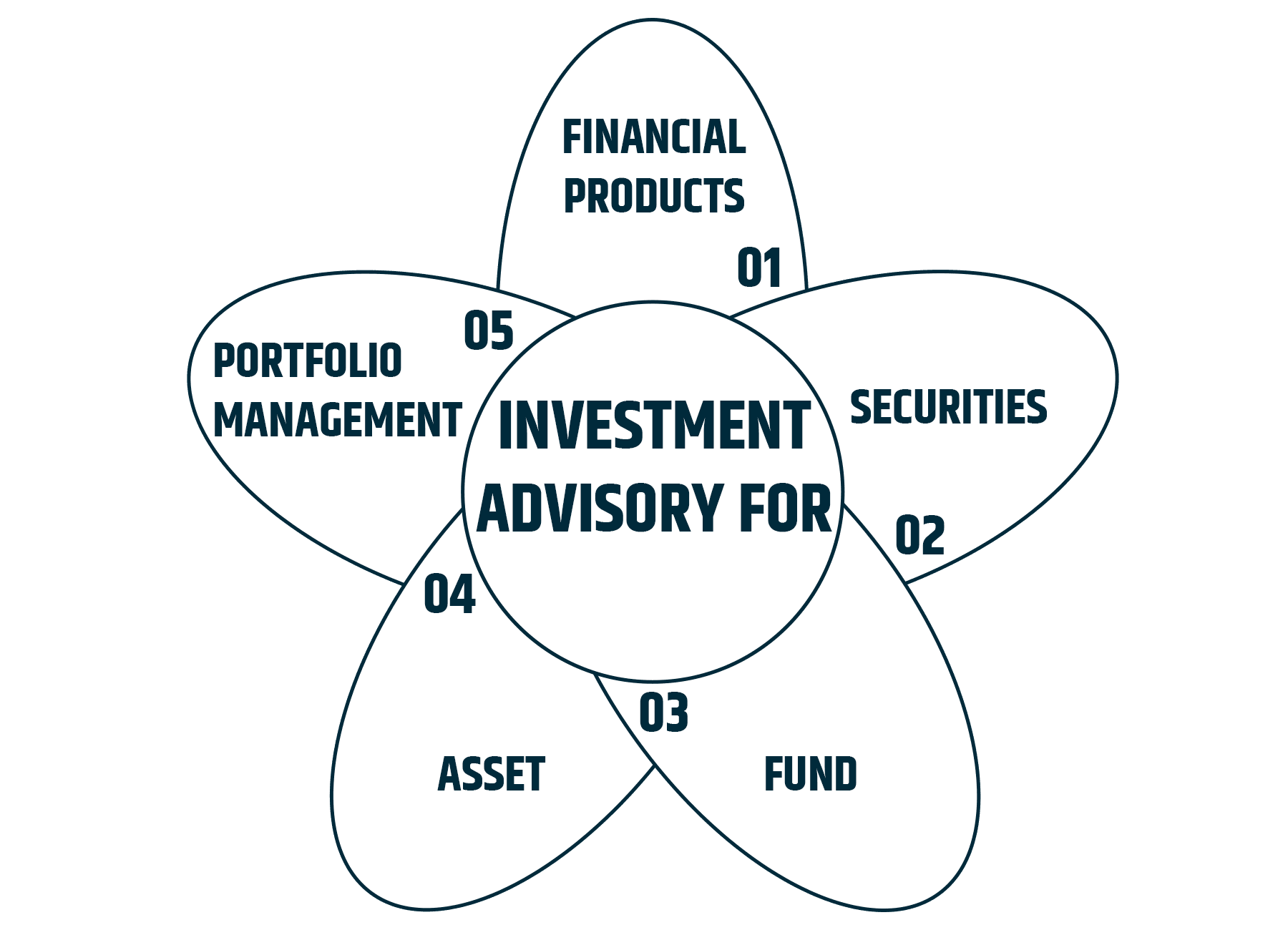

Investment Advice is basically a consultation related to investing, purchasing, selling, or dealing in investment products. The advice can also be on the investment portfolio containing securities or other investment products for the client's benefit. Such advice must reflect financial planning.

If you wish to register yourself as a SEBI licensed Investment Advisory in India with the SEBI, then you must fulfill the following criteria, as stipulated by the SEBI regulations:

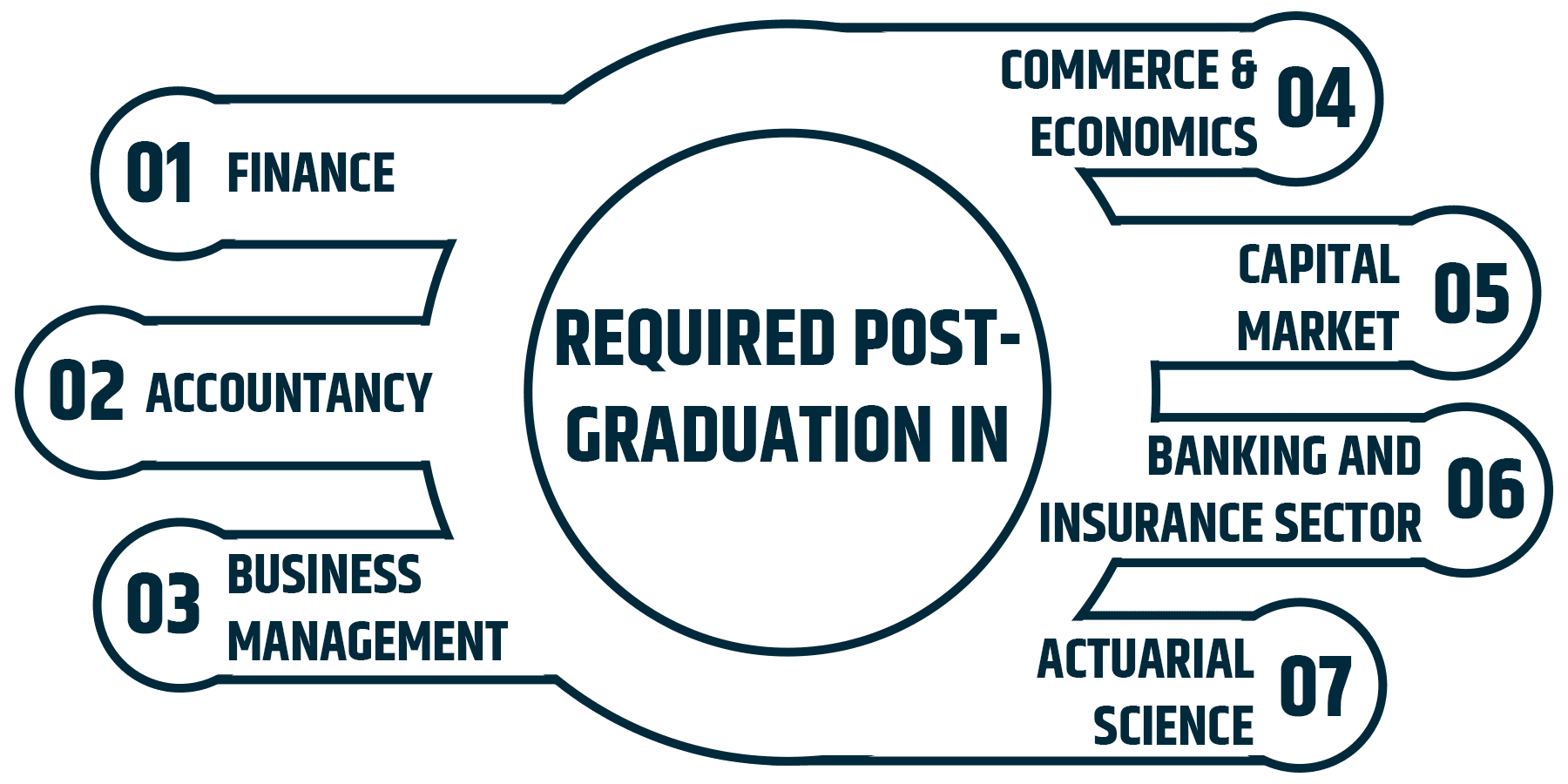

An Individual, a Principal Officer, in the case of a Corporate IA, must have the following minimum Qualification for the applied license:

The duration of any of the aforementioned vocations must be at least two years from a recognized institution by the Central or State Government. It can also be a recognized degree from any Foreign University/Institution.

The SEBI-Registered Investment Advisor licensee or its Principal Officer must have an experience of at least five years in activities relating to issuing advisories for any of the following:

The individual applicant or the Principal Officer of a Corporate IA must have a certificate in any of the investment advisory services from the following:

The net worth of a RIA license applicant depends on its corporate structure, such as:

|

How to calculate your Networth for RIA application? Net worth for your Firm can be calculated by aggregating the values of share capital, in addition to the free reserves. Such reserves will exclude revaluative reserves. A well-computed net worth must not involves any of the following:

The RIA license applicant can obtain the net worth certificate from a Chartered Accountant attached to the application form intended for SEBI. |

The SEBI Registered Investment Advisor aspirant must build an adequate infrastructure, including the following amenities, to undertake the Investment Advisory Services:

The SEBI Registered Investment Advisor license applicant must submit the required documents to the Securities and Exchange Board of India for an Investment Advisor License registration in India:

The applicant must note that the Board can ask for additional documents in addition to the aforementioned as part of the registration procedure. So, we advise you to check the SEBI website periodically. Or you can contact one of our Legal Professionals for the requisite documentation requirement before applying for the RIA certificate.

To become a SEBI Registered Investment Advisor or a licensed RIA in India, you must adhere to the following procedure:

The applicant must first ascertain his qualification for the requisite license. He must also complete a certified course recognized by the Securities and Exchange Board of India. The applicant must also wield at least five years of experience in Financial Advisory services or related fields.

The applicant must apply for and pass the SEBI’s RIA exam conducted by the NISM (National Institute of Securities Markets).

After clearing the SEBI RIA exam, the applicant can apply for RIA certificate registration on SEBI’s online portal. They must provide the requisite details along with the application, such as the following:

The SEBI, after application submission, will conduct a background check on the filed application to ensure that the applicant meets the necessary criteria to become a registered Investment Advisory Firm in India.

After successfully assessing the filed application, SEBI will grant you the RIA license. After the license reception, the licensee can start providing Investment Advisories to its clients.

As a certified RIA, you must show adherence to certain regulations set by SEBI. Such regulations are compliance filing, following the code of conduct, periodic reporting requirements, as well as ongoing training & education for the Principal Officer.

If you wish to start your Business as a Registered Investment Advisor in India, you must seek the requisite RIA license from the SEBI. But the RIA certification procedure, as with many registration procedures, is mandarin to people not well-versed with such procedures. Here, Registrationwala comes in handy to you. Legal Experts at Registrationwala can make you sail through the entire RIA license registration procedure in no time. Let us take you through our RIA certificate consultancy procedures:

If you wish to know more about the RIA licensing procedure, connect with one of our Incorporation Experts.

Q. What are the RIA license requirements as per the SEBI?

A. The RIA license requirements as per the SEBI is as follows:

Ø Requisite Educational Qualification

Ø Essential Experience

Ø Adequate Infrastructure

Ø Net worth requirements

Q. How long does getting a SEBI Registered Investment Advisor license takes in India?

A. The licensing procedure depends on the level of preparation that the applicant is at. For an applicant with a clear scorecard, the registration time drops significantly.

Q. What is the requisite SEBI’s registered Investment Advisor fee in India?

A. The requisite SEBI’s Registered Investment Advisor fee is as follows:

Ø Individual applicant: Rs. 5000

Ø Corporate applicant: Rs. 25000

Q. How to become a SEBI Registered Investment Advisor in India?

A. To learn how to get an RIA license in India, follow the steps:

Q. Where can I avail of the best SEBI Registered Investment Advisor services in India?

A. Registrationwala has a team of accomplished legal professionals who can make you sail through the entire RIA licensing procedure in India.

★ ★ ★ ★ ★

I had a good time working with Registrationwala. Good team. I would recommend their services to others.

★ ★ ★ ★ ★

It was extremely great service of Registrationwala consulting firm, and this firm is providing the best services and worry about the client's required services along the client's satisfaction.

★ ★ ★ ★ ★

Superb Experince! Within no time the trademark registration was on.Highly professional team. I am very much Impressed with the prompt response and efficiency.Thank you.

★ ★ ★ ★ ★

We had taken ISP license from registration wala and the supporting person is very helpful to taken that license his communication and his work is satisfactory and thanks for those services

★ ★ ★ ★ ★

I sincerely appreciate your prompt support in helping me get the access license so quickly. Your professionalism and efficiency are truly commendable. Thank you for going above and beyond to assist me. Keep up the great work!

★ ★ ★ ★ ★

I very much appreciate the fact that you guys possess tremendous knowhow of private limited company incorporation. You have exhibited professional and respectful manner towards my query and I would seriously recommend you guys to all the folks looking for outstanding business services.

★ ★ ★ ★ ★

Thanks to their support, I got my trademark successfully. I highly recommend their services for anyone needing help with their intellectual property. The person assigned to me was very cooperative and helpful.

★ ★ ★ ★ ★

Thanks to their support ragistrationwala team, I got my IP-1 license successfully and special thanks to Miss.Kanishka for your great and timing support !!!!!! I have archived my goal one step forward... Thanks for the entire team....

★ ★ ★ ★ ★

Really helped a lot in getting my both VNO licenses. Great experience working with the team and very humble team, thanks for providing the vno license on time.

★ ★ ★ ★ ★

I had a good time working with Registrationwala. Good team. I would recommend their services to others.

★ ★ ★ ★ ★

It was extremely great service of Registrationwala consulting firm, and this firm is providing the best services and worry about the client's required services along the client's satisfaction.

★ ★ ★ ★ ★

Superb Experince! Within no time the trademark registration was on.Highly professional team. I am very much Impressed with the prompt response and efficiency.Thank you.

★ ★ ★ ★ ★

We had taken ISP license from registration wala and the supporting person is very helpful to taken that license his communication and his work is satisfactory and thanks for those services

★ ★ ★ ★ ★

I sincerely appreciate your prompt support in helping me get the access license so quickly. Your professionalism and efficiency are truly commendable. Thank you for going above and beyond to assist me. Keep up the great work!

★ ★ ★ ★ ★

I very much appreciate the fact that you guys possess tremendous knowhow of private limited company incorporation. You have exhibited professional and respectful manner towards my query and I would seriously recommend you guys to all the folks looking for outstanding business services.

★ ★ ★ ★ ★

Thanks to their support, I got my trademark successfully. I highly recommend their services for anyone needing help with their intellectual property. The person assigned to me was very cooperative and helpful.

★ ★ ★ ★ ★

Thanks to their support ragistrationwala team, I got my IP-1 license successfully and special thanks to Miss.Kanishka for your great and timing support !!!!!! I have archived my goal one step forward... Thanks for the entire team....

★ ★ ★ ★ ★

Really helped a lot in getting my both VNO licenses. Great experience working with the team and very humble team, thanks for providing the vno license on time.

★ ★ ★ ★ ★

I had a good time working with Registrationwala. Good team. I would recommend their services to others.