Get a Quote

Get a Quote and Find Services to Fit Your Needs 50000+ Satisfied Clients

5000+ Licenses & Registration

15 Branches across India

75 Years + Combined experience

ITR V full form is Income Tax Return - Verification. It is basically a confirmation document generated after you e-file your income tax return. It serves as proof that your return has been successfully submitted.

If you do not verify your return electronically, this document must be downloaded online and then signed and submitted to the Centralized Processing Center (CPC) of Income Tax Department (ITD) in Bangalore to complete the filing process.

If you want to learn how to download ITR V, check out this blog post wherein we explain all the necessary steps you need to follow.

The purpose of downloading the ITR-V form is to complete the verification process of your ITR when it is not e-verified online. If you choose not to e-verify your return using methods like Aadhaar OTP, net banking, or digital signature, you’ll need to download the ITR-V from the income tax portal.

This form must then be printed, signed, and sent to the Centralized Processing Center (CPC) in Bangalore within 30 days of filing to validate your return.

Before you can download ITR V form, you need to make sure you fulfill the following key prerequisite conditions:

You must have an account on the official Income Tax Portal.

Additionally, you must have successfully submitted your ITR.

You must have a stable internet connection.

Only ITRs filed for completed assessment years can generate an ITR V for download.

To successfully download the ITR V PDF, your browser should allow pop-ups from the efiling portal or the download might get blocked.

If you fulfill all the requirements, then you can easily download ITR-V online from ITD’s official e-filing portal.

To download ITR V form through the Income Tax Department’s official e-filing portal, you need to follow the following steps:

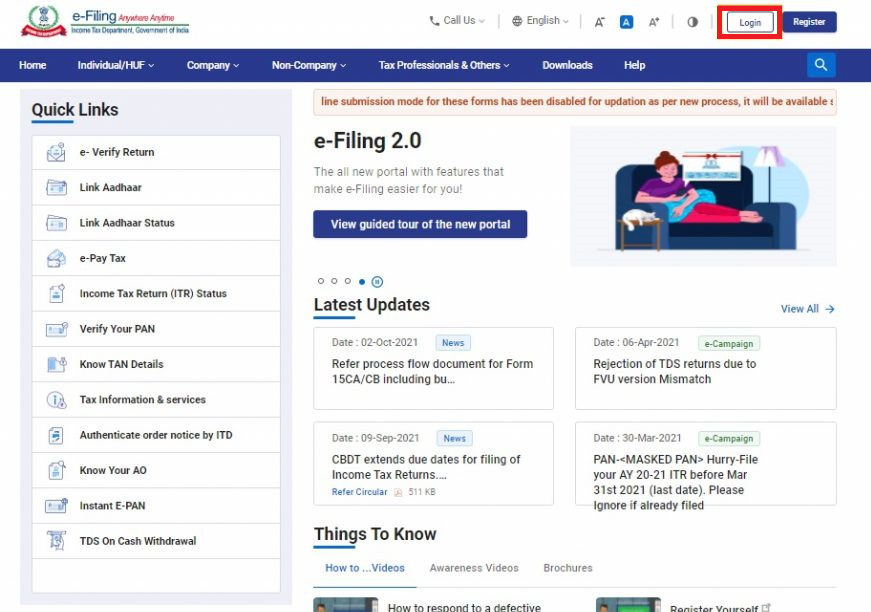

Step 1: Visit the Income Tax India website.

Step 2: Once you are on the home page, click on ‘Login option’.

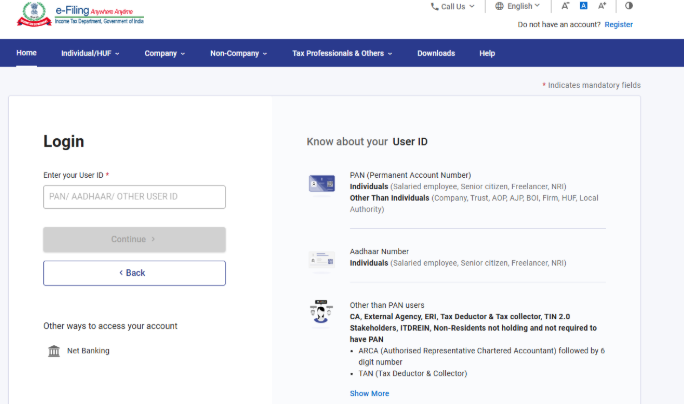

Step 3: Now, enter User ID and then click on continue. Now, enter your password.

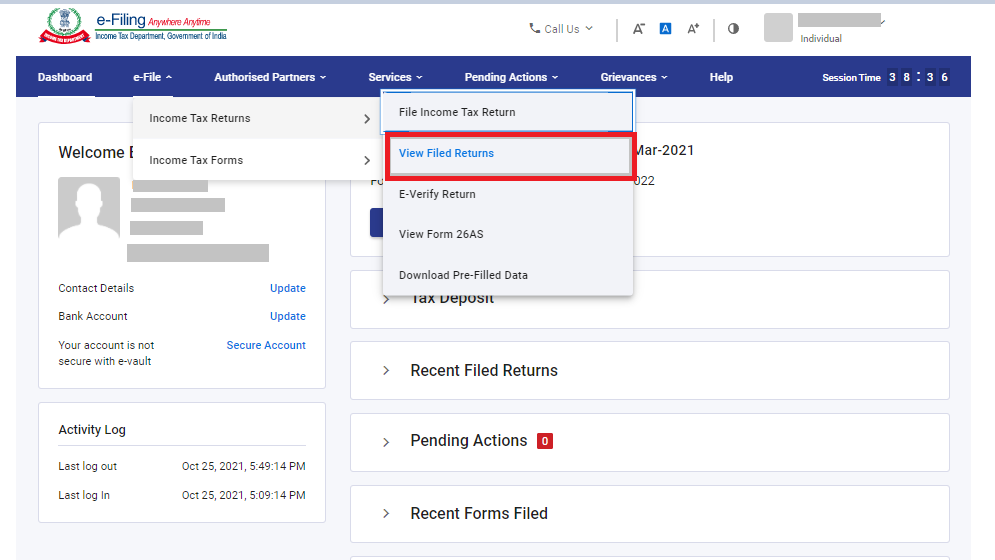

Step 4: Once you log in, select the ‘e-File’>’Income Tax Returns’>’View Filed Returns’ option so that you can see the e-filed tax returns.

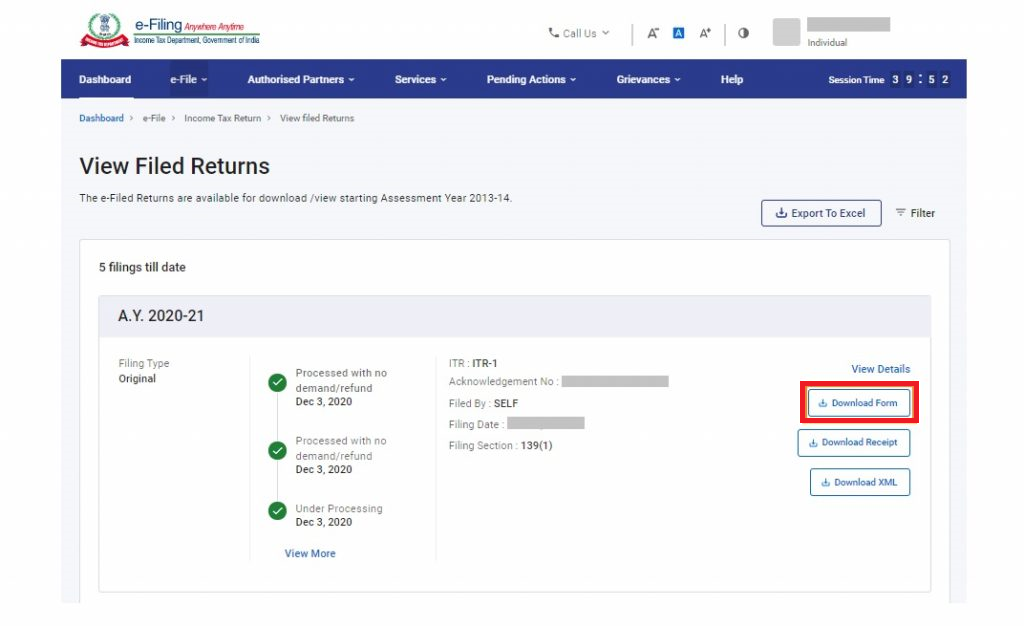

Step 5: Click the ‘Download Form’ button for the applicable assessment year to download the ITR-V.

After completing all the aforementioned steps, the acknowledgment form will be downloaded successfully!

ITR-V is a crucial document in the tax filing process. If you do not e-verify your tax return, then you must use the ITR-V form for the verification. For verification, first, you need to download this form and then sign it. Afterwards, you must send it to the Centralized Processing Center (CPC) in Bangalore. You need to do this within 30 days of filing to validate your return.

If you want assistance in tax filing, then connect with Registrationwala for assistance. Our Chartered Accountants and Tax Consultants would be glad to assist you!

Q1. What is the purpose of the ITR-V form?

A. The ITR-V is an acknowledgment of your filed ITR return.

Q2. Do I need to send the ITR-V to CPC Bangalore if I e-verify my return?

A. No, if you e-verify your return, you don’t need to send the ITR-V physically.

Q3. Where can I download my ITR-V form?

A. You can download it from the 'View Filed Returns' section on the ITD e-filing portal.

Q4. What is the full form of ITR-V?

A. The full form of ITR-V is Income Tax Return - Verification.

Q5. What happens if I don’t file ITR-V form with CPC Bangalore within 30 days to validate my return?

A. If you don’t file the ITR-V with CPC Bangalore within 30 days, your tax return will be treated as invalid.

Q6. If I don’t want to file ITR-V, what other options are available?

A. You can verify your ITR electronically through methods such as Aadhaar OTP, net banking, bank ATM, Demat account, or a digital signature certificate.

Q7. What are the different ways to e-verify an ITR?

A. You can e-verify your ITR using any of the following methods: (i) Aadhaar OTP (ii) Net banking (iii) Bank account (pre-validated) (iv) Demat account (v) Bank ATM (vi) & Digital Signature Certificate. You can also verify your ITR offline by filing ITR-V with CPC.