Cumulative Abnormal Return (CAR) : Understand its meaning, formula and calculation

- August 02, 2024

- Registrationwala

- Home

- /

- Knowledge Base

- /

- Regulatory License

- /

- Registration for Portfolio Manager License

- /

- Cumulative Abnormal Return (CAR) : Understand its meaning, formula and calculation

Cumulative Abnormal Return (CAR) : Understand its meaning, formula and calculation

Cumulative abnormal return is a commonly used term in the world of finance. However, many people do not know about its meaning. Basically, cumulative abnormal return is a type of financial metric. In this article, we’ll explain to you what a cumulative abnormal return is and how it is calculated.

What is Cumulative Abnormal Return?

Cumulative abnormal return, abbreviated as CAR, can be defined as a metric which is used to evaluate how well a stock or portfolio has performed in comparison to its expectations. CAR is the sum of all abnormal returns.

By using cumulative abnormal return, one can measure the impact lawsuits, buyouts and other events have on stock prices. It is also helpful for assessing how accurate asset pricing models are when it comes to predicting the expected performance.

Now, let’s check out how cumulative abnormal return calculation is done.

Must Read: What is Intraday Trading and Its Benefits ?

Cumulative Abnormal Return Calculation

As mentioned above, CAR is the sum of all the abnormal returns combined. Let’s understand how cumulative abnormal calculation is done using the cumulative abnormal return formula.

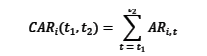

Cumulative Abnormal Return Formula

For a specific stock or portfolio, the CAR from time t1 to t2 is calculated as:

Here, AR_{i,t} represents the abnormal return for the stock at time t.

This formula considers the difference between the actual return and the expected return for each period within the analysis time frame. The cumulative sum provides us a clear picture of how the stock has performed cumulatively over the specified event or period of time.

Conclusion

By using the CAR formula, you can easily evaluate your investment strategies, portfolio management skills and track overall market performance. If the CAR is positive, it indicates outperformance. However, a negative CAR indicates underperformance. You can calculate CAR daily, weekly, monthly or for specific event windows. If you need assistance in obtaining a license for portfolio management services, connect with Registrationwala.

- 1452 views