Get a Quote

Get a Quote and Find Services to Fit Your Needs 50000+ Satisfied Clients

5000+ Licenses & Registration

15 Branches across India

75 Years + Combined experience

The Insurance Regulatory and Development Authority of India (IRDAI) provides various licenses and registrations to individuals and entities interested in operating in the insurance industry. Insurance marketing firm registration is granted to entities seeking to solicit or procure insurance products, undertake insurance service activities, and distribute other financial products.

As specified in Regulation 3(a) of the Insurance Regulatory and Development Authority of India, it is mandatory to register your insurance marketing firm to engage in insurance service activities. To obtain insurance marketing firm registration from IRDAI smoothly, connect with Registrationwala’s IMF registration experts!

An insurance marketing firm, as the name suggests, is a firm that markets insurance services. In the legal terms prescribed by the IRDA, an IMF or Insurance marketing firm is an entity with permission to undertake insurance service activities.

An Insurance Marketing Firm provides the following categories of services:

One can categorize the benefits of an insurance marketing firm into the following:

Here is the explanation for these Insurance marketing firm benefits:

It is because of these benefits that becoming a top insurance marketing firm in India is not a difficult task - provided you follow all the guidelines carefully.

With the age of uncertainty has arrived the realization that we need to safeguard our financial futures. By starting an insurance marketing firm, you can take the first step by making people more aware of it. However, don’t get attached to the term “marketing”, for the legal definition of the term as per IRDA is quite nuanced, and can only be understood by the principal officer, who has to undergo 50 hours of insurance marketing firm training.

It is only one part of the Insurance Marketing firm's eligibility. An insurance marketing firm is only allowed to exist if it’s registered as per the provisions of IRDAI and the training of a principal officer is the topmost eligibility criterion.

If you want to start your own Insurance Marketing Firm, you can reach out to Registrationwala. Registrationwala provides holistic services from application filing to department follow-up, ensuring that your Insurance marketing firm gets registered on time.

The applicant should be a registered business entity under the Ministry of Corporate Affairs. It means that the applicant should either be an LLP, an OPC, or a private limited company.

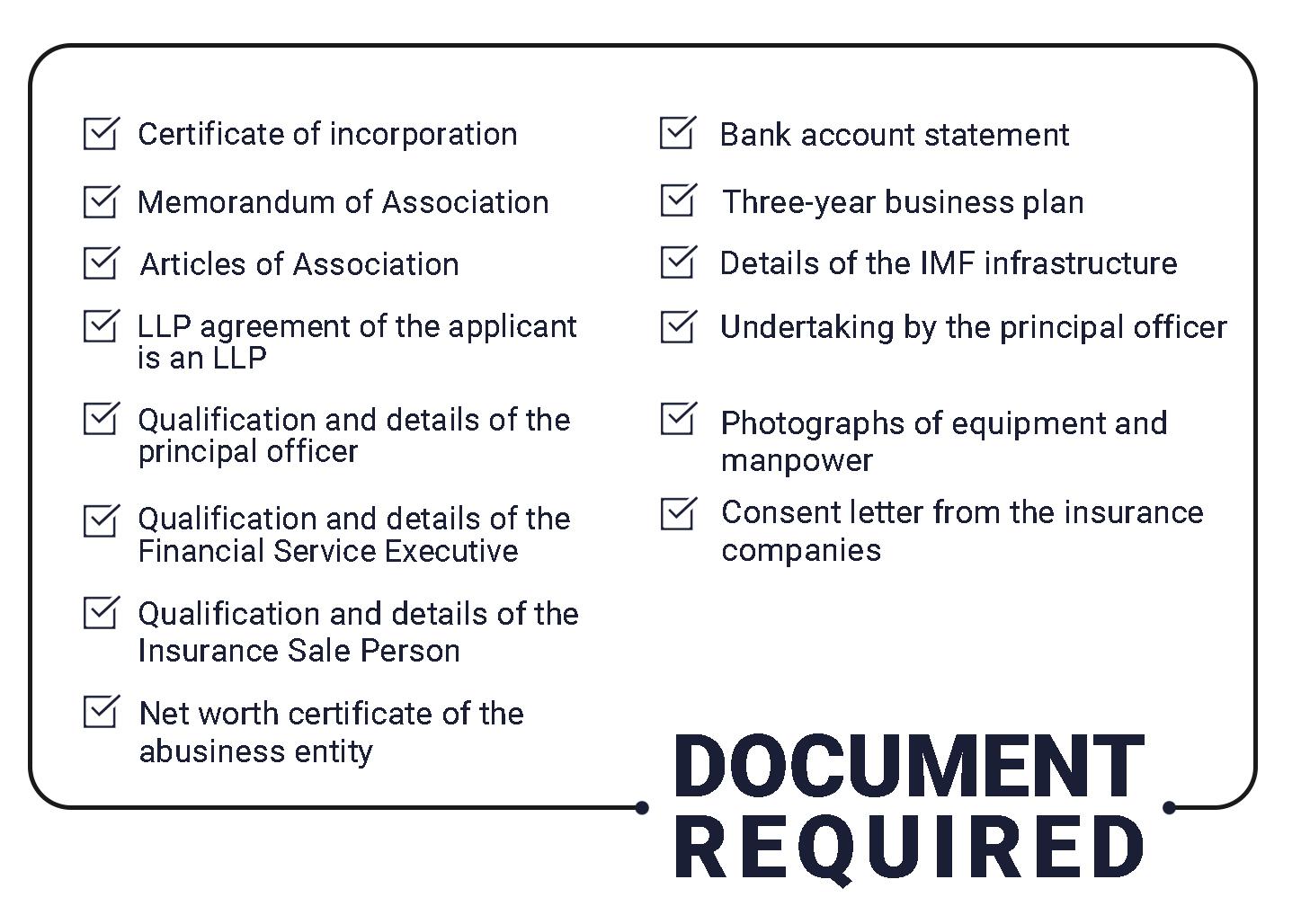

In order to prove that the applicant meets the aforementioned eligibility criteria, it is important to furnish the precise documents for the Insurance marketing firm license.

This section gives you the first half of the answer to the question - how to start an insurance marketing firm in India?

In regards to an insurance marketing firm, IRDA has put forth strict standards when it comes to documents. Therefore, you must ensure that all the documents that we have mentioned are precise and as per the rules and regulations of the department.

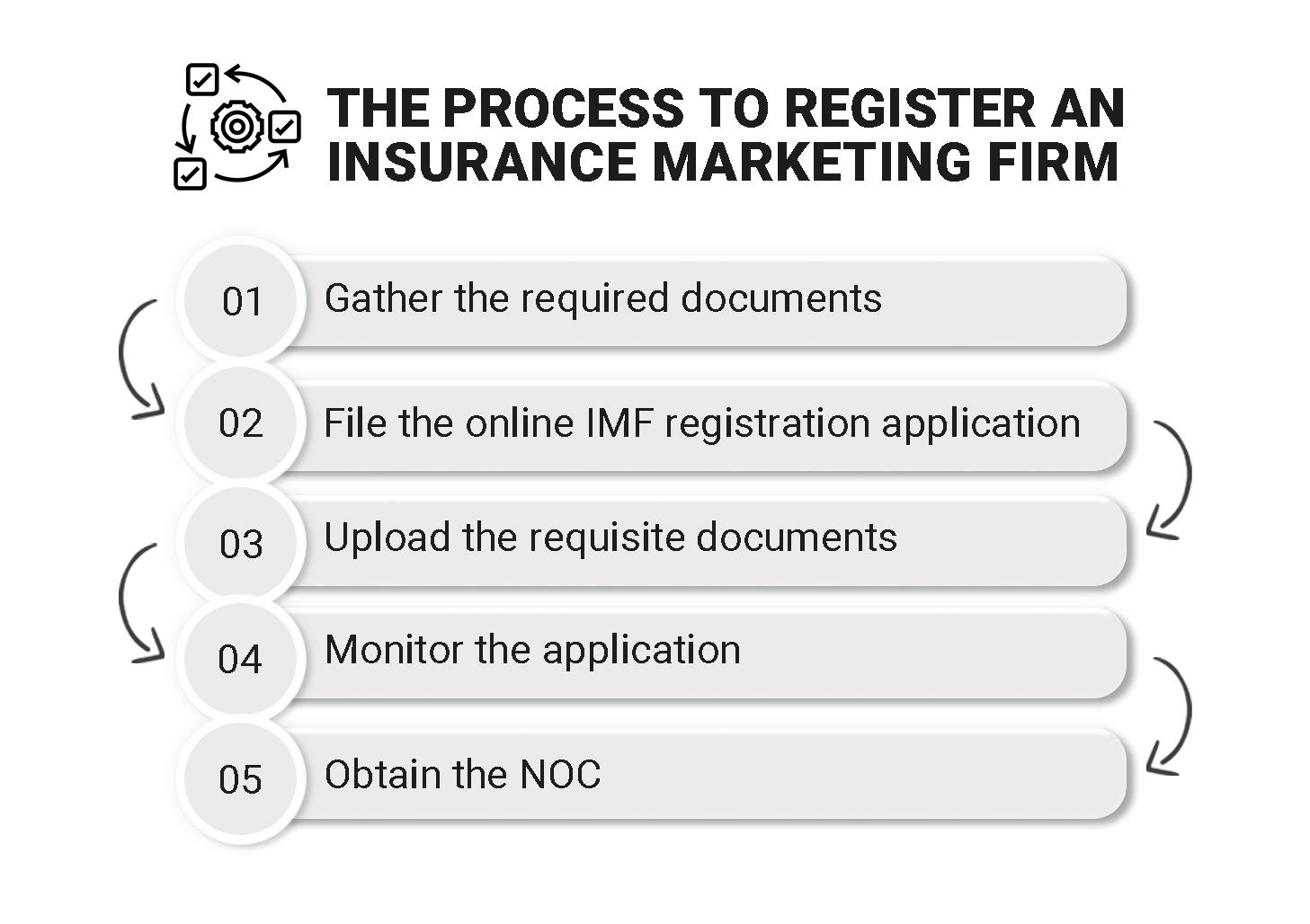

Do you want to know how to become an insurance marketing firm in India? Look no further than these steps:

Do you want to know how to become an insurance marketing firm in India? Look no further than these steps:

Here is the explanation of these steps:

This insurance marketing firm registration process is not a short one. Therefore, to ensure that this IRDA registration process is easier and gives you the license quickly, consult with experts.

Registrationwala provides end-to-end services for aspirants of an Insurance marketing firm. To expedite the process:

In the end, we ensure that you don’t have to worry about taking a lot of time in getting the NOC to set up your Insurance marketing firm.

Call us if you wish to start your firm to promote insurance policies.

An Insurance Marketing Firm is an IRDA-authorized insurance intermediary that provides a multitude of insurance services, including: Soliciting and procuring insurance products Providing insurance services Marketing insurance products.

The Insurance Marketing firm license is the IRDA registration to establish an Insurance marketing firm in India.

Both are licensed by IRDA to solicit insurance policies. However, an insurance marketing firm can also provide insurance services and market financial products.

The IMF registration certificate is valid for 3 years.

★ ★ ★ ★ ★

I had a good time working with Registrationwala. Good team. I would recommend their services to others.

★ ★ ★ ★ ★

It was extremely great service of Registrationwala consulting firm, and this firm is providing the best services and worry about the client's required services along the client's satisfaction.

★ ★ ★ ★ ★

Superb Experince! Within no time the trademark registration was on.Highly professional team. I am very much Impressed with the prompt response and efficiency.Thank you.

★ ★ ★ ★ ★

We had taken ISP license from registration wala and the supporting person is very helpful to taken that license his communication and his work is satisfactory and thanks for those services

★ ★ ★ ★ ★

I sincerely appreciate your prompt support in helping me get the access license so quickly. Your professionalism and efficiency are truly commendable. Thank you for going above and beyond to assist me. Keep up the great work!

★ ★ ★ ★ ★

I very much appreciate the fact that you guys possess tremendous knowhow of private limited company incorporation. You have exhibited professional and respectful manner towards my query and I would seriously recommend you guys to all the folks looking for outstanding business services.

★ ★ ★ ★ ★

Thanks to their support, I got my trademark successfully. I highly recommend their services for anyone needing help with their intellectual property. The person assigned to me was very cooperative and helpful.

★ ★ ★ ★ ★

Thanks to their support ragistrationwala team, I got my IP-1 license successfully and special thanks to Miss.Kanishka for your great and timing support !!!!!! I have archived my goal one step forward... Thanks for the entire team....

★ ★ ★ ★ ★

Really helped a lot in getting my both VNO licenses. Great experience working with the team and very humble team, thanks for providing the vno license on time.

★ ★ ★ ★ ★

I had a good time working with Registrationwala. Good team. I would recommend their services to others.

★ ★ ★ ★ ★

It was extremely great service of Registrationwala consulting firm, and this firm is providing the best services and worry about the client's required services along the client's satisfaction.

★ ★ ★ ★ ★

Superb Experince! Within no time the trademark registration was on.Highly professional team. I am very much Impressed with the prompt response and efficiency.Thank you.

★ ★ ★ ★ ★

We had taken ISP license from registration wala and the supporting person is very helpful to taken that license his communication and his work is satisfactory and thanks for those services

★ ★ ★ ★ ★

I sincerely appreciate your prompt support in helping me get the access license so quickly. Your professionalism and efficiency are truly commendable. Thank you for going above and beyond to assist me. Keep up the great work!

★ ★ ★ ★ ★

I very much appreciate the fact that you guys possess tremendous knowhow of private limited company incorporation. You have exhibited professional and respectful manner towards my query and I would seriously recommend you guys to all the folks looking for outstanding business services.

★ ★ ★ ★ ★

Thanks to their support, I got my trademark successfully. I highly recommend their services for anyone needing help with their intellectual property. The person assigned to me was very cooperative and helpful.

★ ★ ★ ★ ★

Thanks to their support ragistrationwala team, I got my IP-1 license successfully and special thanks to Miss.Kanishka for your great and timing support !!!!!! I have archived my goal one step forward... Thanks for the entire team....

★ ★ ★ ★ ★

Really helped a lot in getting my both VNO licenses. Great experience working with the team and very humble team, thanks for providing the vno license on time.

★ ★ ★ ★ ★

I had a good time working with Registrationwala. Good team. I would recommend their services to others.