Get a Quote

Get a Quote and Find Services to Fit Your Needs 50000+ Satisfied Clients

5000+ Licenses & Registration

15 Branches across India

75 Years + Combined experience

OPC and PLC

One Person Company (OPC) is a business entity run by a sole owner with the benefit of limited liability.One Person Company is a separate legal entity from its members, offering protection to its shareholders. Every One Person Company must nominate a member for the Directorial position in the MoA and AoA in the absence of the prime director.

A Private Limited Company, or LTD or PLC, is a privately-held company. This implies that the business limits owner liability to its shares and limits the number of shareholders to 50. It also restricts shareholders from trading shares publicly.

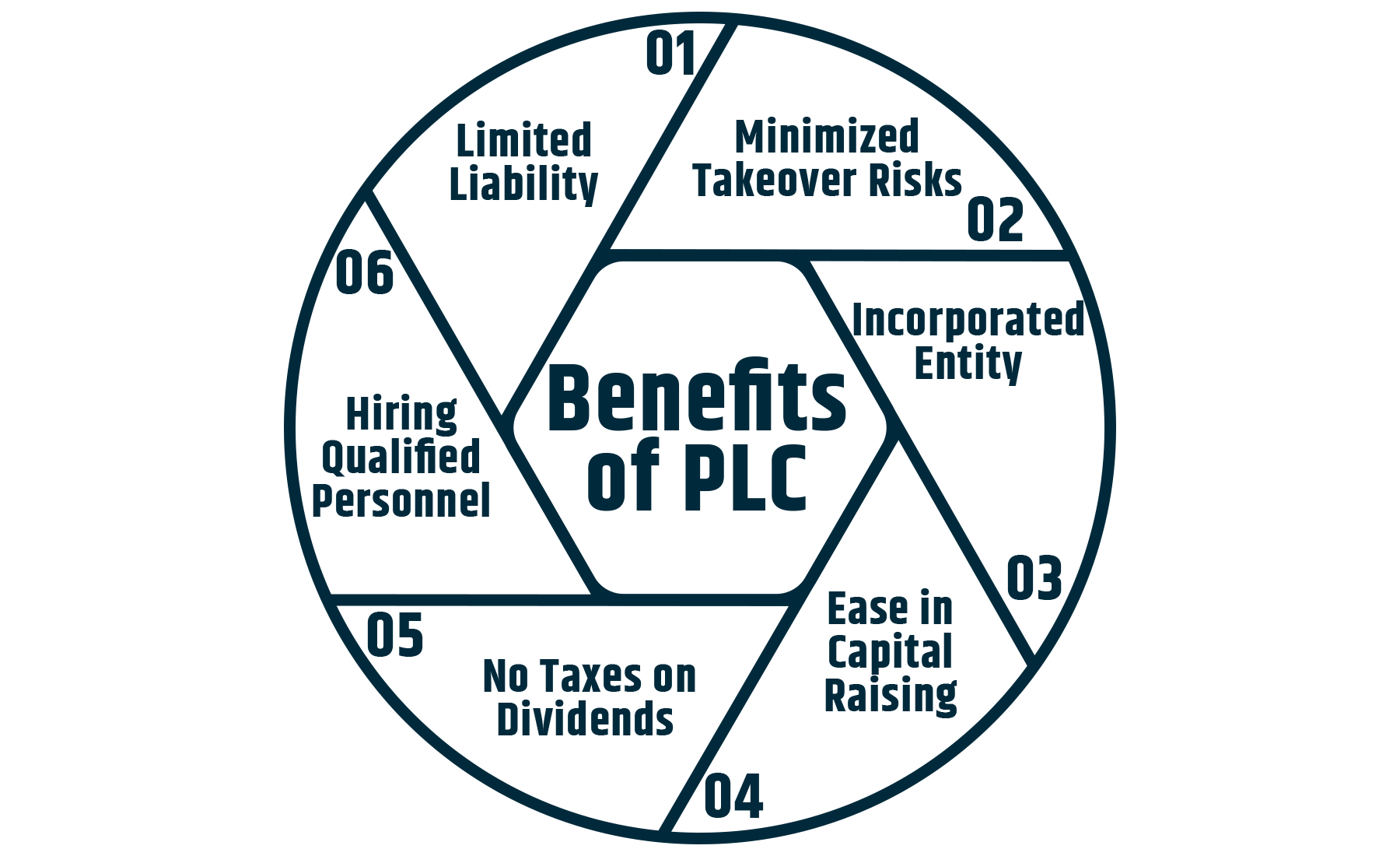

The liability of shareholders is limited to their shares. Financial risks are a part of the business, but minimizing them and sustaining the business's progress is imperative. In an LTD, if due for any reason, the company were to be shut down, the shareholders would not risk losing their personal assets.

The risk of takeovers is minimized when two shareholders trade shares, as the selling and buying of shares are possible only when both parties have given their consent.

Private limited companies are incorporated. Hence it continues to exist even if the owner dies.

The capital or options of raising business investment is not restricted to one person, which is the case in One Person Company.

Private Limited Companies pay corporate tax on their profits. Dividends that the shareholders receive are not taxed. Taxes are determined as per their personal income tax rate.

Private limited companies can attract high-caliber employees that greatly help the company's growth.

Before you're allowed to One Person Company to a Private Limited Company, you must fit the following criteria

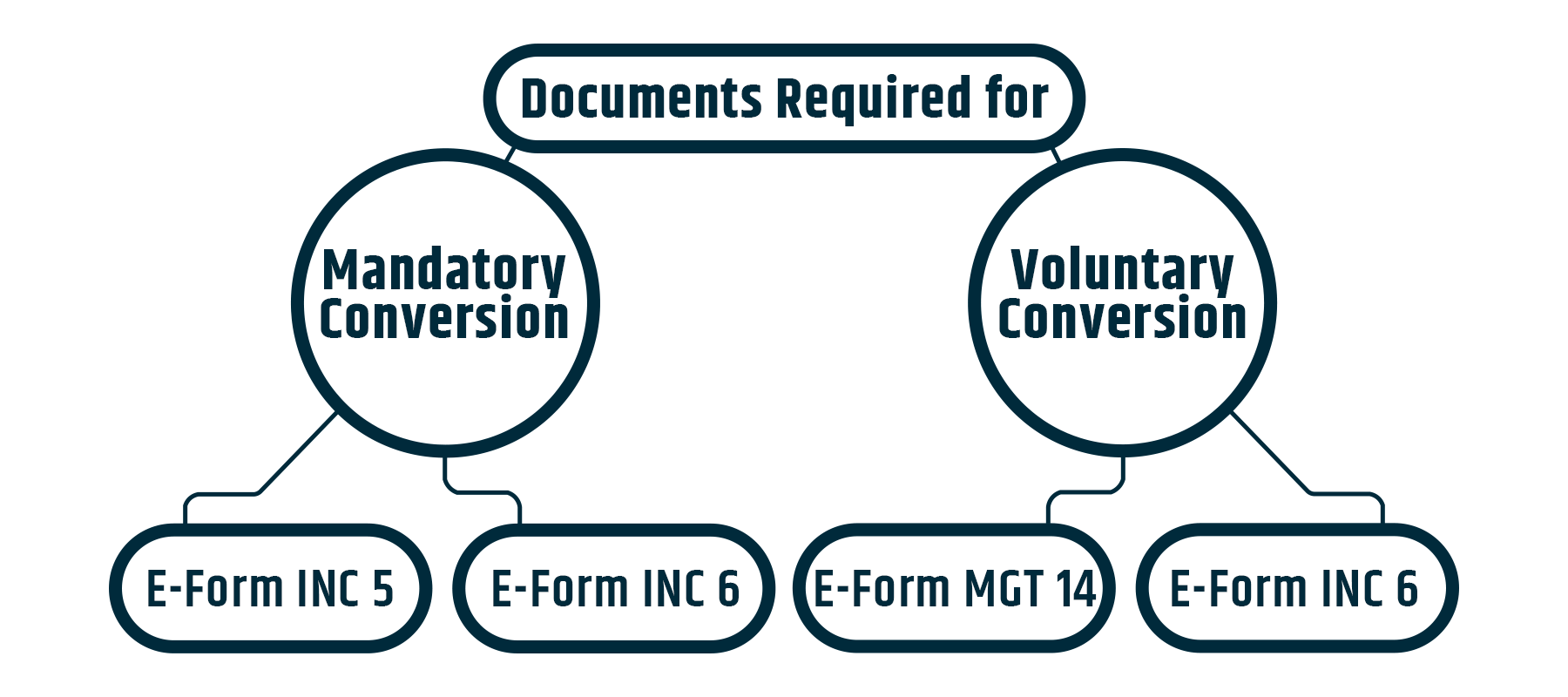

Further, there are two types of Conversion and both require different documents for converting a one-person company to a private limited company.

The conversion of One Person Company to a Private Limited Company becomes mandatory when

The following documents are then required for the conversion:

Copy of the Resolution is needed to be filed with the Registrar of Companies with the following attachments:

Application for the conversion of Private Limited Company to One Person Company with the following necessary attachments:

The conversion of a One Person Company to a Private Limited Company can be voluntarily done when the One Person Company completes two years from the date of incorporation.

The following documents are then required for the conversion.

Copy of the Special Resolution is needed to be filed with the Registrar of Companies with the following attachments:

Application for the conversion of Private Limited Company to One Person Company with the following necessary attachments:

The process to convert an OPC to a private limited company is as follows:

Intimate the Registrar of Companies that you now require to convert your One Person Company into a Private Limited Company on a voluntary or mandatory basis.

Appoint at least one Director to head the company alongside you. They can also act as your co-shareholder.

Organize a general body meeting and pass the resolution to raise the paid-up capital of your company (in case it's needed).

Pass a board resolution to change the Memorandum of Association and Articles of Association.

Convene a general body meeting and obtain "No objection" from your company's creditors.

Make changes to the Memorandum of Association as well as Articles of Association.

File the online e-form via the online MCA portal to start the process of company conversion.

We at Registrationwala provide end-to-end solutions for conversion from One Person Company to a Private Limited Company. Our services include:

Registrationwala.com is a leading legal consultancy firm providing comprehensive services relating to One Person Company to Private Limited Company.

So, take your first steps towards this conversion and reach out to us.

Q. Can we convert OPC to Pvt Ltd Company in India?

A. The OPC to Private Limited conversion is possible in India through voluntary conversion. You can check the documentation section of this page to know about the process.

Q. How to convert OPC to Pvt Ltd company?

A. The procedure for OPC to Pvt Ltd conversion is defined in the conversion process section of this page.

Q. Is the conversion of OPC to a Private Limited Company mandatory?

A. The OPC to Pvt Ltd conversion is not mandatory if the OPC's revenue remains below the defined limits by the MCA.

Q. OPC vs. Pvt Ltd, which business model is better for single ownership?

A. OPC

Q. Can OPC be converted to Pvt Ltd Company?

A. Yes, the conversion of OPC into Private Company is possible through mandatory and voluntary avenues.

Q. What is the voluntary conversion of a One Person Company to Pvt Ltd Company?

A. The One Person Company to Private Limited Company voluntary conversion is the intended conversion of an OPC to the larger enterprise model. If a business, such as an OPC, wants to convert to a larger enterprise model, then it can avail of the Private Company model.

Q. Can OPC be converted into Private Limited Company?

A. Yes, you can convert an OPC into a Private Limited Company by using the procedure of voluntary conversion. If an OPC exceeds its limits of single ownership, then it must mandatorily convert itself into a Private Limited Company.

Q. How to convert OPC into Private Limited Company?

A. To know the process of conversion of One Person Company to Private Company, refer to the process section of this page.

Q. What is the voluntary conversion of OPC into Private Company?

A. The resolution for voluntary conversion of OPC to Private Company is passed by the Company’s Board to expand the business and invite funds into the firm.

Q. What is a One Person Limited Company?

A. One Person Company (OPC) is a business entity run by a sole owner with the benefit of limited liability. One Person Company is a separate legal entity from its members, offering protection to its shareholders.

Q. What are the draft documents for conversion of OPC to Private Company?

A. You can refer to this page's document section for all the required documentation.

Q. Can OPC be converted into Pvt Ltd Company?

A. Yes, the conversion of OPC to Private Company is possible through the voluntary conversion method.

Q. What is the mandatory conversion of OPC?

A. The conversion of One Person Company to a Private Limited Company becomes mandatory when

Q. Is the board resolution necessary for the conversion of OPC to Private Company?

A. Yes.

Q. What are One Person Company limits?

A. Paid-up capital of 50m lakhs

Q. Do we have to alter the MOA and AOA of OPC company for private conversion?

A. Yes, to convert OPC to Private Limited Company, the OPC must alter its existing MoA and AoA.

Q. Where can we get the list of OPC companies in India?

A. You can download it from the MCA website.

Q. Is OPC conversion to Private Company a good decision?

A. Yes, if the extent of the OPC private limited company cannot limit itself into its business structure, then the OPC must inflate to the private company business model.

Q. What is the document checklist of conversion of OPC into Private Limited Company?

A. You can refer to this page's document section for all the required documentation.