Get a Quote

Get a Quote and Find Services to Fit Your Needs 50000+ Satisfied Clients

5000+ Licenses & Registration

15 Branches across India

75 Years + Combined experience

An investment banker is a highly-regarded financial professional, who provides financial services to companies, investors and government. They assist their clients in raising capital through stock offerings like initial public offering (IPO), or floating a bond issue, manage investments and allocate resources. They also help with mergers and acquisitions by offering financial advisory services and have expertise in valuations, analyzing market trends and deal structuring.

Investment bankers are generally employed by the investment banks. In India, the Securities and Exchange Board of India (SEBI) regulates the investment banker. If you want to find out how to become an investment banker, check out this blog post to find out all the requirements!

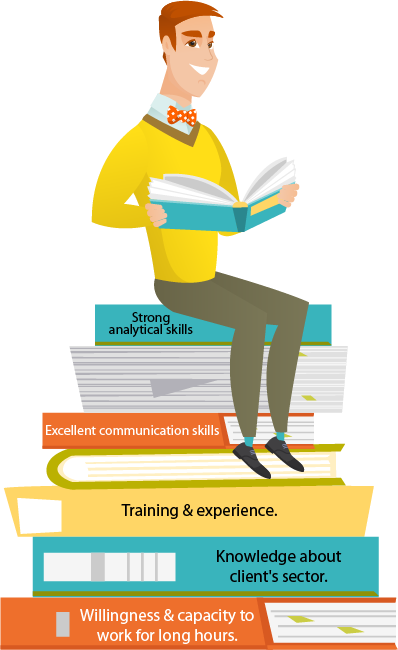

You can consider becoming an investment banker if you have the following skills set:

Strong analytical skills.

The willingness and capacity to work long hours, especially in the early phase of the career.

Excellent verbal and written communication skills.

Required training and experience in the financial industry.

Comprehensive knowledge about the client's sector.

If you want to become an investment banker, it is recommended that you pursue a bachelor’s degree in finance, economics, or a related field. To enhance your qualifications and stand out in the competitive job market, you can secure certifications like CA, CFA, or CPA.

To learn how to become an investment banker, check out the below-mentioned requirements:

The first and most basic requirement to become an investment banker is to clear your higher secondary education (10+2) with more than 50% from a recognized board, such as CBSE or ICSE.

You can go for the humanities, commerce or science stream in your 10+2, depending on what you find interesting. However, the ideal stream would be commerce and studying subjects like maths, accountancy, economics, business and computer technology since they are relevant in the investment banking sector.

To get admission in certain universities, whether for graduation or post-graduation degree, you may be required to give state or national-level competitive entrance exams and pass with qualifying marks/percentage.

Some popular entrance exams that you can give include the following:

|

S. No. |

Exam Name |

|

1. |

Common Entrance Test (CET) |

|

2. |

Common Management Admission Test (CMAT) |

|

3. |

Christ University Entrance Test (CUET) |

|

4. |

Delhi University Joint Admission Test (DU JAT) |

|

5. |

State Eligibility Test (SET) |

|

6. |

Narsee Monjee Aptitude Test (NMAT) |

|

7. |

Graduate Management Admission Test (GMAT) |

|

8. |

Symbiosis National Aptitude Test (SNAP) |

|

9. |

Common Admission Test (CAT) |

|

10. |

Xavier Aptitude Test (XAT) |

|

11. |

University Grants Commission National Eligibility Test (UGC NET) |

|

12. |

Council of Scientific and Industrial Research University Grants Commission National Eligibility Test (CSIR UGC NET) |

A 3-year or 4-year bachelor’s degree is required for gaining an entry-level position with an investment bank. You can choose to get a Bachelor of Commerce (B.Com.), Bachelor of Arts (B.A.), Bachelor of Arts (B.A.) in Economics or Bachelor of Business Administration (BBA) in Finance.

Each Bachelor’s programme is different but they may cover some common subjects like Mathematics, Accounting, Economics, Financial Management, Investment, Data Analytics, Taxation, Business Administration, Corporate Finance, etc.

After getting a Bachelor’s degree, you can get a two-year MBA degree in financial management. Many investment bankers get an MBA degree in Finance to get a more senior position in the workplace.

The National Stock Exchange Academy offers postgraduate programmes with a duration of 6-9 months in investment banking, financial planning, business analytics, management accounting and capital markets.

To make your CV stand out, you can obtain some additional certificates or diplomas. Wallstreet Mojo offers a Free Investment Banking Course with Free Online Certificate. Boston Institute of Analytics offers Certificate in Investment Banking and Financial Analyst and Post Graduate Master Diploma in Investment Banking and Financial Analyst.

You can further enhance your career prospects with the CFA programme or also Postgraduate Certificate Programme in Investment Banking (PGCPIB) offered by the Indian Institute of Management.

To look for internship opportunities, you can use online job portals like Naukri, Indeed, Bank websites or get assistance from the placement cell of the university you graduated from. Internships in investment banks can range from 2 months to 2 years.

When you join as an intern, you will not only get financial training to improve your analytical skills but also get a chance to improve your oral and written communication, presentation, and negotiation skills. Many investment banks offer a permanent position to interns who perform really well.

After you have completed your internship, you may get a job offer directly through a campus job interview or by applying for available positions at investment banks or financial advisory firms.

You must prepare for your interview well. You can google the frequently asked interview questions for investment banking interviews and figure out the best way to answer them to ace your interview. You must answer all questions during the interview with confidence, and be as clear and concise as possible.

To stay competitive and up-to-made regarding latest advancements in investment banking and finance industries, you must continue gaining investment banking education. You can participate in employer-backed training programs and other certification programmes.

You can acquire new skills, be in a network involving industry leaders, gain work experience in investment and corporate finance, and learn about the latest industry developments. Doing so will be extremely beneficial when you’re seeking a higher-level management role in the investment banking domain.

According to Glassdoor, an Investment Banker’s estimated total pay is Rs. 29,50,000 per year, and has an average salary of Rs. 11,00,000 per year. The extra salary is expected to be Rs. 18,50,000 annually. Cash bonuses, commissions, tips, and profit-sharing are examples/sources of extra compensation.

The investment bankers primarily offer the following services:

Underwriting

M&A

Sales and trading

Equity research

Asset management

Commercial banking

Retail banking

The investment banker has the following responsibilities:

Conducting financial research.

Developing financial models for valuation of debt and equity for transactions.

Performing valuation methods.

Maintaining cordial yet professional client relationships.

Crafting investment pitches, presentations and other materials to assist clients.

Preparing recommendations for valuations, private equity transactions, mergers and acquisitions.

An investment banker is a financial professional who is engaged in providing financial services to government, businesses and individuals. They are generally employed by investment banks, and are engaged in the IPO process through participation in underwriting of the offering, setting the initial share price and managing the IPO issuance process. They are also engaged in mergers and acquisitions.

Want IPO consulting services? Connect with Registrationwala now. Our consultation will help you in ensuring a smooth IPO launch process, from underwriting by investment bankers to filing a draft red herring prospectus with SEBI. We’ll guide you through all the necessary steps.

Want to know More ?