Get a Quote

Get a Quote and Find Services to Fit Your Needs 50000+ Satisfied Clients

5000+ Licenses & Registration

15 Branches across India

75 Years + Combined experience

Satisfied Clients

Services

Years Combined Experience

Get Started!

The British Virgin Islands is a British colony in the Caribbean Sea, East of Puerto Rico. It is also termed the Queen of the Virgin Islands. The UK Government terms it as their Overseas Territory. Foreign Establishments usually register as Offshore Companies in the British Virgin Islands. The most popular offshore business entity in the Virgin Islands is the BVI BC, i.e., the British Virgin Islands Company.

You will be shocked that about 40% of the Offshore Companies in the World are registered as BVI. The BVI administration recently passed the British Virgin Islands Business Companies Act as an amendment to the existing Business Companies Act of the island nation. This latest amendment helped remove the difference between BVI's Off Shore and Onshore corporate entities. The amendment also replaced the term International Business Company or IBC with Business Company/BC. The advancement in corporate policymaking has them removing the business restrictions in BVI, and conduct business with BVI residents, and purchasing real estate on the island.

The BVI Authority maintains a Corporate Registry for its enlisted companies. The BVI Corporate Registry is responsible for registering as well as maintaining records of incorporated companies in the British Virgin Islands. The Financial Services Commission of the BVI, a regulatory body for supervision and regulation of financial services in the British archipelago, manages this Registry.

The British Virgin Islands Business Registry is flexible and corporate-friendly among Businesses looking to set themselves up as a BVI offshore company. The BVI registry provides various services in relation to Business Registrations in the BVI, such as the following:

The British Virgin Islands Corporate Registry mandates Companies to maintain such records in its registered office in the BVI. They must be available for inspection by the BVI Financial Services Commission anytime. The Registry is accessible online so that company applicants can access the database to search for details of registered companies, such as their name, status, and registered address.

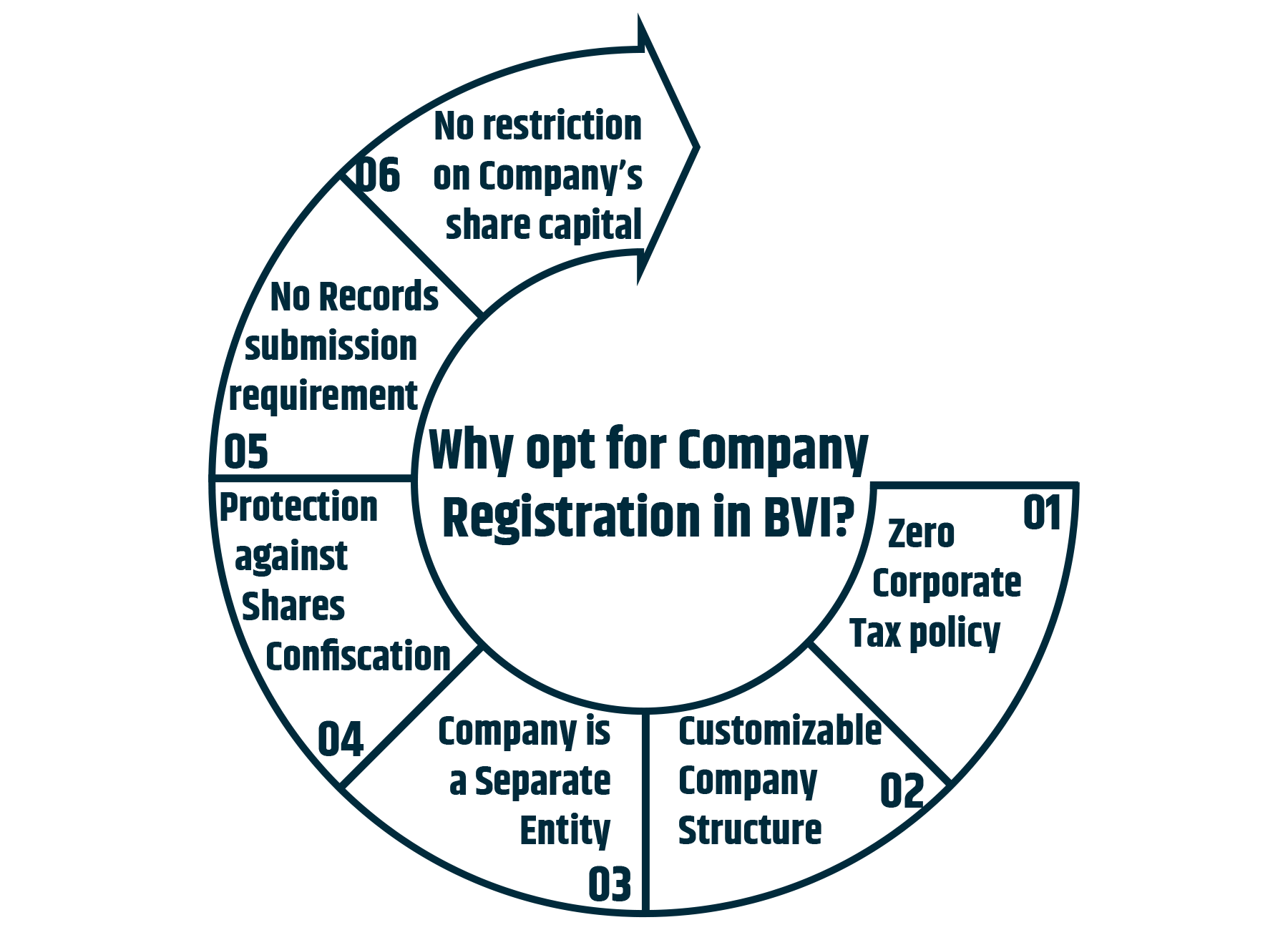

We have briefly discussed the benefits of Company Registration in BVI with you. Now let us look at them one-by-one in detail.

BVI Authority does not charge extra tax on the investors. The investors have to pay taxes specifically in their home country. This move ensures a level playing field for investors from all jurisdictions as well as empowers the BVI companies to progress in a positive direction. This will impact the cost and ease of doing business as well as its operational maintenance and governance.

The Corporates do not have to pay any additional layer of tax. Bring a member of the International Organization of Securities Commissions, IOSCO, BVI Corporate Authority maintains incorporation and ongoing costs low but with high standards. Furthermore, a registered BVI BC is exempted from the income tax from all of the following:

The Corporate Authority of the BVI also exempts all kinds of capital gains, such as:

Lastly, all financial transactions are also exempted from being taxed by the Authority with respect to a BVI BC, along with the instruments relating to transfers of the following:

The BVI Authority requires a BVI BC to maintain a minimum of one of each of the following:

The applicant can design the widest variety of requirements as required to develop a suitable management structure. BVI BC can comprise both Individuals and/or Corporations of any national identity.

The BVI BC is a separate personality from its owners and shareholders. It pulls the same powers as a naturalized citizen of the BVI. The BVI Authority does not mandate that Shareholder and directors' meetings be held in the Virgin Islands. They can be remotely convened anywhere, say telephonically or through electronic means, at the convenience of the Board of Directors. In addition, the BVI Corporate Authority does not mandate the convening of the Company's Annual General Meeting.

If the Company shares are seized by a Foreign Authority or for confiscatory tax, the BVI BC can disregard the seizure. It can continue to treat the person whose shares are seized. Such an Incorporation procedure is cheap and provides annual support.

The BVI Authority does not mandate the Company to file the details of the following with the BVI Registrar of Companies:

They are closed to the public. The Authority puts no restrictions on business operations and purchasing estate in BVI and other countries. You can continue to be a BVI BC in the Virgin Islands even if the Company has been incorporated in another jurisdiction. This offshore jurisdiction permits the circulation of the bearer shares freely and anonymously.

The BVI Authority does not mandate the BVI Companies to prepare financial accounts. The Company must only keep the requisite records sufficient to showcase its transactions. With this, one can accurately assess the Company's financial position. Also, the Company is not mandated to keep the available records in the Virgin Islands. Then BVI BC can freely determine the location by providing any registered Agent with confirmation of the respective address. Consequently, BVI Authority puts no audit requirements on the registered companies.

The Corporate Authority in BVI does not restrict the share capital of a company. A registered company in BVI can issue an unlimited number of shares. This enables more elasticity in the Firm. It also helps declare the required distributions, reverses share splits, and more.

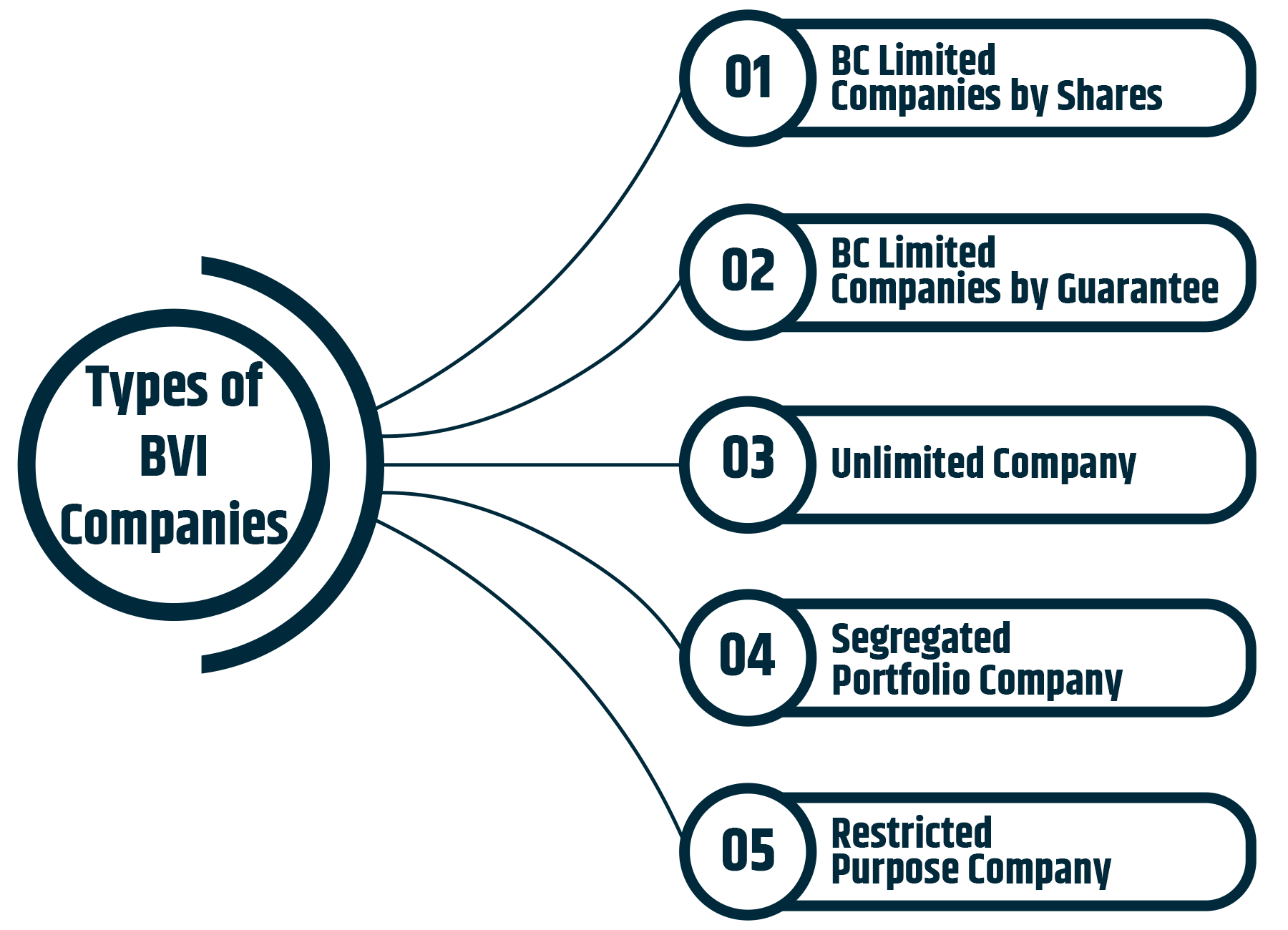

A Business aspirant in BVI can register itself as one of the following corporate models in the British Virgin Islands as per the BVI Corporate Law:

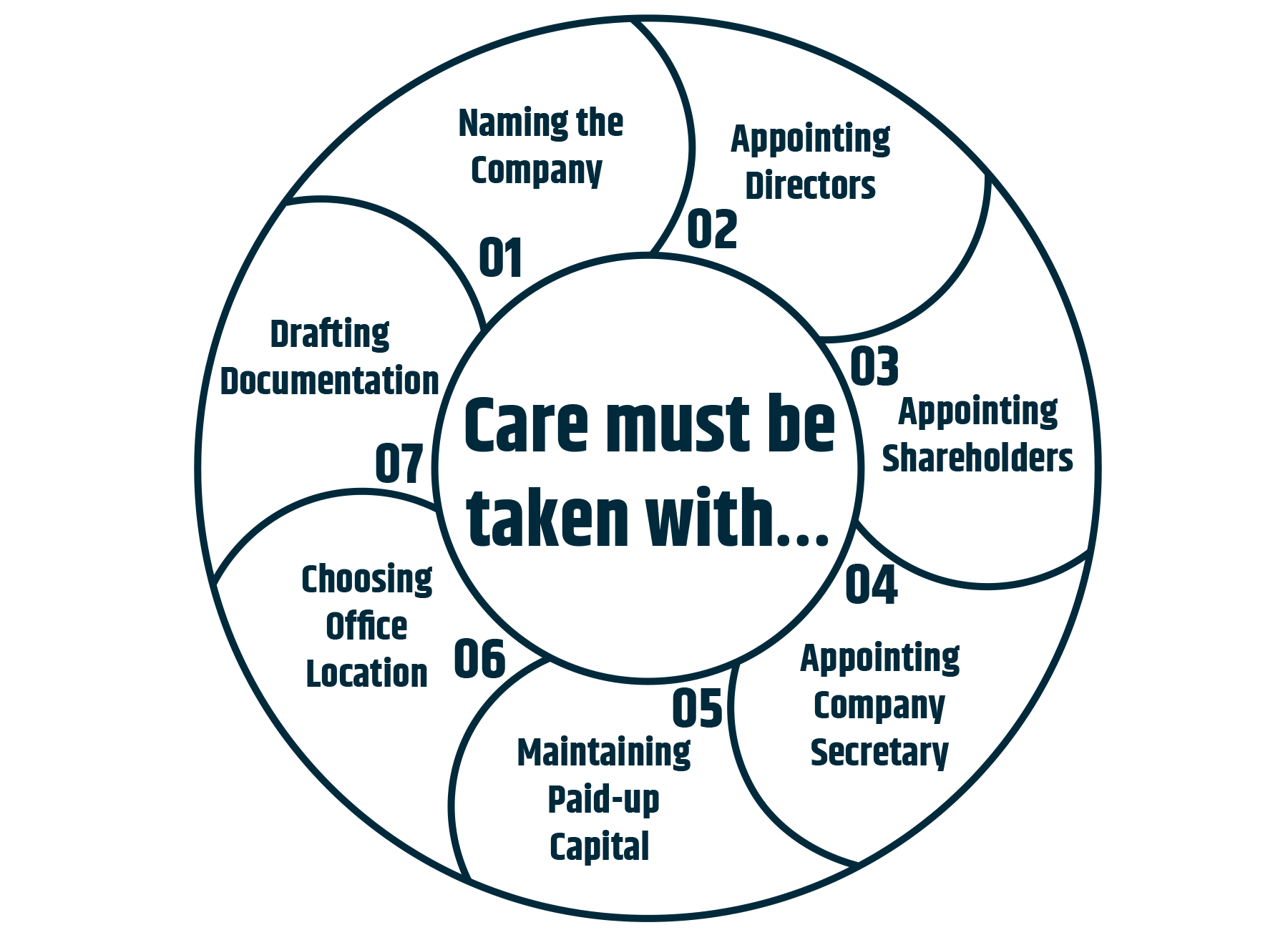

Before applying for the Company Registration, the applicant must conform to the required eligibilities as detailed in the BVI Corporate Law. We have enlisted the pre-requisites for Company Incorporation in BVI in the following points:

Ø The applicant company can generate a company name in any language.

Ø But, the chosen name must be with Roman characters.

Ø Company name ending can have any suffix.

Ø The applicant company must maintain a minimum of one director.

Ø The director can be an individual or a corporate entity.

Ø The Individual or the corporate entity can be of any nationality.

Ø The BVI corporate laws put no requirement for a necessary resident director.

Ø The applicant can appoint any number of directors.

Ø The applicant can also hire consultancies to become a nominee director in the Company.

Ø The applicant company must maintain a minimum of one Shareholder within itself.

Ø A director and a shareholder can be the same person in the Company.

Ø An appointed shareholder can be an individual as well as a corporate body.

Ø BVI corporate laws put no limit on the number of shareholders.

Ø Every company registration applicant must also appoint a Company Secretary for itself.

Ø A CS can be an individual as well as a corporate body.

Ø Also, the same director or Shareholder of a company can act as its company secretary.

Ø You can also hire consultancies to act as the company secretary for any offshore company incorporation.

Ø The requirement for minimum paid-up capital is 1 share of par value in any currency, native or foreign.

Ø The Standard Authorised Shares in the BVI confederacy is half a lac of shares of a minimum of one US dollar per value.

Ø The Company can avail of a registered address for running business operations in the British Virgin Islands.

Ø The BVA authority puts no restrictions on estate hire or purchase for establishing head offices and branches.

Ø The applicant must maintain certified copies of Passports as well as proof of residence of shareholders and directors of the proposed Company.

Ø The applicant must also maintain details of the parent company if the appointed Shareholder is a corporate entity.

Ø These copies must be certified by a professional lawyer, CPA, or Bank.

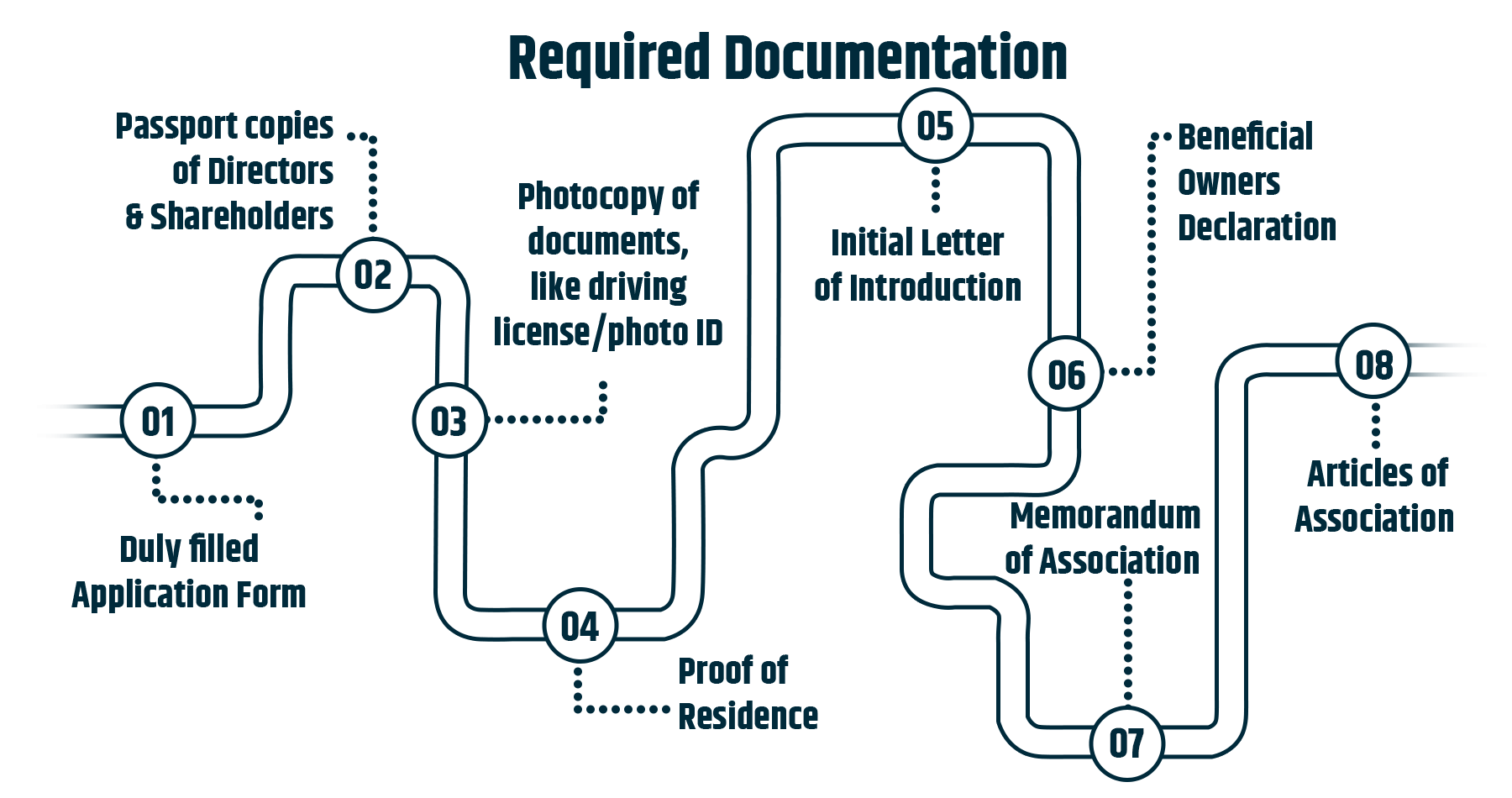

Every company registration aspirant in the BVI must submit the following documents along with the registration application to the BVI Registrar of Companies:

The applicant BVI BC must share the requisite Memorandum as well as Articles of Association and other associated documents with the Registrar for incorporation purposes. The MoA must be carefully drafted. It must also include the following details about the Company:

Furthermore, the applicant must disclose its share capital and the liability of each member partner. If the Examiner accepts the MOA, the Authority will issue the Certificate of Incorporation. The applicants must submit all the documents to the Registrar of Companies at the time of Company formation. There is no need for the applicant to pay for the incorporation.

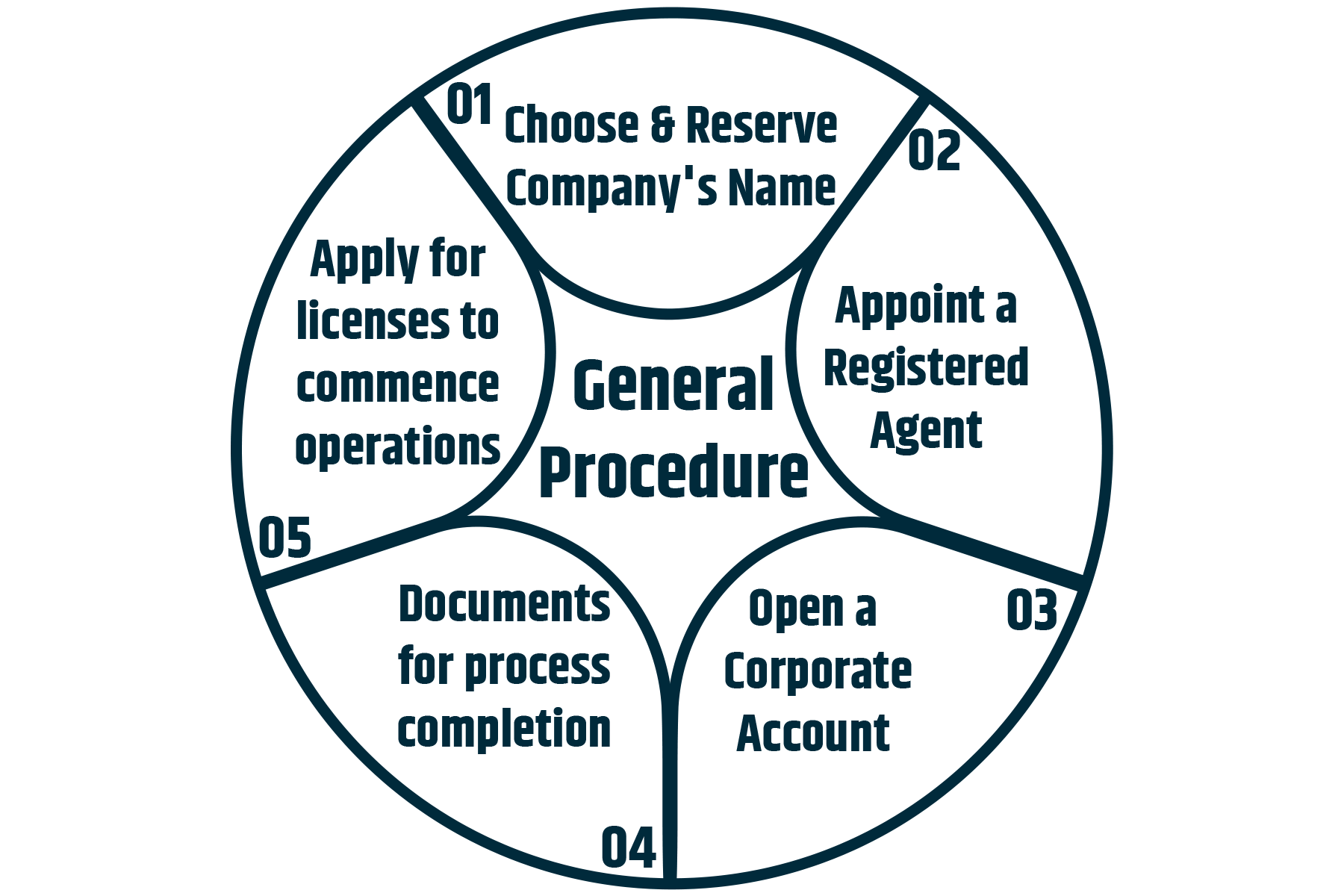

The procedure for Company registration in the British Virgin Islands is poly-furcated into the following processes:

Differing from the expected timelines, the process for company incorporation in the Virgin Islands is straightforward. All you need to do is prepare the required documentation and adhere to the eligibility as per the BVI Corporate Laws. Your incorporation procedure will be smooth as silk. Here we have detailed the steps of company incorporation in the British Virgin Islands.

The applicant must appoint a registered agent when incorporating business with the BVI Registrar.

Along with opening the bank account for the Company, the applicant must draw up the Articles of Association and registered agent and Company's founder's details. Once these documents are drafted and compiled, the applicant must submit them to the BVI Companies Registry for registration approval.

After gaining the registration approval, the newly incorporated Company must officially check for other relevant licenses to kickstart its business. You can obtain such permits from the Financial Services Commission of the BVI.

Our Incorporation experts provide you end to end company incorporation services in the British Virgin Islands by assisting you in the following manner:

We ensure that your company incorporation services requirements for the British Virgin Islands are always on time. Our professionals understand the intricacies of company incorporation procedures in the British Virgin Islands. Thus, we have expedited the process – helping you incorporate your Company at an affordable price.

So, reach out to our Incorporation Experts and realize your dream of starting your own Company in the British Virgin Islands.

★ ★ ★ ★ ★

I very much appreciate the fact that you guys possess tremendous knowhow of private limited company incorporation. You have exhibited professional and respectful manner towards my query and I would seriously recommend you guys to all the folks looking for outstanding business services.

★ ★ ★ ★ ★

Thanks to their support, I got my trademark successfully. I highly recommend their services for anyone needing help with their intellectual property. The person assigned to me was very cooperative and helpful.

★ ★ ★ ★ ★

Thanks to their support ragistrationwala team, I got my IP-1 license successfully and special thanks to Miss.Kanishka for your great and timing support !!!!!! I have archived my goal one step forward... Thanks for the entire team....

★ ★ ★ ★ ★

Really helped a lot in getting my both VNO licenses. Great experience working with the team and very humble team, thanks for providing the vno license on time.

★ ★ ★ ★ ★

I had a good time working with Registrationwala. Good team. I would recommend their services to others.

★ ★ ★ ★ ★

It was extremely great service of Registrationwala consulting firm, and this firm is providing the best services and worry about the client's required services along the client's satisfaction.

★ ★ ★ ★ ★

Superb Experince! Within no time the trademark registration was on.Highly professional team. I am very much Impressed with the prompt response and efficiency.Thank you.

★ ★ ★ ★ ★

We had taken ISP license from registration wala and the supporting person is very helpful to taken that license his communication and his work is satisfactory and thanks for those services

★ ★ ★ ★ ★

I sincerely appreciate your prompt support in helping me get the access license so quickly. Your professionalism and efficiency are truly commendable. Thank you for going above and beyond to assist me. Keep up the great work!