Get a Quote

Get a Quote and Find Services to Fit Your Needs 50000+ Satisfied Clients

5000+ Licenses & Registration

15 Branches across India

75 Years + Combined experience

Satisfied Clients

Services

Years Combined Experience

Get Started!

FEMA is a set of regulations that allows the Reserve Bank of India to pass different regulations and enable the government of India to pass rules related to foreign exchange related to the foreign trade policy of India.

The head of FEMA is known as Enforcement Directorate, and its head is the Director of New Delhi as the headquarters are located in Delhi. FEMA is applicable all over India and similarly applicable to other branches and agencies outside India

The Foreign Exchange Management Act was passed in 1999 which replaced the FERA Act in 2000 because it was not complying with the post-liberalization policies of the Government.

Foreign Exchange Regulation Act was passed in 1973 to regulate the financial transactions related to foreign exchange and securities. It was launched when the foreign reserves of the company were very low. As compared to FERA, the FEMA Act made all criminal offenses civil offenses.

.jpg)

Our FEMA consultants have carved their own unique space in the field of FEMA Consultancy, and as such, we provide our vast and focused outlook in the following FEMA advisory services that we provide:

While dealing in foreign exchange, the RBI issued some regulations which the concerned person or a firm must adhere to to ensure their businesses' smooth functioning. Some of them are listed below, so read carefully.

Explanation.—For this clause, "financial transaction" means making any payment to, or for the credit of any person, or receiving any payment for, by order or on behalf of any person, or drawing, issuing, or negotiating any bill of exchange or promissory note, or transferring any security or acknowledging any debt.

No person resident in India must acquire, hold, own, possess, or transfer any foreign exchange, foreign security, or immovable property outside India.

Any person can sell or draw foreign exchange to or from an authorized person if such sale or drawal is a current account transaction. But the Central Government can, in the public interest and consultation with the Reserve Bank, impose reasonable restrictions for current account transactions as prescribed.

Note: The Reserve Bank must not impose any restriction on the withdrawal of foreign exchange for payments due on amortization of loans or non-depreciation of direct investments in the course of business.

Transfer or issue of any foreign security by the following:

Any borrowing or lending in foreign exchange in any form or by any name called.

Any borrowing or lending in rupees in any form or by any name called between a person resident in India and a person resident outside India.

Suppose any amount of foreign exchange is due or has accrued to any person resident in India. In that case, such a person must take all reasonable steps to realize and repatriate such foreign exchange to India within the specified period specified by the Reserve Bank.

6.jpg)

To provide the most robust FEMA legal advisory services, we will need from you:

4.jpg)

The process of getting our FEMA legal advisory services is as follows:

Our Foreign Exchange Management Act experts will assist you in the following steps:

Thus, if you're in the market for experienced, professional, and ethical FEMA consultants, you know Registrationwala will always help your back. Reach out to us with your requirements, and let our experts handle the rest. You can always connect with us for FEMA consultants in Delhi or FEMA consultants in Mumbai.

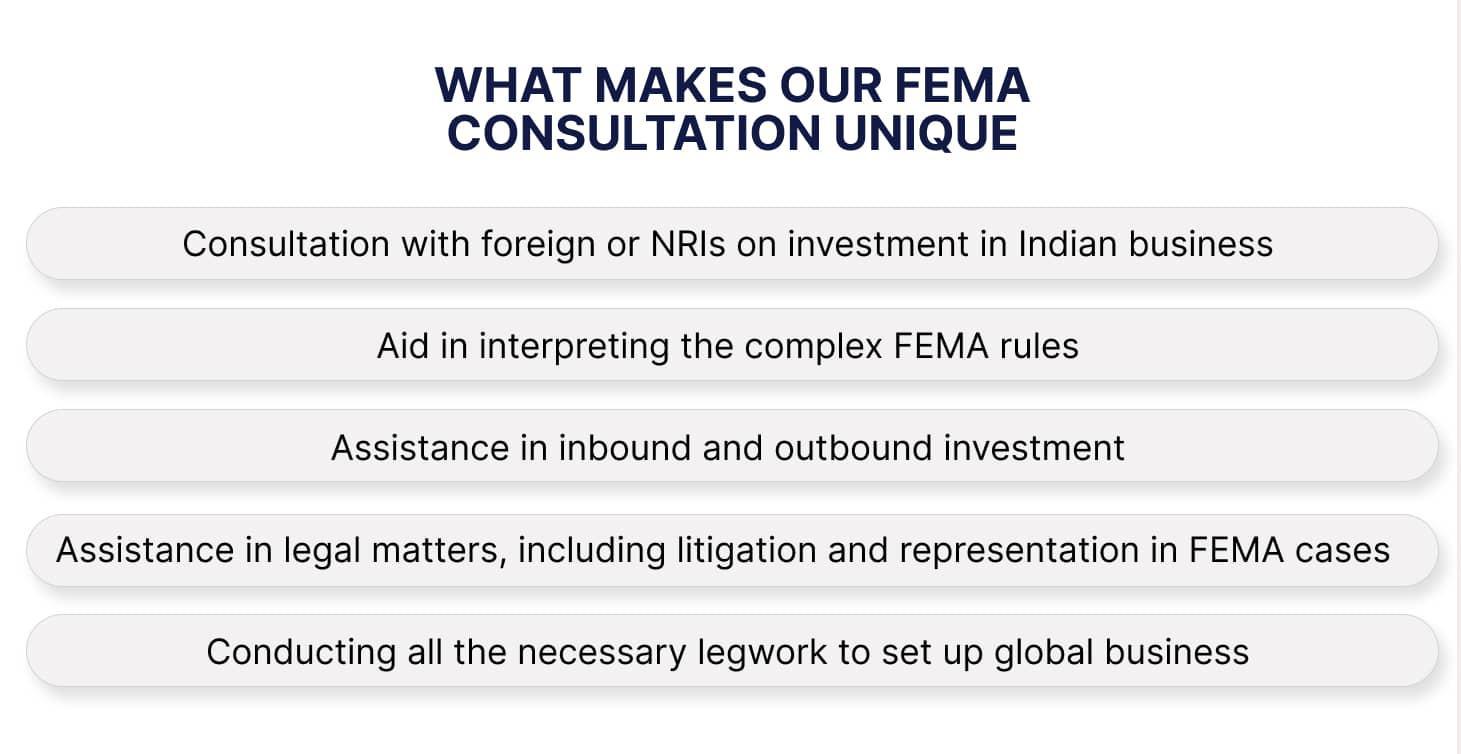

What makes our FEMA consultation unique

Registrationwala is one of India's leading FEMA consultancy specializing in-depth knowledge of Foreign Exchange Management Laws. We understand that the FEMA rules and Regulations can be quite confusing. And at times, the volatile nature of the rules can create more issues because of rapid changes.

To keep up with those changes, and to help your as per FEMA Act, our active FEMA Consultants in Delhi and Mumbai come together to provide help with a plethora of matters, including:

So, what makes us the partner of choice when it comes to FEMA consultancy:

Experience: We possess a vast industry experience in the field that's the FEMA. Our experts have absorbed the entirety of the Act's literature. With that, we provide only the best solutions to our clients.

Professionalism: The cumbersome and complex Act that's FEMA requires the FEMA consultants to be patient, analytical, and, most importantly, professional. We never leave you midway in our services. In fact, we make sure that you only get the best results.

Ethical services: When matters concern foreign monetary exchange, it's easy to attract towards cutting corners and do the bare minimum. As ethical FEMA consultants, we never only provide your bare minimum, but rather, we go beyond.

Frequently Asked Questions – FAQs FEMA Consultant

Q1. What does FEMA stand for?

A. The FEMA's full form is Foreign Exchange Management Act.

Q2. When did FEMA Act came into being?

A. Foreign Exchange Management Act or FEMA Act came into being in 1999.

Q3. What is the goal of the FEMA Act?

A. The goal of the FEMA Act 1999 is to promote external payments and trades across borders.

Q.4 What is the relation between FERA and FEMA?

The difference between FEMA and FERA are as follows:

|

FERA |

FEMA |

|

Launched in 1973 by the Parliament of India. |

Launched in 1999 to replace FEMA. |

|

FERA has 81 sections. |

FEMA has 49 sections. |

|

FERA rules regulated foreign payments. |

It focused on the foreign exchange reserves of India. Includes foreign payments and trade. |

|

The objective is the conservation of Foreign Exchange. |

The objective is the Management of Foreign Exchange. |

Q.5 What is the penalty for violation of the FEMA Act?

If any person violates the rules and provisions, notification, or any order of FEMA, the individual is liable to pay a penalty up to thrice of the sum involved in the contravention or a maximum of Rs. 2 lakhs. If the violation is on a continuous basis, then the person is liable to pay Rs. 5,000 for each day.

Q.6 What is the FEMA Scheme?

To encourage external payments and foreign trade the Central Government of India has introduced the Foreign Exchange Management Act (FEMA). It was launched to fill the loopholes and drawbacks of FERA. FEMA was basically introduced to de-regularise and maintain a liberal economy in India.

★ ★ ★ ★ ★

I very much appreciate the fact that you guys possess tremendous knowhow of private limited company incorporation. You have exhibited professional and respectful manner towards my query and I would seriously recommend you guys to all the folks looking for outstanding business services.

★ ★ ★ ★ ★

Thanks to their support, I got my trademark successfully. I highly recommend their services for anyone needing help with their intellectual property. The person assigned to me was very cooperative and helpful.

★ ★ ★ ★ ★

Thanks to their support ragistrationwala team, I got my IP-1 license successfully and special thanks to Miss.Kanishka for your great and timing support !!!!!! I have archived my goal one step forward... Thanks for the entire team....

★ ★ ★ ★ ★

Really helped a lot in getting my both VNO licenses. Great experience working with the team and very humble team, thanks for providing the vno license on time.

★ ★ ★ ★ ★

I had a good time working with Registrationwala. Good team. I would recommend their services to others.

★ ★ ★ ★ ★

It was extremely great service of Registrationwala consulting firm, and this firm is providing the best services and worry about the client's required services along the client's satisfaction.

★ ★ ★ ★ ★

Superb Experince! Within no time the trademark registration was on.Highly professional team. I am very much Impressed with the prompt response and efficiency.Thank you.

★ ★ ★ ★ ★

We had taken ISP license from registration wala and the supporting person is very helpful to taken that license his communication and his work is satisfactory and thanks for those services

★ ★ ★ ★ ★

I sincerely appreciate your prompt support in helping me get the access license so quickly. Your professionalism and efficiency are truly commendable. Thank you for going above and beyond to assist me. Keep up the great work!