GST Exemption Can Now be Enjoyed on the Double

- January 10, 2019

- Registrationwala

- Home

- /

- Knowledge Base

- /

- gst

- /

- GST Registration

- /

- GST Exemption Can Now be Enjoyed on the Double

GST Exemption Can Now be Enjoyed on the Double

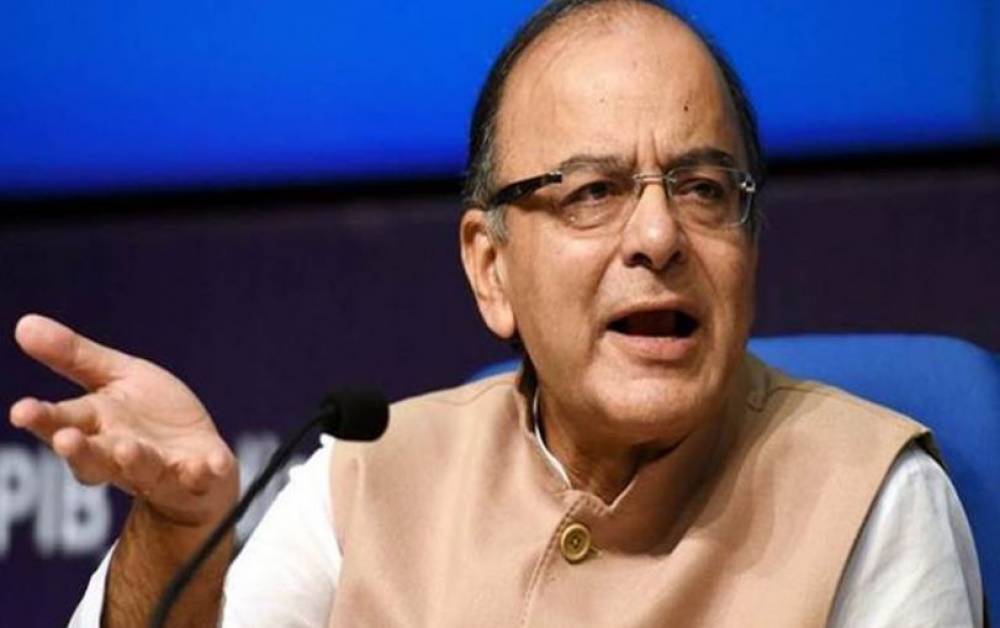

It always a good news when a positive step is taken in the direction of aiding small enterprises. This was perhaps the idea behind the recent development where the finance minister Arun Jaitley announced that the GST council nigh-doubled the annual turnover limit for the composition scheme.

To be more precise, where previously GST exemption was given up to the Annual turnover of INR 20 lakhs, now this exemption can be enjoyed even at the annual turnover of INR 40 lakhs. The same goes for the North eastern states where the previous exemption was set of INR 10 lakhs and now it is INR 20 lakhs.

This Annual turnover for availing composition scheme has also increased from INR 1.5 crore to 1 Crore. This new rule is to be implemented starting from April 1 2019.

Following are the new and refined features of the annual composition scheme:

- Now, the income tax has to be paid on quarterly basis. However, the GST return is to be filled on the annual basis.

- The aforementioned scheme has been added to the services sector as well.

- There is an option left open for the small companies where they can opt out of the GST tax net.

The GST Council, which is headed by Arun Jaitley, the Finance minister has also said the following for Kerala:

Kerala is now fully entitled to intra–state trade and is now allowed to impose a cess of maximum 1 percent. This limit is to be pursued for the period of 2 years.

The aforementioned exemption is especially good for the ones who have opted for MSME registration (Micro Small and medium Enterprises). This doubled limit would have far reaching consequences for the small companies gaining a proper foothold in the market.

Therefore, if you have not still opted for MSME registration, now is the time that you should not defer it anymore and apply for this registration at Registrationwala. Our team is going to make sure that you get this registration on time so that your business endeavours won’t just start, they are also successful.

- 5336 views