Get a Quote

Get a Quote and Find Services to Fit Your Needs 50000+ Satisfied Clients

5000+ Licenses & Registration

15 Branches across India

75 Years + Combined experience

PPIs are instruments that facilitate the purchase of goods and services, conduct financial services, enable remittance facilities, etc., against the value stored therein.

As per the provision of the Payment and Settlement Systems Act, 2007, those wishing to start a Payment Wallet in India must obtain the Certificate of Authorization from the Reserve Bank of India. This authorization is called the Payment Wallet License.

Prepaid Payment Instruments (PPIs) are referred to as instruments that have a high monetary value. One can use them to purchase goods and services at a fixed amount. These instruments store a fixed value of the user's amount to pay. The amount can be cash, credit card, or debit.

To start a Prepaid payment instrument, known by its more popular term, the prepaid wallet, one must obtain a Prepaid Wallet license in India.

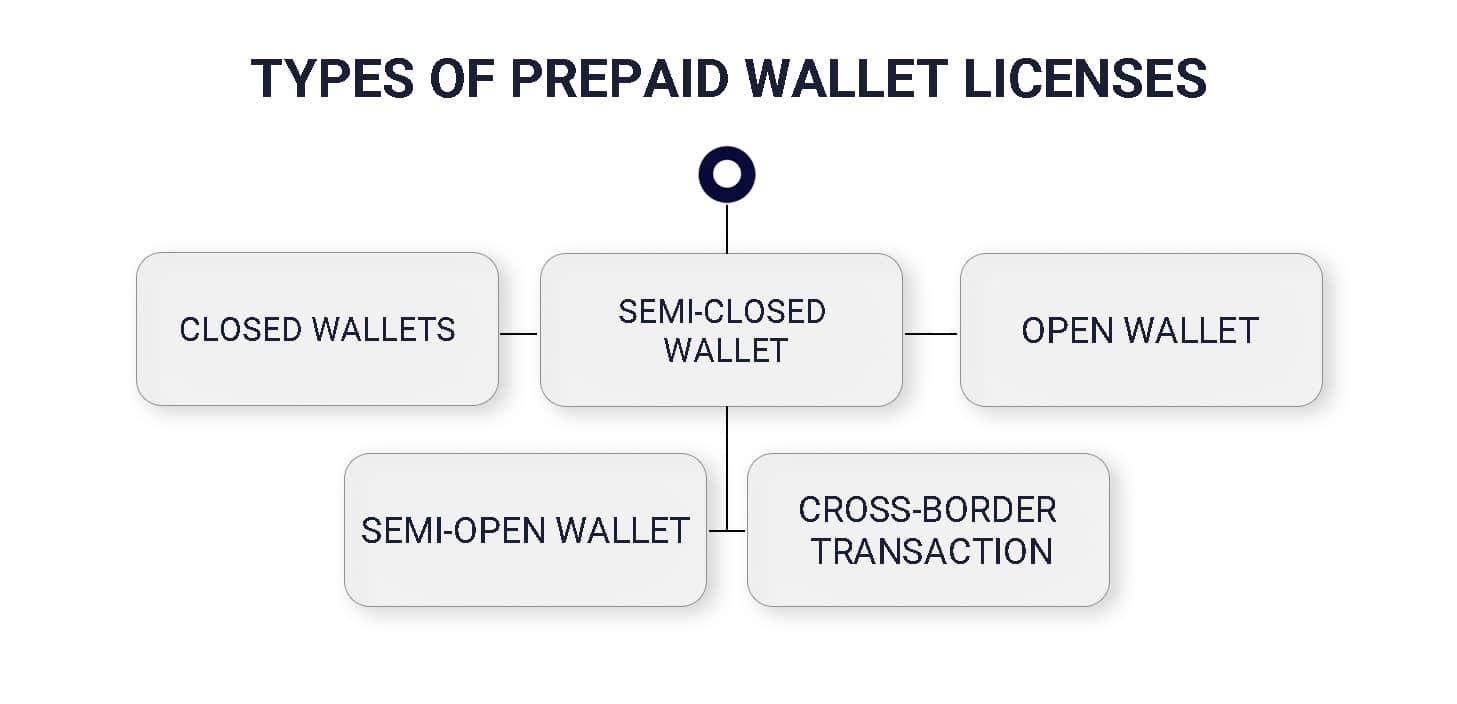

Following are the different types of Prepaid wallets currently prevalent in India:

Following are the types of prepaid payment instruments or RBI PPI wallet license in India:

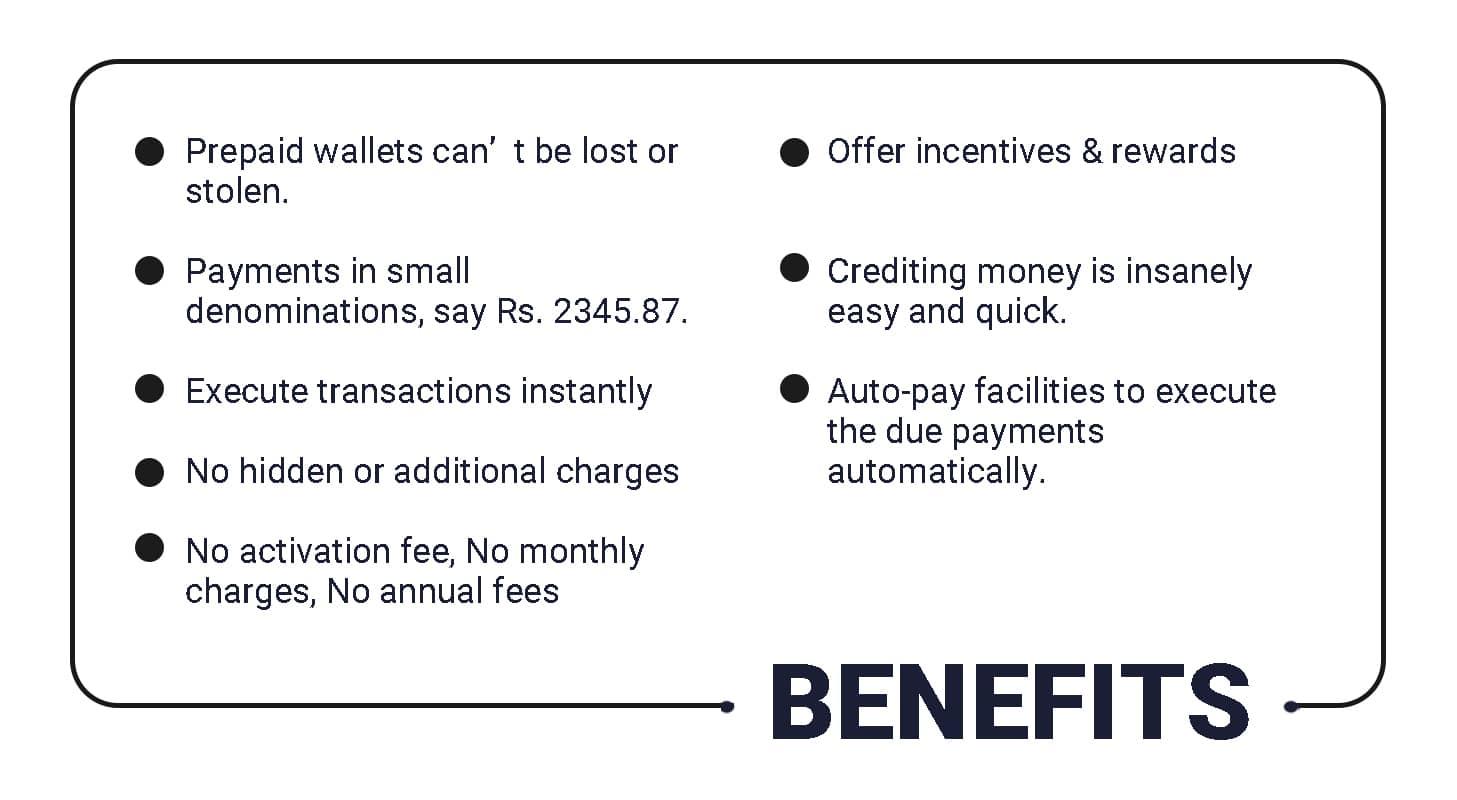

The following are the reasons to adopt an RBI PPI license or a Prepaid Payment wallet for conducting digital transactions:

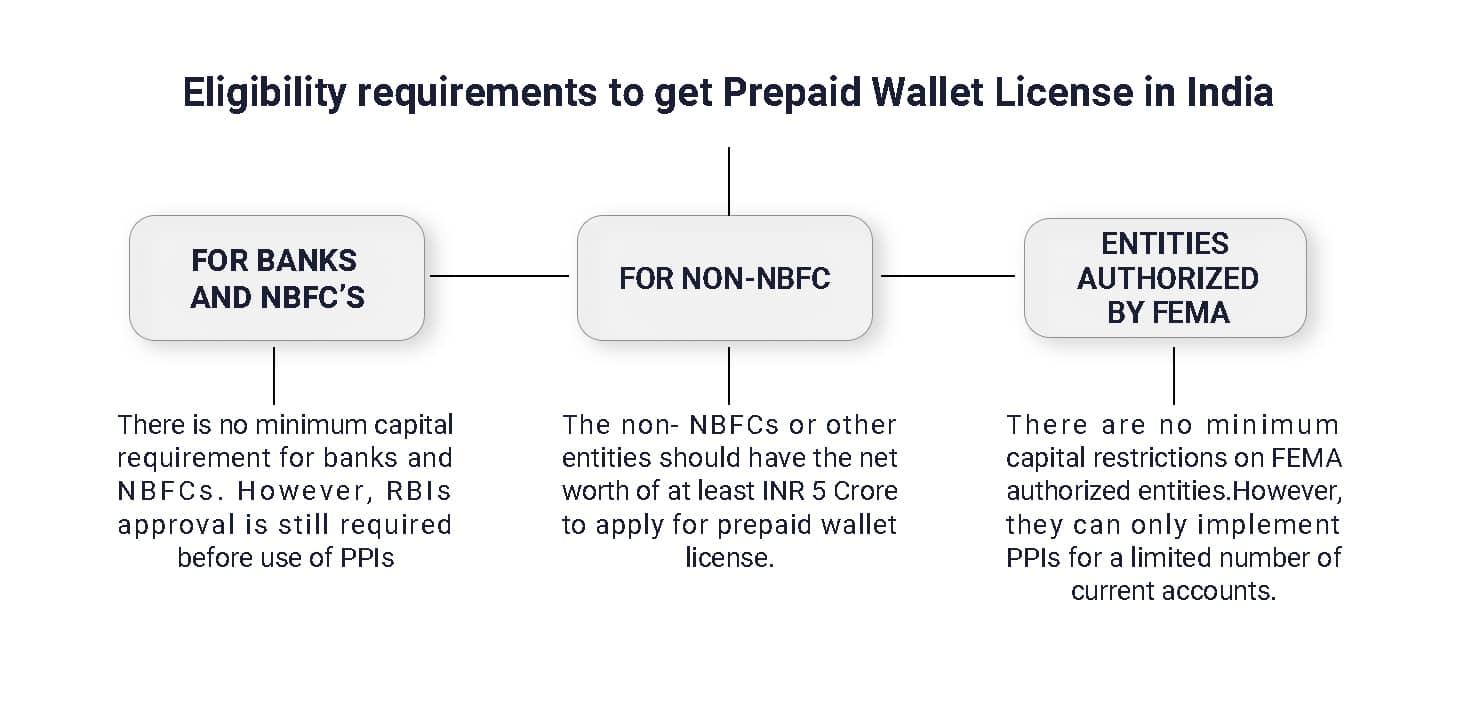

Eligibility requirements to get Prepaid Wallet License in India

Following are the eligibility requirement for prepaid wallet license:

.jpg)

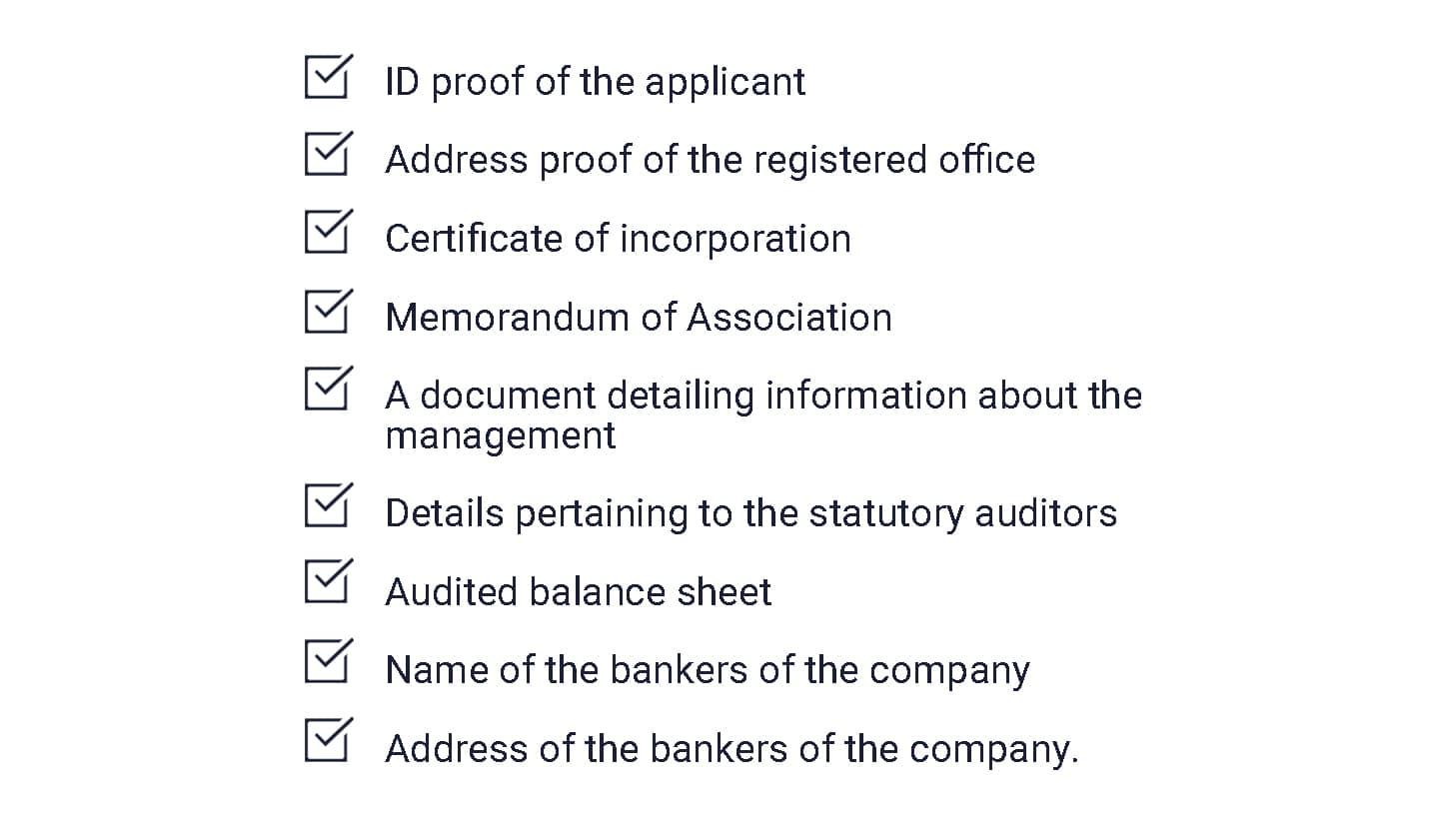

How to apply for a PPI license? The process to obtain a prepaid wallet license from the RBI is as follows:

If the reports, application, and documents satisfy the RBI, you'll be granted Prepaid Wallet Approval.

All the registered PPIs issued in the country have a minimum validity period of 1 year from the last loading/reloading date.

The guidelines issued by the Department of Regulation (DoR) of the Reserve Bank of India must apply mutatis mutandis to all the entities issuing PPIs.

The PPI issuer must adhere to the provisions of the Prevention of Money Laundering Act, 2002 (PMLA) and rules.

The PPI issuer must maintain a log of all the PPI transactions for at least ten years. All such transactions must be made available for scrutiny to RBI.

The PPI issuer must file Suspicious Transaction Reports (STRs) to Financial Intelligence Unit-India (FIU-IND).

All entities authorized to issue PPIs by RBI are permitted to issue reloadable or non-reloadable PPIs.

PPIs must be permitted to be loaded/reloaded by cash, debit by a Bank account, credit and debit cards, PPIs (as permitted from time to time), and other payment instruments issued by regulated entities in India and shall be in INR only.

Banks and non-banks must be permitted to load/reload PPIs through their authorized agents subject to the following conditions:-

Ensuring adherence to applicable laws of the land, including KYC / AML / CFT norms.

We provide end to end assistance in getting prepaid wallet license.

Thus, if you want to start a business of starting your own digital payment wallet, reach out to registrationwala.

Q.1) What is a PPI license?

PPI license is a legal permit that the RBI issues to facilitate Prepaid Payment Wallet services like:

in exchange for the credit stored within.

Q.2) What is the validity of a PPI license?

All the registered PPIs issued in the country have a minimum validity period of 1 year from the last loading/reloading date. A PPI issuer can issue PPIs with longer validity. The certificate of Authorisation issued by the RBI is valid for 5 years.

Q.3) What are the different types of Payment e-wallet instruments in India?

Following are the different types of Prepaid Wallet Licenses in India:

★ ★ ★ ★ ★

I had a good time working with Registrationwala. Good team. I would recommend their services to others.

★ ★ ★ ★ ★

It was extremely great service of Registrationwala consulting firm, and this firm is providing the best services and worry about the client's required services along the client's satisfaction.

★ ★ ★ ★ ★

Superb Experince! Within no time the trademark registration was on.Highly professional team. I am very much Impressed with the prompt response and efficiency.Thank you.

★ ★ ★ ★ ★

We had taken ISP license from registration wala and the supporting person is very helpful to taken that license his communication and his work is satisfactory and thanks for those services

★ ★ ★ ★ ★

I sincerely appreciate your prompt support in helping me get the access license so quickly. Your professionalism and efficiency are truly commendable. Thank you for going above and beyond to assist me. Keep up the great work!

★ ★ ★ ★ ★

I very much appreciate the fact that you guys possess tremendous knowhow of private limited company incorporation. You have exhibited professional and respectful manner towards my query and I would seriously recommend you guys to all the folks looking for outstanding business services.

★ ★ ★ ★ ★

Thanks to their support, I got my trademark successfully. I highly recommend their services for anyone needing help with their intellectual property. The person assigned to me was very cooperative and helpful.

★ ★ ★ ★ ★

Thanks to their support ragistrationwala team, I got my IP-1 license successfully and special thanks to Miss.Kanishka for your great and timing support !!!!!! I have archived my goal one step forward... Thanks for the entire team....

★ ★ ★ ★ ★

Really helped a lot in getting my both VNO licenses. Great experience working with the team and very humble team, thanks for providing the vno license on time.

★ ★ ★ ★ ★

I had a good time working with Registrationwala. Good team. I would recommend their services to others.

★ ★ ★ ★ ★

It was extremely great service of Registrationwala consulting firm, and this firm is providing the best services and worry about the client's required services along the client's satisfaction.

★ ★ ★ ★ ★

Superb Experince! Within no time the trademark registration was on.Highly professional team. I am very much Impressed with the prompt response and efficiency.Thank you.

★ ★ ★ ★ ★

We had taken ISP license from registration wala and the supporting person is very helpful to taken that license his communication and his work is satisfactory and thanks for those services

★ ★ ★ ★ ★

I sincerely appreciate your prompt support in helping me get the access license so quickly. Your professionalism and efficiency are truly commendable. Thank you for going above and beyond to assist me. Keep up the great work!

★ ★ ★ ★ ★

I very much appreciate the fact that you guys possess tremendous knowhow of private limited company incorporation. You have exhibited professional and respectful manner towards my query and I would seriously recommend you guys to all the folks looking for outstanding business services.

★ ★ ★ ★ ★

Thanks to their support, I got my trademark successfully. I highly recommend their services for anyone needing help with their intellectual property. The person assigned to me was very cooperative and helpful.

★ ★ ★ ★ ★

Thanks to their support ragistrationwala team, I got my IP-1 license successfully and special thanks to Miss.Kanishka for your great and timing support !!!!!! I have archived my goal one step forward... Thanks for the entire team....

★ ★ ★ ★ ★

Really helped a lot in getting my both VNO licenses. Great experience working with the team and very humble team, thanks for providing the vno license on time.

★ ★ ★ ★ ★

I had a good time working with Registrationwala. Good team. I would recommend their services to others.