Get a Quote

Get a Quote and Find Services to Fit Your Needs 50000+ Satisfied Clients

5000+ Licenses & Registration

15 Branches across India

75 Years + Combined experience

As one of the giants in the Middle East, Dubai City offers many business opportunities to foreign investors. Because of that, such foreign establishments set up different kinds of businesses in Dubai. It has expanded its region's opportunities for constant trade and business development. Despite being an Oil-rich country, Dubai has diversified its economy from oil production, which now only accounts for less than 1% of its economy.

With rampant diversification and economic growth in the Middle Eastern City, the Dubian Authority has issued nearly 46000+ business licenses in the first half of the fiscal year 2022. This figure is significantly higher than the issued licenses in the previous year, showing a quarterly growth in Company Registrations in Dubai. You can account for the growth of Businesses in the economy to the following:

From the aforementioned points, you can say that Dubai is MECCA for starting new businesses. Therefore, Setting up a Business in Dubai can benefit business owners and entrepreneurs, especially foreign nationals.

Types of Registration of Company in Dubai

The following are the different types of dubai company registration:

Free Zone Companies

The free zone business setup Dubai is different from mainland companies because these are situated in the Free Trade Zones where different laws implement related to taxation, customs, ownership, etc. In the free zone, the owner has complete ownership and their entrepreneurs can establish two types of Dubai companies; Free zone establishment and Free zone company.

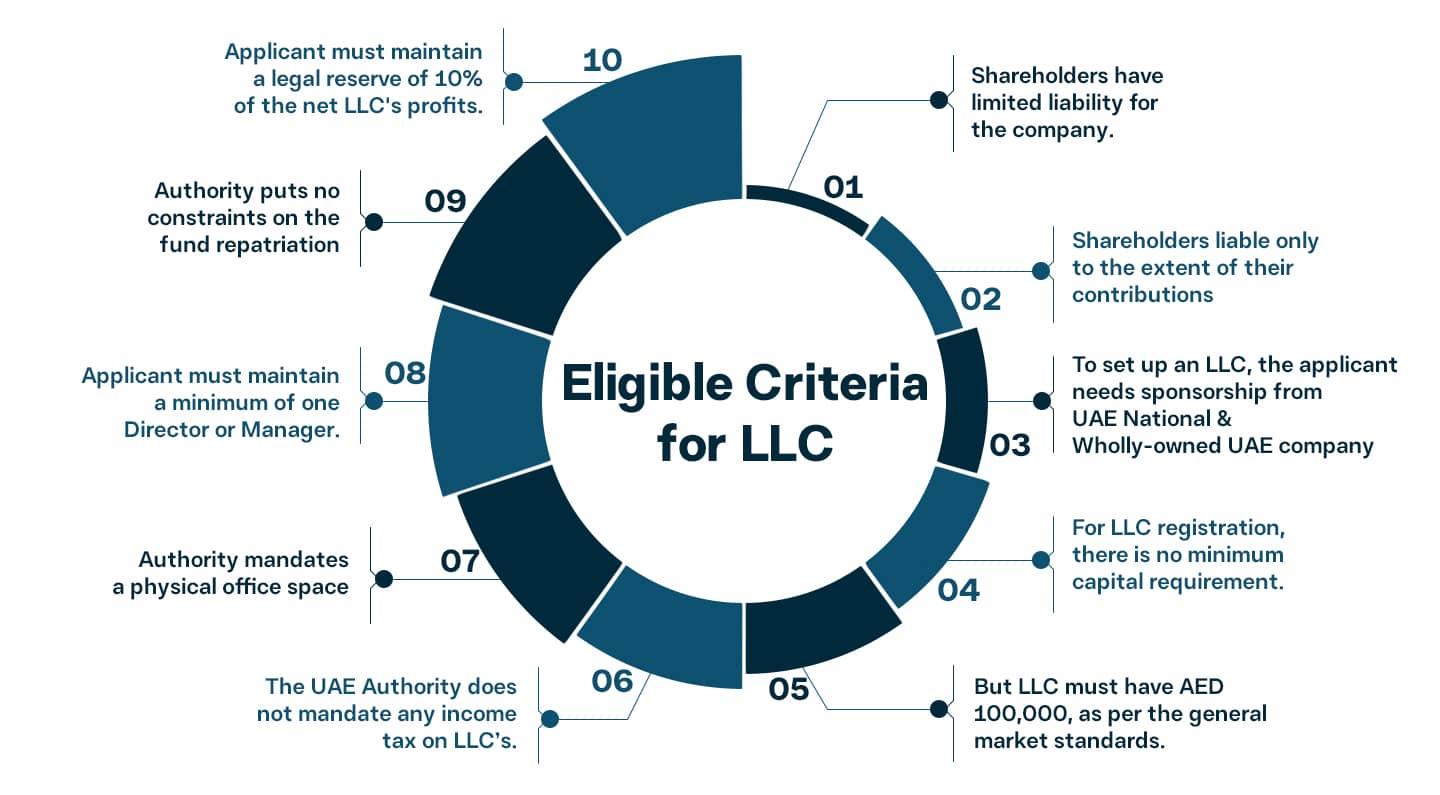

To form an LLP in Dubai, a minimum of 2 shareholders and a maximum of 50 shareholders are required. The liability of the members is required for their capital contribution. Except for banking, insurance, or investment, an LLC Dubai company can carry any kind of business.

Onshore Company

An onshore company is set up in the mainland of Dubai which is managed by the Directors. Recently the Dubai government has notified that now foreign entrepreneurs also have 100% ownership and complete authority to participate in business activities. But first was limited to 49% ownership for foreign investors.

Offshore Company

A business that is run outside the jurisdiction of a company is known as an offshore company. An offshore company formation in Dubai is completely done by foreign investors who have 100% ownership of the business.

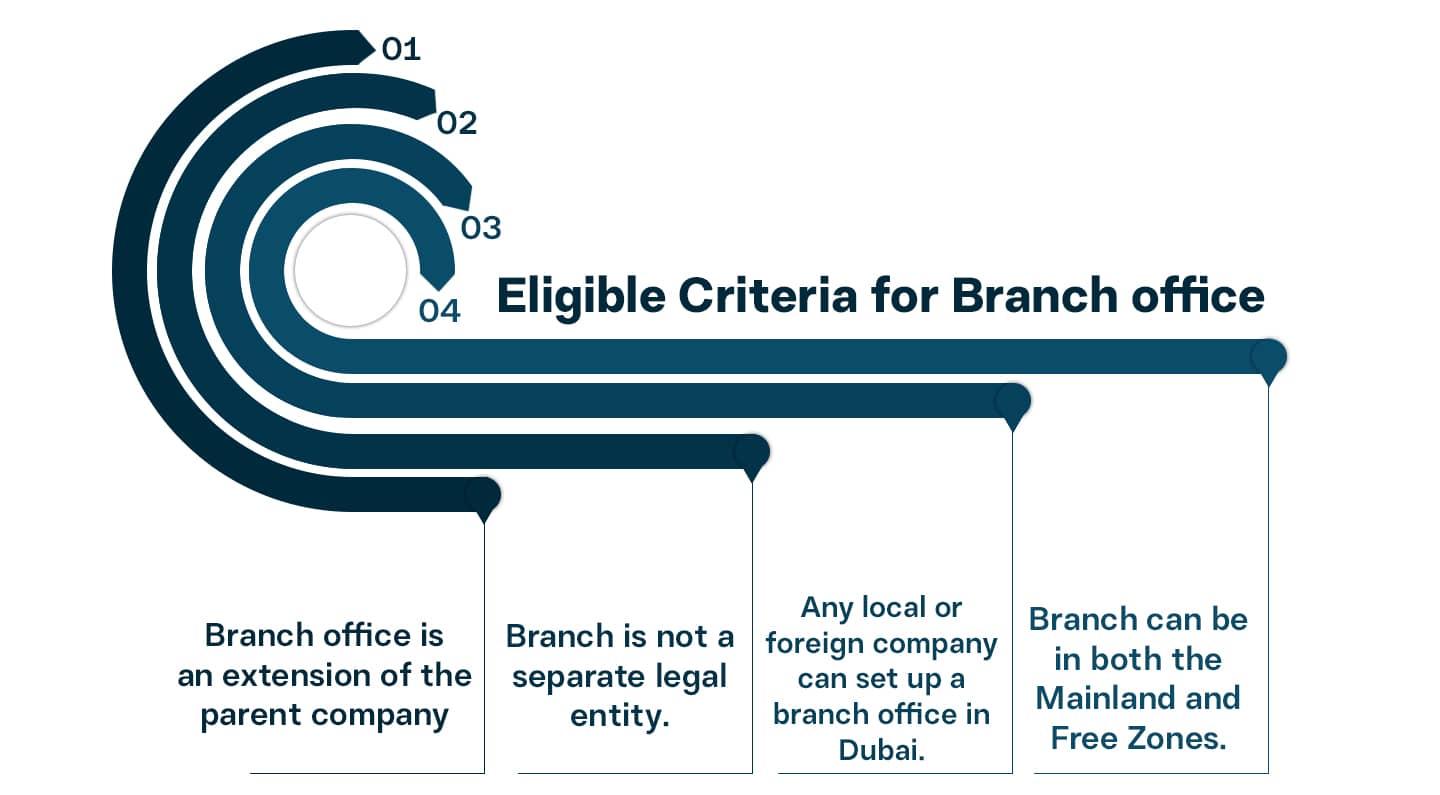

Branch Office

It is a part of the main branch of any company. Branch offices can be set up on the mainland or in the free trade zone. This is the best way to expand the business in the local market and reach the local customer base.

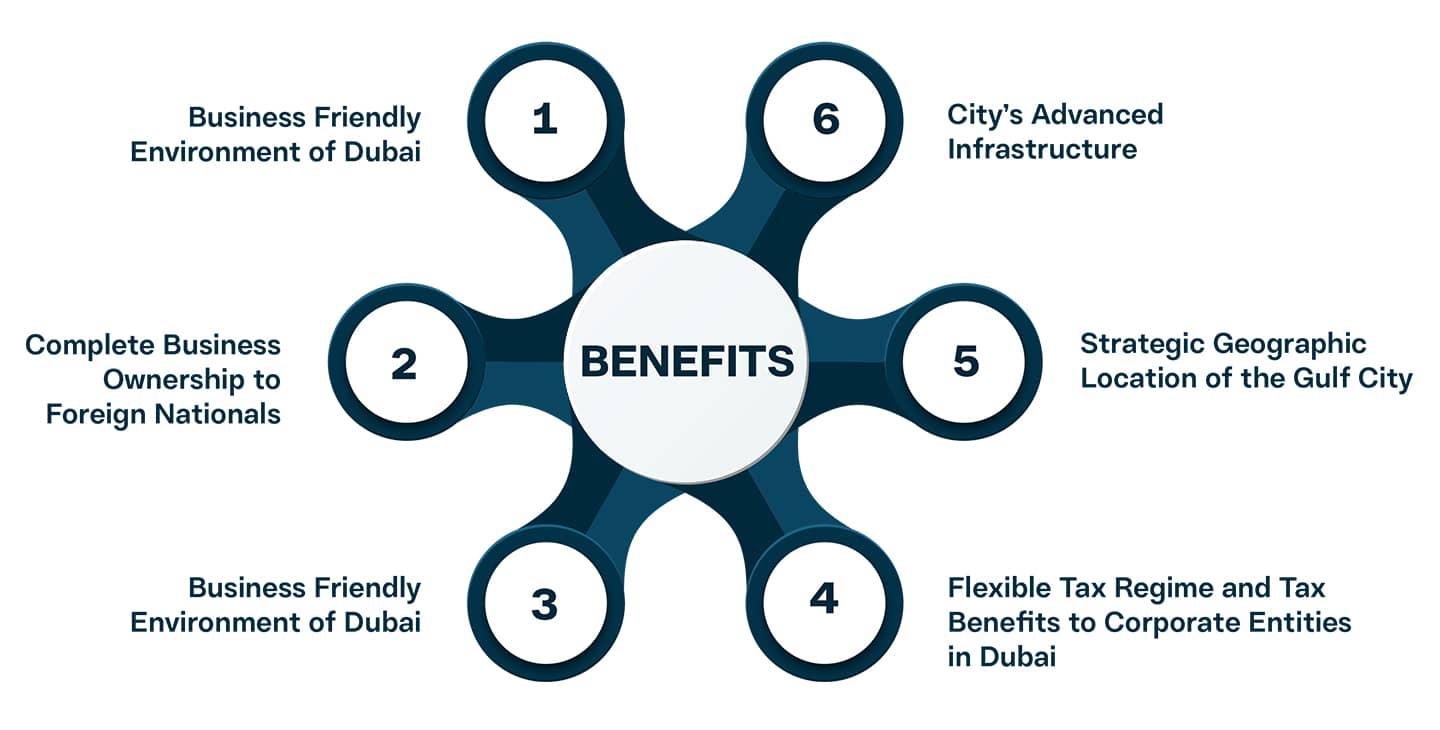

The following paragraphs have detailed some of the benefits of company formation in Dubai.

We have enlisted some of the major benefits of registering your Firm as a Company in Dubai. So let us look at them one by one.

The UAE Government has rapidly adopted technology for business incorporation procedures in Dubai. It has made the company registration process very easy in Dubai. An applicant can easily complete the procedure in a few days. The incorporation requires almost no paperwork, and the online steps are easy, even for the novice.

The Emirate Authority introduced certain amendments in the Commercial Companies Law of UAE last year, allowing foreign investors to have complete ownership of their businesses. This is a major step forward in inviting more Foreign Investors into the Gulf City. Foreign investors and establishments conduct more than half of Dubai's total economic activities.

The investors from Foreign Lands can set up their companies in the Dubai Mainland Area which consists of Free Zones. Free Zones are the regions where doing Business allows a 100% ownership of the Business to the Foreign National and complete profit claim with provisions of repatriation and capital invested without any tax cuts. Dubai provides more than 30 Free Zones for budding entrepreuners as well as investors from all over the world. The investors can further collaborate with the other players in the same economic sector.

One of the major benefits of registering your Business as a company in Dubai is that the company need not pay any taxes. The Authority levies no corporate or personal taxes in Dubai. Although, a few companies are liable to pay the VAT (GCC) at 5% on specific business activities, as applicable by the Dubai Corporate Laws.

Dubai City has a strategically advantageous location as it sits on the crossroads connecting from all directions of the sea and land. Also, the City is one of the biggest re-export hubs in the world. With one of the world's most active and busiest airports/seaports, Dubai also boasts one of the most efficient logistics infrastructures. The UAE government has invested greatly in making Dubai one of the world's greatest tourist hubs.

Dubai has one of the most developed and advanced infrastructures in all of Central Asia. Boasting of possessing one of the world's best infrastructures, Dubai’s logistical capabilities are ever-evolving. It offers excellent public transportation, telecommunication facilities, and public terminals. The Dubai Expo 2020 showcased significant advancements the City has made in its overall infrastructure.

Who undertakes Company Registration activities in Dubai?

The regulatory Authority for Company Registration in Dubai is the Department of Economic Development (DED). Businesses must file their new applications for company registrations with the DED. It is where the companies have to file their compliances and registration applications.

Connect with our Dubai company incorporation experts to fulfill your dream of owning a business in UAE.

A business aspirant for Company Registration in Dubai must choose a relevant business structure before applying for the business license. Following are the business structures availed by the RoC in Dubai which the entrepreneurs can adopt:

Free Zone Companies

The Free Zone companies in Dubai are situated in a Free Zone.

There are special laws related to the following in the designated Free Zone:

Free Zones are distinct from mainland Dubai.

There are two kinds of companies that can be established in a Free Zone area:

Free Zone Company

Dual License Branch Office

.png)

Documents for Business Setup Services in Dubai

Every Company Registration applicant in Dubai must draft and compile the following documents to be submitted with the Company Registration application in Dubai. The listed documents further the candidature of the applicant for Company Registration in Dubai:

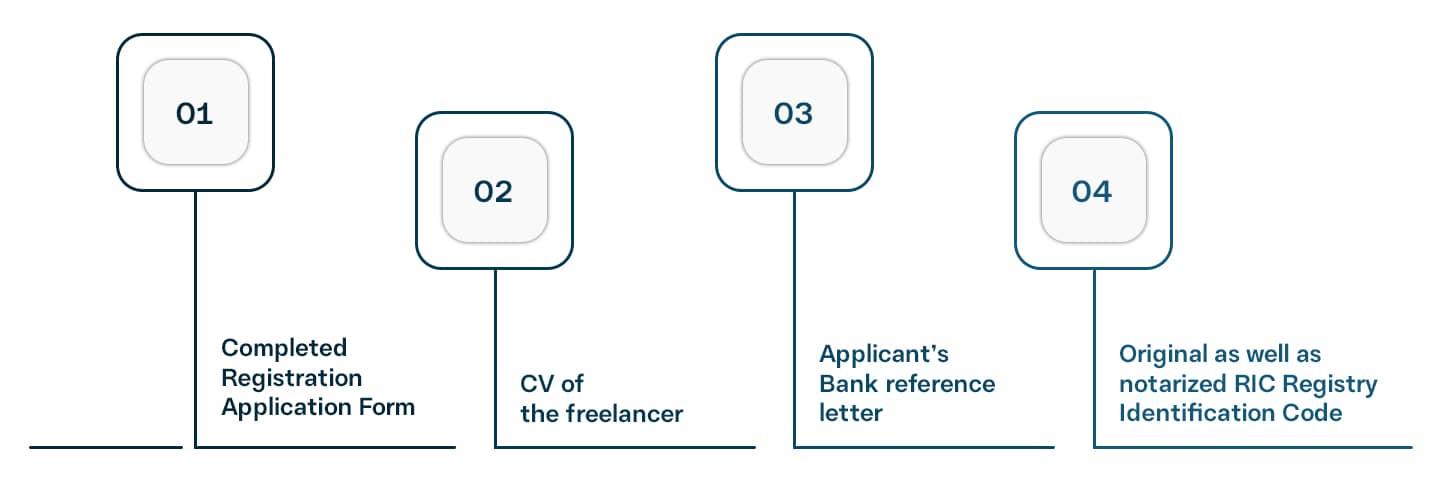

The Freelancers wanting to work as a Company in Dubai must submit the following documents:

Once the applicant obtains the initial approval, the registration and licensing fee payments are next. This fee depends on the commercial activity undertaken by the applicant company and the required license type. The applicant must submit the following documents required for registration:

.png)

The applicant must notarize as well as attest the following documents for company registration:

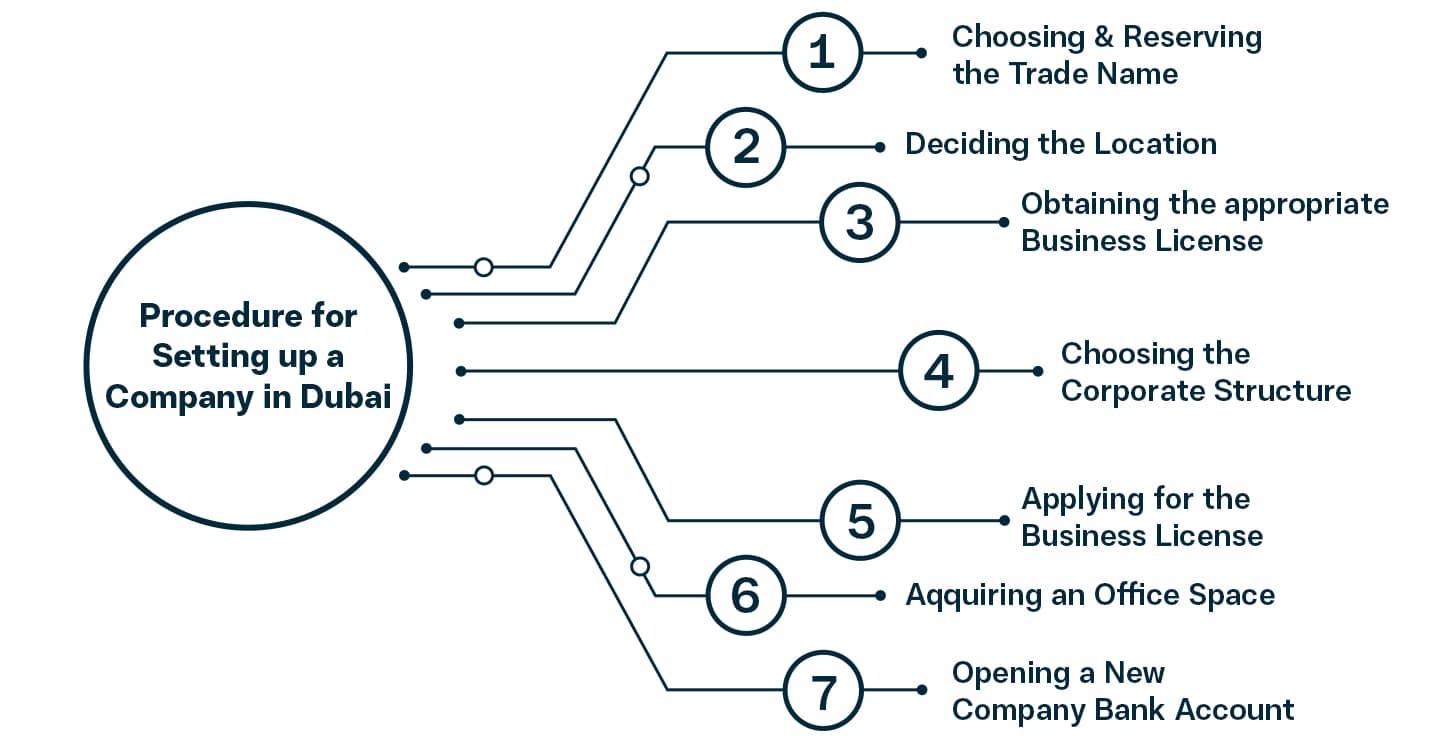

Procedure for Setting up a Company in Dubai

Every Company aspirant must follow the procedure detailed in the following for Company Registration in Dubai:

The applicant must decide the appropriate corporate structure for the proposed company. The applicant can adopt any of the following structures:

There are a number of factors on which selecting a suitable business structure depends, such as:

The next step is reserving a name under which the company will undertake its business activities. Firstly, the applicant must confirm the chosen name's availability with the UAE’s Department of Economic Affairs. In the case of a Free Zone area, the concerned Free Zone Authority must be consulted. The applicant must ensure that the chosen name is in accordance with the law of the land. The name must not be taken by some other registered company.

After reserving the name with the Authority, the applicant must apply for a business license per the business activities the proposed company wishes to undertake in the Gulf City. The Company license is a legal document that authorizes its holders to conduct their business operations as mentioned in the licensing certificate.

The Registrar of Companies issues the following business licenses in Dubai:

The commercial license is issued to those business entities wishing to engage in commodity’s or service’s trading.

The Industrial license is issued to those business entities wishing to engage in the activities of production as well as industrial operations.

The professional license is issued to those business entities wishing to offer professional services, technicians, or artisans.

Your choice of office location can be a game-changer for your business profits. Therefore, you must choose your office space wisely. The entrepreneur can either buy the office space or lease the land. In Dubai, the office space selection depends on the following:

Different Free Zones in Dubai offer different office sizes ranging from 20-30 sq. to 2000 sq. m. and beyond. You must take your pick.

The respective laws of the jurisdictions govern the newly registered Companies at a designated place. Accordingly, new Companies must apply with the appropriate documents to obtain the required permits from the concerned Authorities in UAE, such as:

The required documentation depends on the following:

Once all the required approvals have been obtained from the UAE Authorities, the newly incorporated Company must register for and maintain a Corporate Bank Account under its tradename. This Account will be used for receiving as well as sending funds in furtherance of the company’s affairs.

Our Incorporation experts provide you end to end company formation services in Dubai by assisting you in the following manner:

We ensure that your company incorporation services requirements for Dubai are always on time. Our professionals understand the intricacies of company incorporation procedures in Dubai. Thus, we have expedited the process – helping you incorporate your Company at an affordable price.

So, reach out to our Incorporation Experts and realize your dream of Business Setup in Dubai.

A. Yes, you can set up a company in Dubai with 100% ownership and repatriation benefits. Also, you don’t need any local sponsor to set up a business in Dubai.

A. Yes, you can register a company in the free zone of Dubai, UAE without being physically present in Dubai. Anyone from any country can set up a business in Dubai.

A. Process of registration is not tough to complete, especially in the free zone but for the mainland. It is advisable to consult with a professional. Reach out to Registrationwala.

A. To establish a business in Dubai, UAE, it takes around 4 to 5 working days. However, in the case of a free zone company registration, it can take 3-5 days and for the mainland, ten days are required to register a business.

A. Registrationwala offers one of the best mainland business setup services in Dubai. Connect with the Incorporation experts at Registrationwala. Our seasoned experts can guide you throughout the registration procedure.

A. The registration license will take about one week to be renewed and you have to send the following documents along with the renewal application:

A. As per the new amendment of UAE, the new investors or businesses can set up a business with 100% ownership. To read more about this, check the article here.

★ ★ ★ ★ ★

I had a good time working with Registrationwala. Good team. I would recommend their services to others.

★ ★ ★ ★ ★

It was extremely great service of Registrationwala consulting firm, and this firm is providing the best services and worry about the client's required services along the client's satisfaction.

★ ★ ★ ★ ★

Superb Experince! Within no time the trademark registration was on.Highly professional team. I am very much Impressed with the prompt response and efficiency.Thank you.

★ ★ ★ ★ ★

We had taken ISP license from registration wala and the supporting person is very helpful to taken that license his communication and his work is satisfactory and thanks for those services

★ ★ ★ ★ ★

I sincerely appreciate your prompt support in helping me get the access license so quickly. Your professionalism and efficiency are truly commendable. Thank you for going above and beyond to assist me. Keep up the great work!

★ ★ ★ ★ ★

I very much appreciate the fact that you guys possess tremendous knowhow of private limited company incorporation. You have exhibited professional and respectful manner towards my query and I would seriously recommend you guys to all the folks looking for outstanding business services.

★ ★ ★ ★ ★

Thanks to their support, I got my trademark successfully. I highly recommend their services for anyone needing help with their intellectual property. The person assigned to me was very cooperative and helpful.

★ ★ ★ ★ ★

Thanks to their support ragistrationwala team, I got my IP-1 license successfully and special thanks to Miss.Kanishka for your great and timing support !!!!!! I have archived my goal one step forward... Thanks for the entire team....

★ ★ ★ ★ ★

Really helped a lot in getting my both VNO licenses. Great experience working with the team and very humble team, thanks for providing the vno license on time.

★ ★ ★ ★ ★

I had a good time working with Registrationwala. Good team. I would recommend their services to others.

★ ★ ★ ★ ★

It was extremely great service of Registrationwala consulting firm, and this firm is providing the best services and worry about the client's required services along the client's satisfaction.

★ ★ ★ ★ ★

Superb Experince! Within no time the trademark registration was on.Highly professional team. I am very much Impressed with the prompt response and efficiency.Thank you.

★ ★ ★ ★ ★

We had taken ISP license from registration wala and the supporting person is very helpful to taken that license his communication and his work is satisfactory and thanks for those services

★ ★ ★ ★ ★

I sincerely appreciate your prompt support in helping me get the access license so quickly. Your professionalism and efficiency are truly commendable. Thank you for going above and beyond to assist me. Keep up the great work!

★ ★ ★ ★ ★

I very much appreciate the fact that you guys possess tremendous knowhow of private limited company incorporation. You have exhibited professional and respectful manner towards my query and I would seriously recommend you guys to all the folks looking for outstanding business services.

★ ★ ★ ★ ★

Thanks to their support, I got my trademark successfully. I highly recommend their services for anyone needing help with their intellectual property. The person assigned to me was very cooperative and helpful.

★ ★ ★ ★ ★

Thanks to their support ragistrationwala team, I got my IP-1 license successfully and special thanks to Miss.Kanishka for your great and timing support !!!!!! I have archived my goal one step forward... Thanks for the entire team....

★ ★ ★ ★ ★

Really helped a lot in getting my both VNO licenses. Great experience working with the team and very humble team, thanks for providing the vno license on time.

★ ★ ★ ★ ★

I had a good time working with Registrationwala. Good team. I would recommend their services to others.