Get a Quote

Get a Quote and Find Services to Fit Your Needs 50000+ Satisfied Clients

5000+ Licenses & Registration

15 Branches across India

75 Years + Combined experience

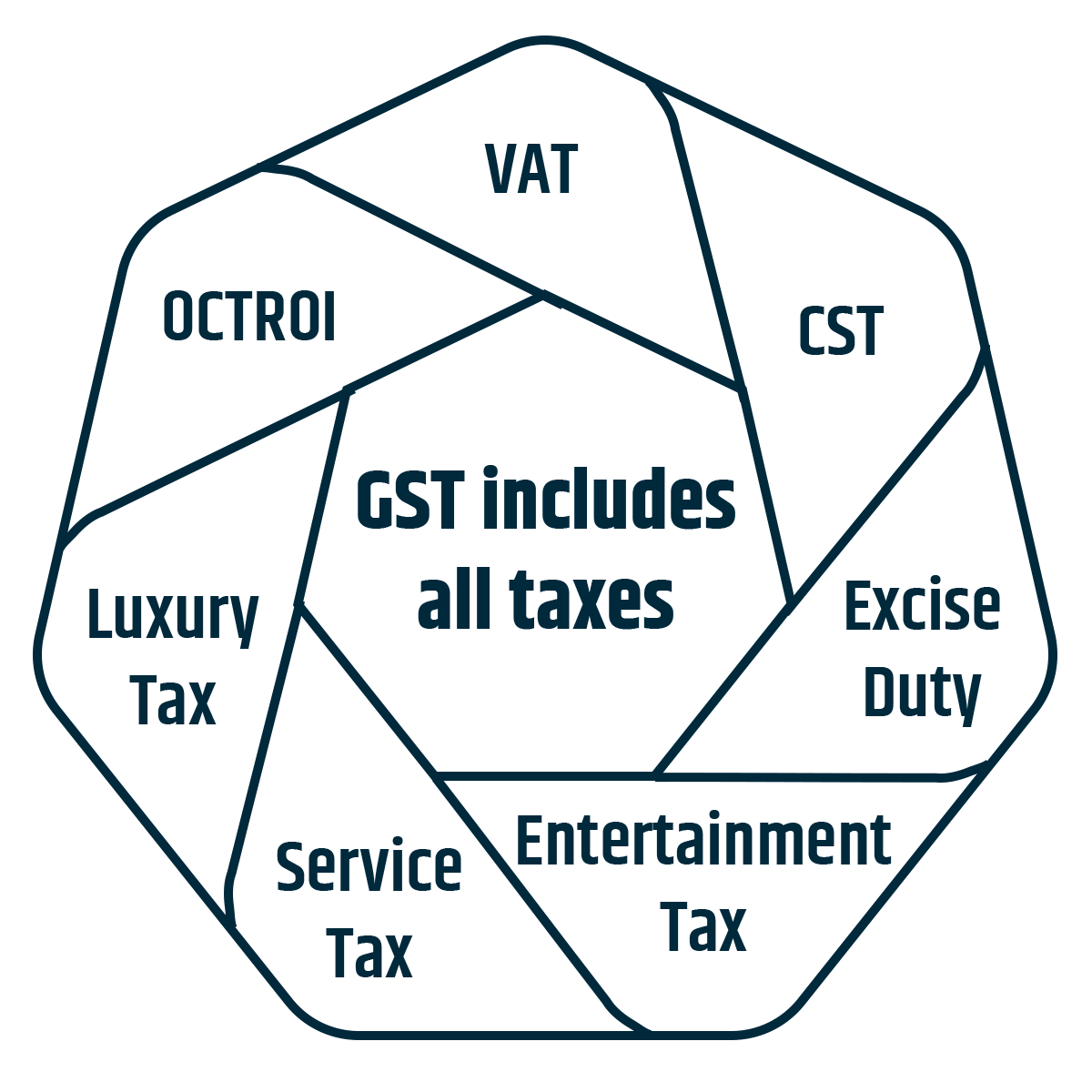

The full form of GST is Goods & Services Tax. It is an all-in-one tax that subsumes a variety of state (VAT, Entertainment Tax, Luxury Tax, Octroi) and central taxes (CST, Service Tax, Excise Duty).

GST Registration refers to the process of obtaining a unique identification number for businesses that are liable to pay Good and Service Tax. According to the GST law, businesses whose revenue exceeds the threshold of Rs. 40 lakh (goods) or Rs. 20 lakh (services) are required to register for GST and pay taxes on their taxable good & service.

Many enterprises in India are required to register under the GST regime. When businesses are required to secure a Goods and Services Tax registration but fail to do so, they are subject to severe fines and legal repercussions. The GST certificate registration process is entirely online and requires no manual intervention.

If you want to register your business under the GST system, connect with our Chartered Accountants & Consultants at Registrationwala.

The features of goods and services tax registration are as follows:

One of the key advantages of registering under GST is the ability to claim input tax credit (ITC). This allows the businesses to reduce their tax liability by offsetting the GST paid on purchases and business-related expenses (excluding personal expenses) against the GST collected on sales. For instance, if a business pays Rs 15000 as G S T on purchases and collects Rs. 20000 as GST on sales, it can claim Rs. 15000 as input tax credit. As a result, the business will only need to pay the remaining Rs. 5000 to the Union government.

When a business is registered under the GST system, their credibility is enhanced. Registering under Good and Service Tax showcases that the business complies with national tax laws. This can build trust and confidence in customers, suppliers and stakeholders. Small businesses wanting to establish a good reputation in the market can greatly benefit from this.

Good and Service Tax registration makes transactions simpler with other business entities. Many B2B customers choose to deal with vendors who are GST-registered to avail themselves of ITC.

It is crucial for businesses involved in interstate trade to ensure compliance with interstate GST regulations. Hence, businesses with Goods and Services Tax registration can easily expand operations beyond state borders without facing legal challenges or complications.

Many e-commerce platforms make it mandatory for sellers to be GST-registered. Thus, businesses can opt for voluntary registration under GST systems so they can list their products on famous e-commerce websites and reach a wider audience to increase their revenue.

For registering under the Goods & Services Tax, the following individuals and entities are eligible:

Businesses whose annual turnover is Rs. 40 lakhs or more for goods, and Rs. 20 lakhs or more for services.

The person making inter-state supplies

Casual taxable person

A taxable person who is a non-resident

The agent of the supplier

Taxpayers paying tax under the Reverse charge mechanism

E-commerce aggregator or operator

Person supplying online information from a place outside of India to a person inside India.

The documents required for registration under Good & Service Tax regime depends on the corporate structure of the business entity:

The following documents are required by sole proprietorship to get registration under GST regime:

Details of Bank account

PAN card of the proprietor

Proprietor’s address proof

Photographs of Proprietor

Proprietor’s Aadhaar card

Proofs for the Place of Business and additional place of business

The following documents are required by LLPs to get GST-registered:

PAN Card of LLP

LLP Agreement

Certificate of Incorporation

Address Proof of LLP’s registered office

Partners’ names and address proof

Bank account details

Letter of Authorization authorizing the signatory.

For a private/public limited company, the following documents are required to get registered under G.S.T system:

Certificate of Incorporation

PAN Card of Company

Memorandum of Association (MoA)

Articles of Association (AoAs)

Resolution signed by board members

Identity and address proof of directors

Signatory’s PAN card

Signatory's appointment proof

Signatory’s Aadhaar card

Bank details

Letter of Authorization authorizing the signatory.

The registration process for Goods and Services Tax takes place in the following manner:

Before filing an application for the Good and Service Tax regime, you must ensure you have all the required documents. The documents differ for different entities. Private companies require certain documents, such as articles of association, memorandum of association, certificate of incorporation, etc.

In case of an LLP, you will need LLP agreement, address proof of LLP, partners’ names and address proof, etc.. For sole proprietorship, you will need the proprietor's PAN card, bank details, photographs, aadhar card, etc.

The process to get GST-registered can be completed online. You must file an application on the official GST portal with all the necessary details. Make sure all the details are filled in correctly. Along with the online application, you will also need to attach all the necessary documents.

Once you’ve filed the application, Application Reference Number (ARN) will be sent to the registered email and mobile. By entering the ARN number, you can check the status of your application on the GST portal.

Upon application processing and verification by GST authorities, your business will become GST-registered. Upon obtaining registration under GST, your business will be issued a new GST registration number known as GSTIN. After securing GSTIN, you can operate your business smoothly with enhanced credibility and ensure compliance with GST regulations.

At Registrationwala, our GST Consultants can assist you through the GST registration process by providing you with the following services:

Document drafting

Application filing

Tracking the application status

Completing the registration process by securing GSTIN

Therefore, get in touch with us as soon as possible if you want to get your business GST-registered in minimum time. We’ll ensure a smooth and hassle-free experience for you!

Q1. Who must mandatorily register under the GST system?

A. A business whose annual turnover limit exceeds Rs. 40 Lakh for goods or Rs. 20 Lakh for services must mandatorily apply for GST registration.

Q2. Can a business voluntarily opt for registration under the GST system?

A. Yes, a business can voluntarily opt for registering under the Goods & Services Tax system. Doing so will help it to enhance credibility among customers. Many e-commerce platforms require sellers to have a GST number before allowing them to sell their products online.

Q3. Do sole proprietorships require Goods and Services Tax registration?

A. Yes, sole proprietorships require this registration if it crosses specific turnover thresholds or engages in interstate trade.

Q4. What is GSTIN?

A. GSTIN is a 15-digit Goods and Services Tax identification number that is unique to every GST-registered business operating in India.

Q5. Who is exempt from GST registration?

A. Businesses and individuals whose annual turnover is less than Rs. 40 lakhs for goods and Rs. 20 lakhs for services are exempt from Goods and Services Tax registration.

Q6. What is the penalty for not registering under GST?

A. If a business must mandatorily register under the GST system but fails to do so, it will have to pay a penalty. The penalty is 100% of the tax due or Rs. 10,000, whichever is higher.

Q7. What is the validity of GST registration certificate?

A. The GST registration certificate remains valid for an indefinite period as long as the business continues to conduct business operations and files GST returns regularly.

Q8. How to calculate GST online?

A. To calculate GST online, you can use Registrationwala’s GST calculator.

Q9. What is GST registration fees?

A. The GST registration cost or fees depends on various factors such as business entity type, annual turnover, consultation and application filing fees.

Q10. Which form do I need to file GST return?

A. To file GST return, you need GSTR 9 form.

★ ★ ★ ★ ★

I had a good time working with Registrationwala. Good team. I would recommend their services to others.

★ ★ ★ ★ ★

It was extremely great service of Registrationwala consulting firm, and this firm is providing the best services and worry about the client's required services along the client's satisfaction.

★ ★ ★ ★ ★

Superb Experince! Within no time the trademark registration was on.Highly professional team. I am very much Impressed with the prompt response and efficiency.Thank you.

★ ★ ★ ★ ★

We had taken ISP license from registration wala and the supporting person is very helpful to taken that license his communication and his work is satisfactory and thanks for those services

★ ★ ★ ★ ★

I sincerely appreciate your prompt support in helping me get the access license so quickly. Your professionalism and efficiency are truly commendable. Thank you for going above and beyond to assist me. Keep up the great work!

★ ★ ★ ★ ★

I very much appreciate the fact that you guys possess tremendous knowhow of private limited company incorporation. You have exhibited professional and respectful manner towards my query and I would seriously recommend you guys to all the folks looking for outstanding business services.

★ ★ ★ ★ ★

Thanks to their support, I got my trademark successfully. I highly recommend their services for anyone needing help with their intellectual property. The person assigned to me was very cooperative and helpful.

★ ★ ★ ★ ★

Thanks to their support ragistrationwala team, I got my IP-1 license successfully and special thanks to Miss.Kanishka for your great and timing support !!!!!! I have archived my goal one step forward... Thanks for the entire team....

★ ★ ★ ★ ★

Really helped a lot in getting my both VNO licenses. Great experience working with the team and very humble team, thanks for providing the vno license on time.

★ ★ ★ ★ ★

I had a good time working with Registrationwala. Good team. I would recommend their services to others.

★ ★ ★ ★ ★

It was extremely great service of Registrationwala consulting firm, and this firm is providing the best services and worry about the client's required services along the client's satisfaction.

★ ★ ★ ★ ★

Superb Experince! Within no time the trademark registration was on.Highly professional team. I am very much Impressed with the prompt response and efficiency.Thank you.

★ ★ ★ ★ ★

We had taken ISP license from registration wala and the supporting person is very helpful to taken that license his communication and his work is satisfactory and thanks for those services

★ ★ ★ ★ ★

I sincerely appreciate your prompt support in helping me get the access license so quickly. Your professionalism and efficiency are truly commendable. Thank you for going above and beyond to assist me. Keep up the great work!

★ ★ ★ ★ ★

I very much appreciate the fact that you guys possess tremendous knowhow of private limited company incorporation. You have exhibited professional and respectful manner towards my query and I would seriously recommend you guys to all the folks looking for outstanding business services.

★ ★ ★ ★ ★

Thanks to their support, I got my trademark successfully. I highly recommend their services for anyone needing help with their intellectual property. The person assigned to me was very cooperative and helpful.

★ ★ ★ ★ ★

Thanks to their support ragistrationwala team, I got my IP-1 license successfully and special thanks to Miss.Kanishka for your great and timing support !!!!!! I have archived my goal one step forward... Thanks for the entire team....

★ ★ ★ ★ ★

Really helped a lot in getting my both VNO licenses. Great experience working with the team and very humble team, thanks for providing the vno license on time.

★ ★ ★ ★ ★

I had a good time working with Registrationwala. Good team. I would recommend their services to others.