How to Download GST Certificate

- January 25, 2025

- Registrationwala

- Home

- /

- Knowledge Base

- /

- Taxation

- /

- Income Tax

- /

- How to Download GST Certificate

How to Download GST Certificate

Last Updated on November 8, 2025

GST certificate is a document issued by the Government of India to a business entity that has registered for GST. This certificate shows that a business has obtained GST registration and contains essential information such as GST number, name of business and address of business.

Once a business has obtained a GST certificate, it can begin collecting taxes from customers on the government’s behalf. We shall explain how to download GST certificate in this blog post.

Importance of the GST Certification in India

GST certificate is an important document that legitimizes a business as an authorized supplier of goods and/or services. Essential business details are contained in this certificate, including GSTIN, business name and address.

To show compliance with rules and regulations of the Government of India, securing a GST registration certificate is mandatory for business entities whose annual turnover crosses the Rs. 40 threshold limit in a financial year.

For certain special category states (Arunachal Pradesh, Assam, Meghalaya, Manipur, Mizoram, Nagaland, Sikkim, Tripura, Himachal Pradesh and Uttarakhand), the threshold limit is Rs. 20 lakhs.

Prerequisites for GST Reg Certificate Download

The following prerequisites must be fulfilled for GST certificate download:

-

The applicant needs to secure GST Registration and have a valid GSTIN beforehand to be able to fulfill the steps involved in the GST Certificate download process.

-

They must have a registered account on the official GST portal, and access to the login credentials.

-

They must verify their GST registration profile is complete and has accurate business details. If the business details are incorrect, the GST certificate will reflect incorrect details as well.

-

The GST registration must be active, and should have complied with filing returns (if applicable).

-

The GST account should not be suspended. If it is, then you won’t be able to partake in the GST certificate download process.

Process for GST Certificate Download Online

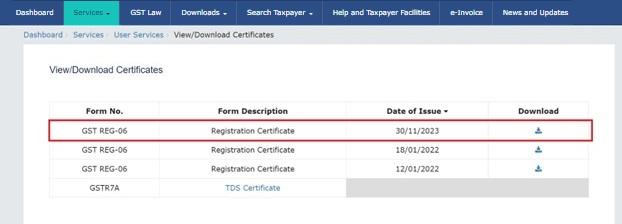

Every successfully registered business entity under GST receives a GST certificate in Form GST REG-06. Follow these steps to download GST certificate in Form GST REG-06:

Step 1: Visit the official website of GST.

Step 2: Click on the ‘Login’ option on the homepage.

Step 3: Enter your username and password. Now, click on ‘login’.

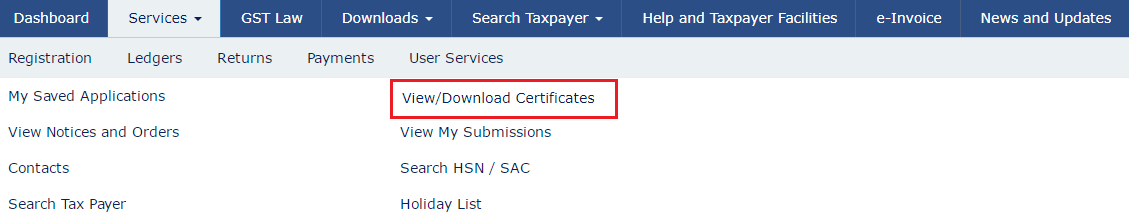

Step 4: Once you have logged in successfully, go to ‘Services’ > ‘User Services’ > ‘View/ Download Certificate.

Step 5: Now, click on the ‘Download’ icon.

Step 6: Thereafter, the GST certificate online download will be done in PDF document. You can take a printout of the same.

Validity Period of GST Certificate

The GST certificate issued to regular taxpayers remains valid for an indefinite period unless cancelled by GST authority or willingly surrendered.

Which Businesses must download GST Certificate?

The following business entities must mandatorily fulfill GST certificate download process to obtain GST certificate:

-

Indian companies, including producers, suppliers, dealers, and online retailers.

-

Businesses that make taxable supplies and are registered for the Goods and Services Tax must have the certificate.

-

Businesses that make taxable supplies and are registered for the composition scheme must have it.

-

Businesses that manufacture exempt supplies must have this certificate to take advantage of the many exemptions the Government of India offers.

Conclusion

All the businesses that require GST registration must obtain a GST certificate. The Government of India issues the GST registration certificate in Form GST REG-06. For GST certificate download online, you must have a registered account on the official GST portal and follow the instructions in this blog post. After completing all the required steps to download GST certificate, you will receive it in PDF format of which you can take a printout.

Businesses must register under GST before they can download the GST certificate. If you need assistance in securing GST registration, you may reach out to our GST registration team at Registrationwala. We would be happy to assist you!

Frequently Asked Questions (FAQs)

Q1. Where can I download the certificate for GST?

A. You can download it by visiting the official GST portal.

Q2. In which format does the GST e certificate get downloaded via GST portal?

A. It gets downloaded in the PDF format.

Q3. In which GST form is the GST registration certificate issued by the Government of India?

A. The Government of India issues the GST registration certificate in Form GST REG-06.

Q4. Can Registrationwala help me to obtain the GST e-certificate?

A. Yes, Registrationwala can help you to obtain the GST e-certificate.

- 8266 views